Close to 5,000 people now work for asset management companies in the grandy duchy, as asset managers move to Luxembourg ahead of Brexit, FT.com reports and a further article states that most large UK insurers have set up plans to ensure that cross-border insurance contracts are honoured in the event of a no-deal Brexit.

In this case Luxembourg has also fared well as the FT says,“the most popular destinations for insurers have been Luxembourg, Dublin and Brussels.”

The latter article quotes Ashley Prebble, partner at the law firm Clifford Chance as saying, “In the past six or seven months people have gone from ‘we’re hopeful that we can rely on a transition period’ to ‘there’s no point in being hopeful--we need to implement our contingency plans, or we’ll be in a very difficult position.”

In its Annual Report 2017, Luxembourg financial sector regulator the CSSF confirmed that contingency plans have indeed been put it place over the last year as business tires of waiting on politicians to get their acts together. It showed that the number of employees of asset management companies in the grand duchy rose to 4,969 in 2017, saying that this was directly related to fund managers taking steps to prepare for Brexit. There are now more than 300 asset management companies located in Luxembourg.

According to the Luxembourg agency for statistics and economic studies (Statec) figures more than 30 companies have chosen Luxembourg as their post-Brexit location, principally coming from the insurance, asset management and banking sectors (in that order). More recent figures from KPMG Luxembourg, put this figure at 41 (in the same order), placing the grand duchy far ahead of other European jurisdictions, with Ireland thus far attracting 30 companies; Germany 19; France 16; The Netherlands 14; Belgium 5 and Spain 3.

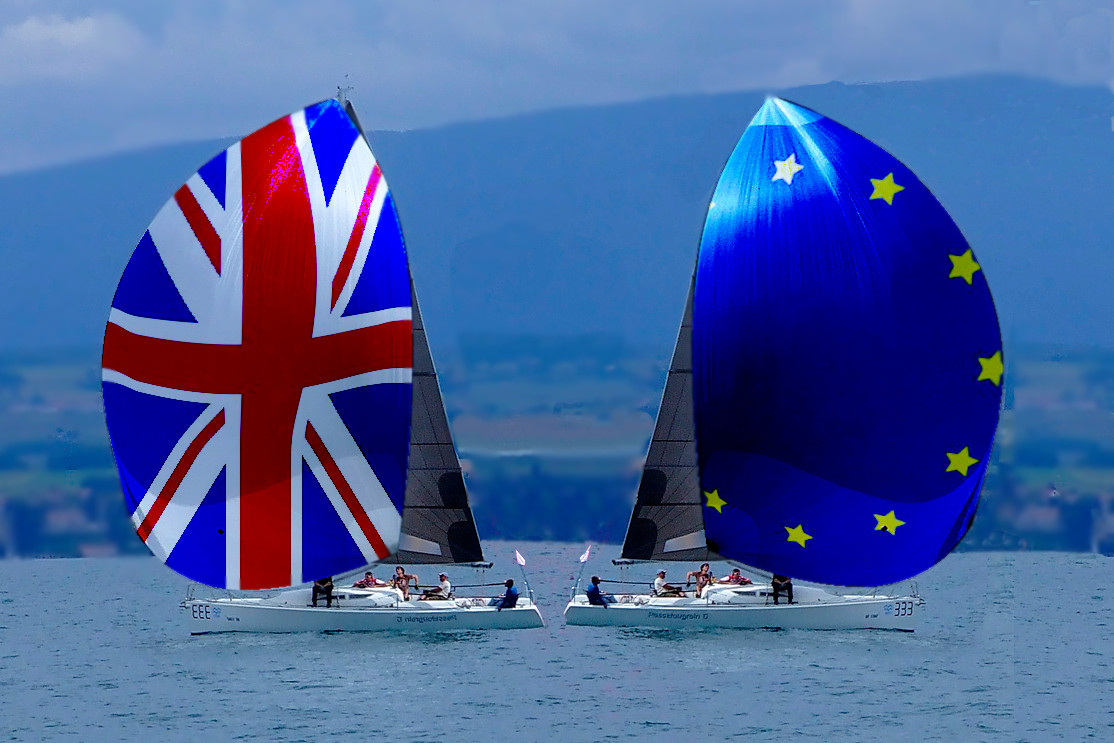

It will be interesting to see how these figures change over the next 7 months, as it appears more and more likely that the UK will leave the bloc with no deal. And even if politicians do manage to patch something together, it is unlikely that financial services will be top of the agenda. In a recent interview with Delano, following the EBA’s (European Banking Authority) warning to banks to get moving on Brexit, Serge De Cillia, CEO of the Luxembourg Bankers' Association (ABBL) said, “…it seems that financial services is not a priority for the European Commission in the Brexit discussions compared to other domains--fish are getting more attention.”