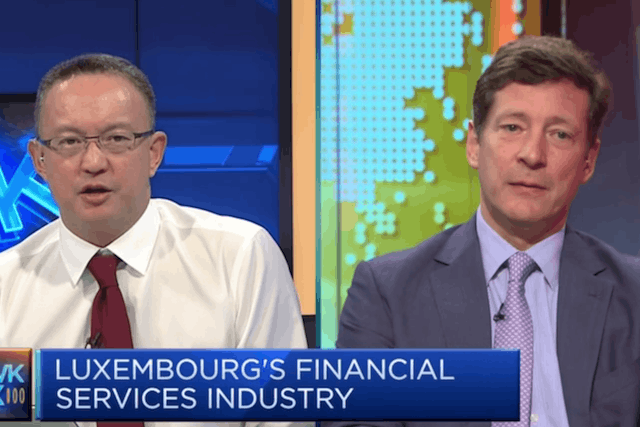

Luxembourg for finance head Nicolas Mackel spoke to Squawk Box in an interview published on their website on Sunday.

He said companies had “made their decisions relatively early in the process.” Over 25 banks, insurers and investment companies last year confirmed plans to establish operations in Luxembourg in response to Britain’s planned departure from the European Union. In an interview with Sky News in September, Mackel predicted the post-Brexit rush would generate up to 3,000 jobs in Luxembourg.

He did not speak about jobs in this his latest interview but said that financial institutions which opted for Luxembourg mainly did so based on their activities and where they already have a presence. He said: “Some banks use Luxembourg as a post-Brexit wealth hub, for instance. That’s something that is positive but ultimately Brexit in itself is nothing to rejoice about.”

Mackel further talked about a multi-polarisation of the European financial services landscape after Brexit suggesting that while it is unlikely Paris, Dublin, Luxembourg or Frankfurt will ever have become the global champion London is, smaller champions are just as good and “competition has always been good.”

When asked what Luxembourg was doing to attract financial companies, Mackel stressed no-one was getting special treatment and the appeal lay in its eco-system, know-how, ease with languages and political and economic stability.