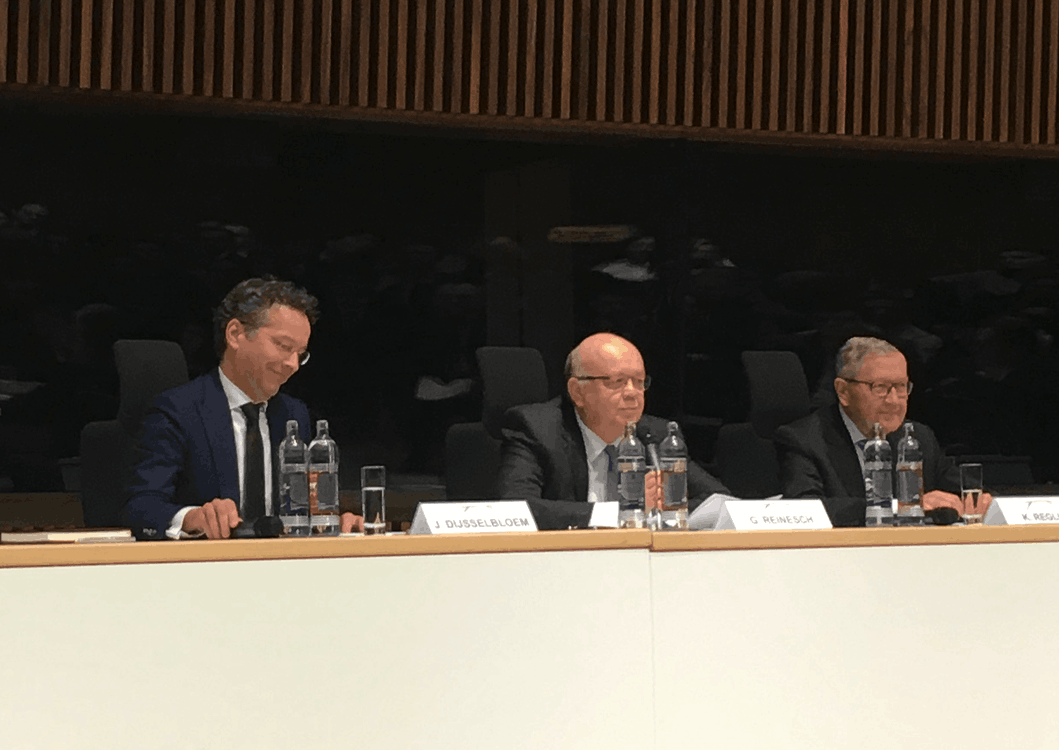

Speaking Thursday evening at the 5th anniversary of the European institution which was set up during the Eurocrisis, Dijsselbloem set out several ideas that were currently being discussed in the Eurogroup, the club of euro area finance ministers, and called for a better use of the ESM’s potential.

Among them were the ideas to use the funds from the ESM to provide loans for member states who want to start significant reforms, managing support programmes, and providing a backstop for the banking union.

The former (until October of this year) Dutch finance minister stated at the conference in Kirchberg, organised by the Bridge Forum:

“The ESM might also play a role in providing a stabilisation tool for member states, facing an adverse economic shock, whilst supporting their process of necessary economic reforms. This instrument could be designed as a revolving fund which can be used again in future crises. Further discussions on this topic will obviously be needed in the coming year.”

The future of the ESM is “very much embedded in the discussion on the future of the EMU”, Dijsselbloem said.

Current discussions in the Eurogroup focused on four issues: 1) strengthening the role of the ESM in crisis management; 2) giving it a role in the completion of the banking union; 3) considering a role for the ESM in financing member states in their reform drive; and 4) governance issues and the relation of the ESM to the EU framework.

The timeline given by European Council president Donald Tusk was: “June 2018 to present decisions on the banking union, some of the fiscal discussions, on fiscal instruments, and the role of the ESM.”

No complacency

While growth was “exceeding expectations” and growth levels were converging in Europe, which was very important economically and politically for the future, politicians should not become complacent. Disselbloem said on 29 November:

“Now is the time to fix the roof, in other words to become resilient to possible future shocks. This is not about creating fiscal space or creating new fiscal instruments at national or European level, it’s first and foremost about markets being able to react in a more flexible way to adverse shocks inside our union.”

He urged member states to make crucial investments to improve productivity and create fiscal buffers while also reducing their debt levels.

Completing the banking union

Dijsselbloem reiterated that he was in favour of creating a European deposit insurance scheme. Risk sharing and risk reduction in the financial sector were the objectives, and “timely provisioning for dealing with non-performing loans is crucial.”

EU fiscal rules

Dijsselbloem said that the current rules on fiscal policies needed to be made more predictable and less complex.

The Eurogroup president indicated that:

“More medium-term orientation could help ensure more prudent fiscal decision-making.”

ESM governance

Dijsselbloem argued that the ESM should stay an intergovernmental institution, and keep its independence.

He explained that there was little support for the ESM to become an agency that is part of the European Commission. The intergovernmental character of the institution has helped to build trust between member states and has created a solid base for further steps of integration, Dijsselbloem said.

Integration into the EU legal framework could be on the agenda at a later stage. The legal set-up of the European Investment Bank could be an example, but would require EU treaty change. However, accountability to the European Parliament should be enhanced, to increase transparency.

Both Regling and Dijsselbloem said that in future, the euro area should not involve the IMF anymore in any financing programmes.

Regling looks back

In his remarks at the event, Klaus Regling, the managing director of the ESM, traced the evolution of the ESM from the European Financial Stability Facility, a temporary crisis resolution mechanism created at the height of the Eurocrisis in June 2010, to provide financial assistance to Ireland, Portugal and Greece, to the current institution which employs 180 people from 44 countries. The ESM, a permanent institution, was created in 2012, and currently only provides loans to Greece.

Regling said the “comprehensive strategy” had several elements: member states had to tighten budget policies, implement structural reforms, and restore competitiveness. The ECB also played “a crucial role in fighting the crisis”, and the steps towards a banking union, through the creation of a Single Supervisory Mechanism and the Single Resolution Fund made the financial sector much stronger and safer. The final element was the creation of the rescue funds.

After Greece, Ireland and Portugal lost market access, they could have been forced to leave the euro area under chaotic circumstances, Regling said on 29 November.

Regling said: “we are, in other words, the lender of last resort for sovereigns in the euro area.”

€273 billion

Since 2011, a total of €273 billion have been disbursed to Greece, Ireland, Portugal, Spain and Cyprus, 2.5 times as much as the IMF globally in the same period. Its paid-in capital amounts to €80 billion.

Rgeling stressed that:

“The ESM does not spend any taxpayer money to finance our assistance programmes. Instead, we raise money from investors by issuing bonds and bills. We can do this at very low interest.”

The so-called programme countries can realise “considerable” budget savings; Greece’s budget is €10 billion lower than if it had contracted these loans on the market. However, the conditionality clause is based on painful reforms, such as cutting wages, pensions and cutting government support programmes.

However, Regling was keen to underline that four countries (Ireland, Spain, Portugal and Cyprus) ended their programmes after three years, and their economies were growing again at high levels.

Greece was now in its “seventh and final year”, and Regling stated that:

“If Greece continues to implement the agreed reforms, chances are good that it can regularly finance itself in the markets after completing the programme in August next year.”

He noted that Greece had already successfully accessed the bond market in July this year, and again a few days ago. Greece can however count on continued help, if needed, the managing director of the ESM said.