The report includes press announcements through 7 June, therefore prior to insurers Liberty Specialty Markets and CNA Hardy announcing their plans to set up in Luxembourg. However, in some cases, only part of company operations are heading away from the UK.

Top contenders

The report further lists the next most popular locations for post-Brexit, including Ireland (14 companies), Germany (8), the Netherlands (4), Belgium (3) and France (1).

Although originally the Netherlands was expected to be a top post-Brexit contender for company relocations, mainly due to its focus on connectivity, fintech and ease of using English as a second language, the results--at least for the time being--speak otherwise.

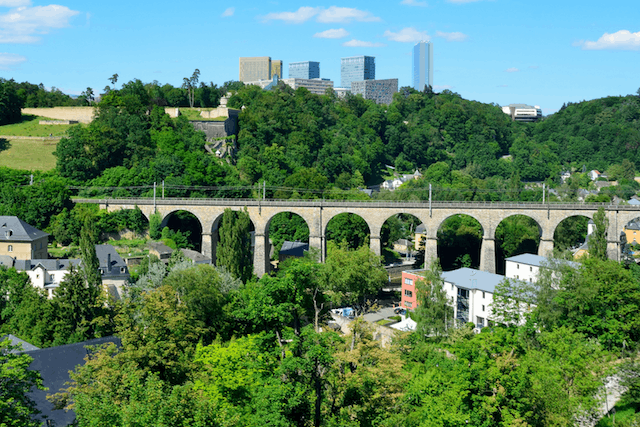

Luxembourg, which supports a hard Brexit stance, is still a top financial centre and also boasts an international, multilingual workforce, not to mention its recent focus in other areas, including fintech, green bonds and space mining. Factor in stability, security and accessibility, both in terms of infrastructure and ease of meeting key decision makers, and it becomes clear why the country is attractive to companies.

The list so far

The companies that have announced their plans to set up in Luxembourg post-Brexit include (in addition to the aforementioned) the following: 31, AIG, Bank of America, Blackstone, Carlyle, China Everbright Bank, Columbia Threadneedle, EQT Partners, FM Global, Goldman Sachs, Hiscox, HSBC, ICG (Intermediate Capital Group), JP Morgan, M&G Investments, MJ Hudson, Morgan Stanley, Ping Pong, Ppro Group, Rakuten Commercial Banking, RSA, Shanghai Pudong Bank.