An uncertain outlook

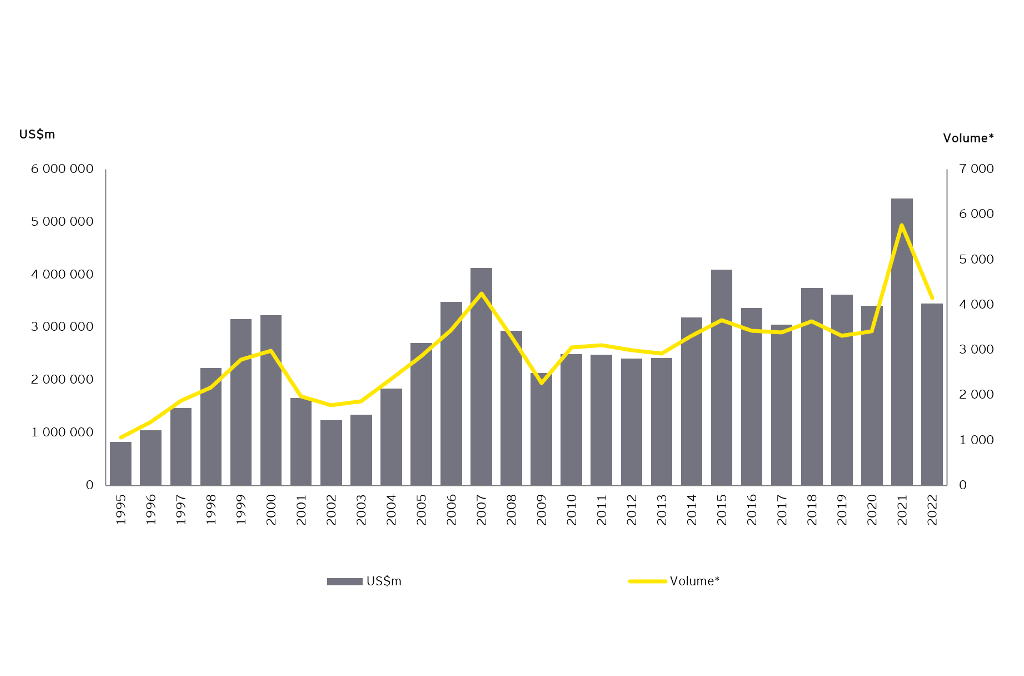

Companies are hard-pressed to evaluate acquisition targets and predict M&A deal costs due to fluctuating inflation coupled with uncertainty around interest rates. As such, the M&A market turned somewhat sluggish in 2022, as shown in the below graph. Despite this, EY surveys suggest that companies are still eager to make deals, albeit smaller in size. Technical indicators, such as bid-premium, also suggest that the M&A market may strengthen in Q2 2023.

Yearly Global M&A

Yearly Global M&A EY Luxembourg

Private equity as a driving force

Private equity buyers, driven by the abundance of dry powder, drove market activity in 2022, making it the second-highest year for private equity activity since 2007. Acquirers continued to make record-breaking transactions, with buyouts and exits 50% and 43% higher respectively than 2015-2019 numbers. In total, private equity accounted for over 40% of deal values in 2022.

For 2023, the private equity transaction landscape is expected to see a rise of co-investments with Family Offices, which have shown a growing interest in direct investments and private assets, especially in uncertain times.

The tech scene: a constant

The technology sector continues to dominate M&A, accounting for 20% of all deals in 2022. While activity is currently calm in this sector, we expect to see M&A, partnerships, and strategic alliances focused on data utilization, cybersecurity solutions, operational efficiency, and faster transactions this year. Strong and financially stable tech companies, and big corporations from other industries looking to enhance their tech offerings, are poised to take advantage.

Fintech also remains a hot target for investors, but financial pressures on this sector caused by current market conditions, could see banks take advantage of lower valuations.

Healthcare and life sciences: a new era of dealmaking ahead?

Life sciences may be entering a new dealmaking age. With $105 billion of life sciences deals completed last year, 2022 was the lowest year of dealmaking since 2017. Despite this, the outlook is positive, as demonstrated by recent announcements of industry giants planning billion-high acquisition. Biopharmaceutical companies alone hold over $1.4 trillion in unused capital, an all-time high, according to EY.

With the recent addition of Lars Goldhammer to its partnership, EY Luxembourg is even better equipped to assist clients in navigating the current economic climate and positioning themselves for success throughout the M&A deal life cycle.

Lars Goldhammer joined EY Luxembourg as Partner in International Transaction Tax Services. Transferring from EY Germany and New York, he brings more than 20 years of expertise in providing advice to his clients throughout the entire process of M&A transactions, with a focus on investment banks and private equity clients. He was educated and professionally trained both in Germany and the UK and is also qualified in Islamic Finance.

Source: EY Analysis / Dealogic*Volume based on deals with a disclosed value US$100m+