Franck Vialaron, CEO of Accelex, from France, and Michael Aldridge, president and chief revenue officer, from the United States, are no ordinary entrepreneurs. The founders of the London-based fintech were involved in the launch and resale of Expand Research in the United States to the Boston Consulting Group, where he stayed from 2001 to 2019, and in the same adventure and another successful exit with the sale of CoreOne to IHS Markit in 2015 for $200 million.

In September, the two men had installed Steve Husk, with an eloquent pedigree, at the head of their board of directors. He has led, among others, CloudMargin (a SaaS solution for collateral management), Dovetail (an enterprise-wide payment solution), Point Nine (a buy-side SaaS solution for trading and risk reporting) and FRS Global (a risk management and regulatory reporting solution).

This time, the two men are tackling another area of data, which they have mastered since the late 1990s: financial data for investment professionals. Their fintech, which is not even two years old, has already convinced clients who manage $300 billion in assets and invest in 3,500 funds. Last November, it won over the manager of a portion of Canada's pension funds, Alberta Investment Management Corporation, just as the latter's CEO, Kevin Uebelein, announced that he would be stepping down after AIMco's worst performance in eight years, a loss of more than $2 billion, due to a lack of access to enough information to develop better strategies.

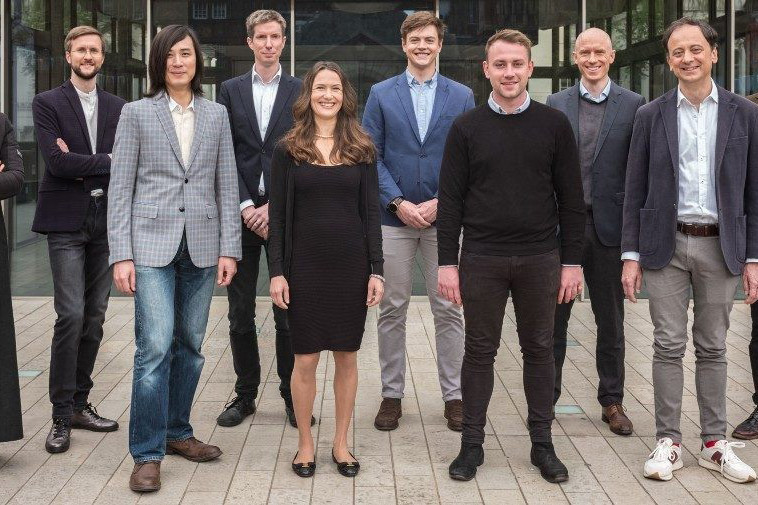

At the end of May, Accelex raised $5m in seed funding, a round led by Illuminate Financial and AlbionVC, with Luxembourg's Expon Capital and SixThirty Ventures participating. "Accelex combines compelling automation with an elegant user experience for last mile validation and team collaboration," noted Jerome Wittamer, partner and founder of Expon Capital. "This approach streamlines investor operations, dramatically reducing the time between document receipt and actionable data and information."

Based in London, the fintech has offices in New York, Toronto and Paris and has just registered a structure in Luxembourg, where it will operate from the Luxembourg House of Financial Technology (Lhoft).