A demanding context for compliance

Compliance with the fight against money laundering and terrorist financing (AML/CFT) has become a central issue for companies, whether in the financial sector or not. The complexity of the obligations, the regular changes to the regulations and the growing expectations of the authorities mean that constant adaptation is required.

Beyond simply ensuring compliance, these requirements represent an opportunity for organisations to structure and optimise their internal processes. An effective approach to compliance is not limited to the application of rules, but can become a lever for performance and risk control.

A bespoke approach for a variety of needs

Faced with these challenges, many companies need to develop strategies tailored to their size, sector and risk exposure. While some have dedicated in-house resources, others need to rely on external expertise to navigate this constantly changing regulatory landscape.

With its new service offering, reinforces its commitment by proposing an innovative and personalized approach. This offer has been specially developed to adapt to changes in the regulatory framework and the growing expectations of the authorities.

By combining its historic operational expertise with a renewed approach to operational excellence, Ease offers a range of modular services that can be perfectly adapted to the specific requirements of each customer, guaranteeing not only compliance but also optimized operational efficiency.

Ease supports its clients with expert and modular AML/CFT compliance solutions. From KYC reviews to training and governance, Ease optimises processes to ensure compliance and efficiency.

Concrete solutions for effective compliance

Through each of its assignments, Ease is committed to working in perfect symbiosis with its clients. This joint work makes it possible to define tailor-made, effective solutions that are adapted to the specific features of each organisation, ensuring a personalised approach that fully meets the challenges and requirements of each player in the sector.

Among the major areas for strengthening AML/CFT arrangements, several elements appear essential:

—Review of KYC files: ensuring the quality and updating of customer data is an essential condition for effective risk management.

—Training and awareness: staff who are informed and trained in AML/CFT issues are an asset for mastering obligations and anticipating risks.

—Governance and management: an appropriate organisation, clear processes and robust internal controls ensure effective and scalable compliance.

—Audit and evaluation: carrying out periodic diagnostics to identify areas for improvement and adjust the systems in place.

—Tests and simulations: simulating regulatory controls makes it possible to measure the effectiveness of systems and anticipate points of vigilance.

A dynamic of continuous improvement

Far from being a mere constraint, AML/CFT compliance can become a strategic asset for companies. By putting in place tailored processes that are both personalised and flexible, they can boost their credibility, reassure their partners and improve their risk management.

Thanks to its new approach, Ease enables companies to position themselves ahead of regulatory developments and transform compliance into a performance driver. Expert support provides a valuable outside perspective and access to best practices, in line with the expectations of regulators and the market. The aim is to ensure that compliance is not just a matter of compliance, but an integrated process that creates value for the entire organisation.

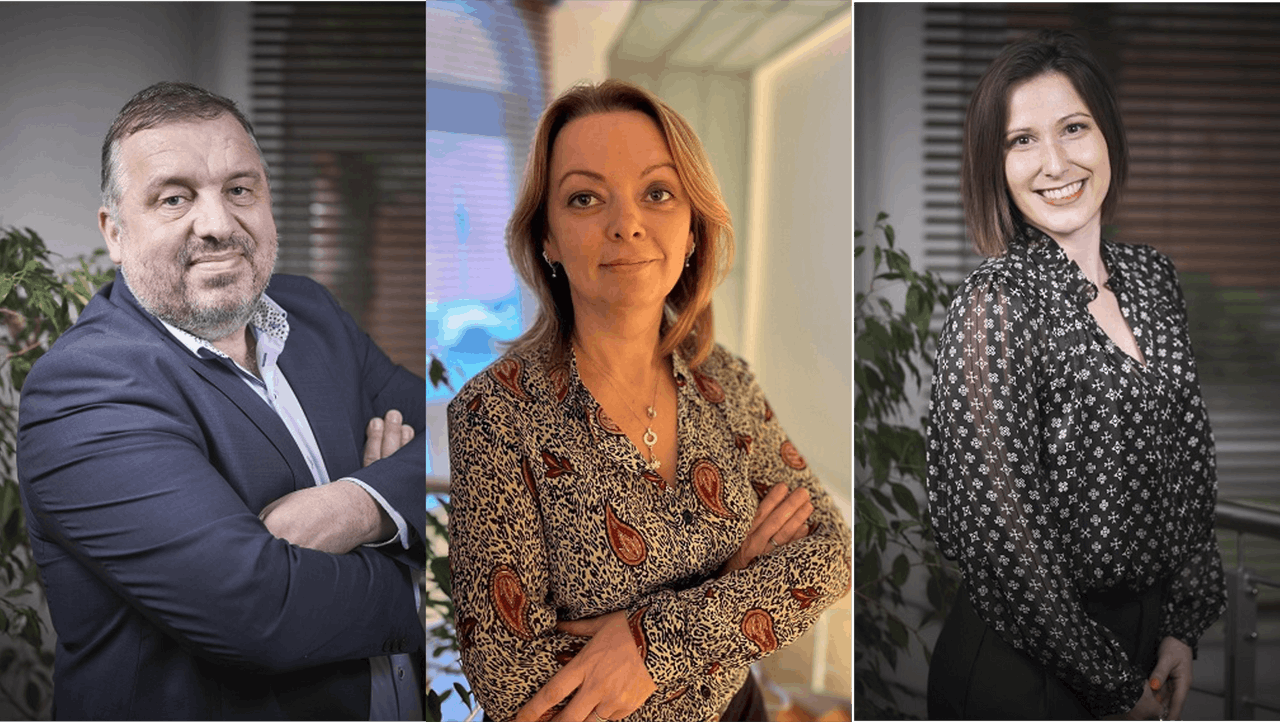

To find out how to navigate the challenges of AML/CFT compliance with confidence and efficiency, , Head of AML/KYC Advisory at Ease.

This article was originally published in .

This promotional article has been written as part of Ease’s membership with the Paperjam Club. If you too would like to join the Club, please contact us at .