In Europe, an average of 2% of company revenue is lost due to poor spend management. This figure is part of a survey of 950 European business leaders commissioned by the fintech company Soldo. It illustrates the scale of a global problem that costs European businesses €347 billion every year. This represents a barrier to growth for many organisations, as the money cannot be used for business development.

Time and money wasted

But how could so much money have been lost purely through poor spend management? “This results in part from receipt processing errors, overspending and fraud, but also from unclaimed VAT, which represents an annual loss of more than €38 billion in Europe,” says Luxisle Faubert, Regional Marketing Manager France and Benelux at Soldo. The other problem relates to the often arcane processes companies use to pay or process receipts. The administrative burden hinders the efficiency of teams and makes spend management complex. If not digitised and automated, it becomes a source of errors and costly for the company, which devotes time and resources to these low value-added tasks.

Technology to the rescue

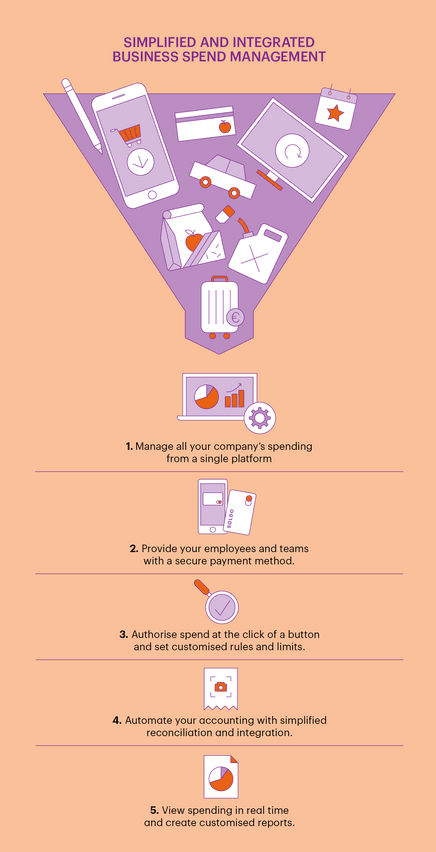

To resolve these issues, Soldo aims to provide a comprehensive spend management suite that provides stakeholders with a spending limit and a means of payment while also giving companies greater security and visibility. “The idea is to connect smart payment cards to a powerful management tool in order to centralise all spending information on a single platform,” explains Luxisle Faubert. In practical terms, any department or employee who incurs business expenses is issued with a payment card, either physical or virtual, in order to be more responsive when conducting their business. Each transaction carried out is reported in real time on the platform, enriched with data related to the spend (MCC code, VAT rate, receipts, etc.), and will be linked to the right company analytical accounting code to save time.” Businesses can also establish rules to restrict certain types of expenses or the places where they are authorised.

This solution therefore considerably reduces the administrative burden by automating the end-to-end process. “With our SaaS platform, we make businesses more agile and provide them with an accurate overview of their costs at all times,” adds Luxisle Faubert.

€38 billion is lost every year in Europe in unclaimed VAT alone.

Development throughout Europe

The Soldo solution certainly appears to be attractive. The company already has 26,000 customers of all sizes and sectors in 31 countries. Since its last fundraising round of $180 million, it has been looking to accelerate its development in Europe, particularly in Luxembourg. “It is a country that is positioning itself as a ‘tech leader’ in Europe, with a diverse ecosystem and an appetite for digitisation. It therefore made sense for us to approach this market with a digital solution that would resonate with many companies,” says Luxisle Faubert. To continue this development, the company is not resting on its laurels and regularly releases new functionalities to better meet the needs of the market. With a significant proportion of corporate spending now being digital, a module dedicated to managing online subscriptions and advertising has recently been released.

This will provide control over spend related to subscription plans, which often result in duplication or payment for services that are not required.

Trust and control are not mutually exclusive

Soldo’s solution aims to provide companies with greater agility by allowing them to delegate payment processing and, in so doing, give their employees more autonomy. This gesture of trust is accompanied by a set of measures that allow the company to maintain control, both before and after an expense is incurred. In addition to creating spending limits on its cards, Soldo has implemented an approval system for one-off expenses. It allows a single payment request to be submitted directly via the platform and approved with one click. “It’s a great solution when you don't want to issue a card to all your employees,” continues Luxisle Faubert.

“You can request a sum of €500 for a new computer and, after your request is approved, you’ll instantly receive a virtual prepaid payment card with the requested amount.” The post purchase validation system will also soon be available and will allow the manager to verify supporting documents for the expense in order to validate it before sending it to the financial department. Regular monitoring of spend using Soldo’s solution leads to improved profitability. “Soldo offers a modern and highly customisable tool to help companies manage their spending and support them in their growth,” concludes Soldo’s Regional Marketing Manager.

Business spend management Maison moderne

Find out more at