According to a case study by PWC on sales of battery electric vehicles in 2024, the European market is slightly declining compared to the previous year. Although , the biggest European markets saw a decline in BEV sales. The downward trend extended into the fourth quarter, with a 5% year-on-year drop.

Germany, Europe’s largest automotive market, experienced a sharp 27% decline in annual BEV sales, exacerbated by inflation, rising vehicle prices and strategic delays by manufacturers ahead of stricter EU CO2 emissions targets effective January 2025. In the French market, BEV sales faced a slight decline in 2024, with a 2% drop year-on-year. Hybrid vehicles gained traction with a 36% increase, reflecting a preference for transitional technologies amid rising prices and economic uncertainty.

The UK, however, bucked the trend, recording a 47% growth in BEV sales in the fourth quarter and 21% for the full year. The introduction of the zero emissions vehicle (ZEV) mandate at the start of 2024 played a key role in driving this growth. Beyond the top five, Belgium saw BEV sales rise by 37% in the final quarter, reflecting a growing interest in electrification despite broader regional challenges. Meanwhile, the Netherlands recorded a 45% increase in BEV sales in the fourth quarter, while Norway continued to dominate market share, with BEVs accounting for 89% of new vehicle registrations in 2024.

Amongst Europe’s top five markets, electric vehicles accounted for 53% of all car sales. However, it was only 13% for BEV. In comparison, the share of battery electric vehicle sales in Luxembourg rose to 30% in 2024.

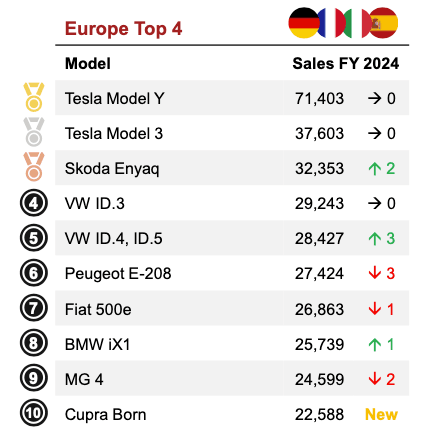

Most sold BEV in France, Germany, Italy and Spain in 2024. Source: PWC

In Germany, France, Italy and Spain, Tesla cars were topping the ranking of most sold BEV in 2024. The other models were all from European manufacturers, with the exception of the MG4.

When compared globally, Europe lagged behind the US and China. In the US, BEV sales rose by 7% for the year and 11% in the final quarter, driven by record-breaking sales in December amid concerns over potential policy changes. Meanwhile, China, the world’s dominant BEV market, accounted for 65% of global sales in 2024, growing by 20% for the year and 32% in the fourth quarter. The strong performance was fuelled by a vehicle trade-in subsidy that boosted consumer demand.