Some see Bitcoin as the future of finance, while others compare it to a classic pyramid scheme. As the crypto craze has intensified, so have the stakes, with the market capitalization of cryptocurrencies exceeding $2.2 trillion in 2021.

How can you come up with a reasonable price for Bitcoin?

MC: Bitcoin’s valuation is a real paradox. On the one hand, it’s an asset that doesn’t produce any earnings, so you can’t do a cash flow analysis on it. That means it’s only worth what buyers are willing to pay for it. On the other hand, Bitcoin could become a very valuable asset, for several reasons.

First, total Bitcoin supply is capped at 21 million, and once that limit is reached, no one can create any more of it. Second, it’s a currency that can’t be censored: it’s available for use by anyone with an internet connection. Finally, it can’t be confiscated by the government or creditors, which is a particularly strong argument for people living under authoritarian regimes.

DU: In reality, the scarcity of Bitcoin is artificial. It was originally created by someone as a way of sending money over the internet. Over time, somehow the premise changed to it being a store of value. The price of Bitcoin is set by the financial markets. The financial markets don’t need Bitcoin, but Bitcoin needs the financial markets. That sounds a lot like a pyramid scheme. You can’t put an intellectual framework around Bitcoin’s valuation.

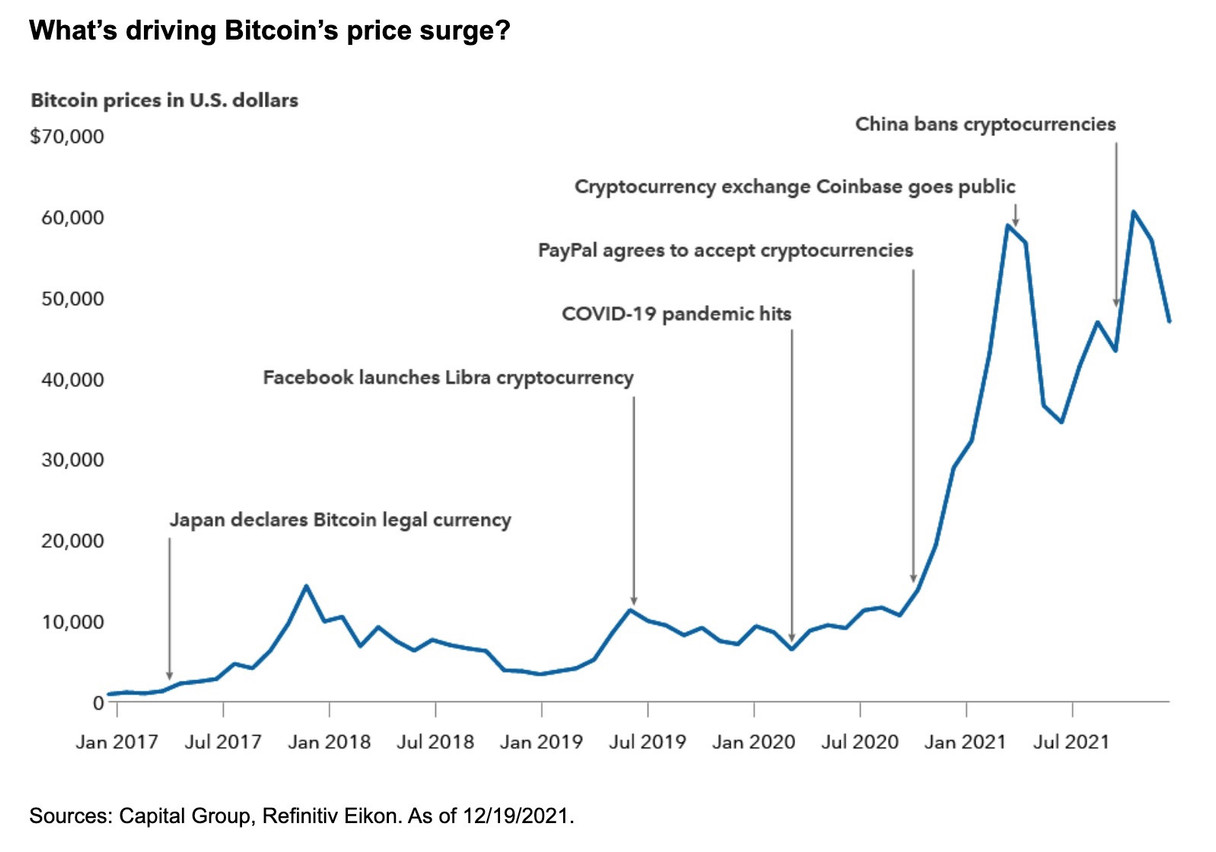

What’s driving Bitcoin’s price surge? Capital Group

Interested in learning more? Further data and analysis by Capital Group experts Mark Casey, portfolio manager, and Douglas Upton, an equity analyst covering the metals and mining industry, is available

Is Bitcoin an effective hedge against inflation?

MC: I think it’s an excellent inflation hedge. If you look around the world, there are about $100 trillion of assets held in various forms of cash, all of which are losing purchasing power. Some bonds even have negative yields – this is the case, for instance, for some bonds issued by Luxembourg and Germany. With this in mind, some investors will turn to Bitcoin since it’s a form of money where you can’t change the monetary policy.

DU: That argument is only valid if real interest rates are negative, which over the long term has rarely been the case. In addition, if you’re looking to avoid currency risk, then the key decision is to get your money out of that currency. I also think there are lots of tangible assets, such as commodities, that have a long track record and can work well as a hedge against inflation. So there are choices out there other than Bitcoin.

Is crypto mining a threat to the environment?

MC: The software that drives the adaptable system is designed to thrive regardless of the number of miners, the price of computer chips, the price of energy, or the price of Bitcoin, and it flexes up and down based on these variables. That makes Bitcoin a particularly green industry compared to other industrial activities, and it’s constantly looking for ways to improve. Bitcoin miners purchase just one-tenth of 1% of all the energy in the world, and this energy use is likely to remain low.

Bitcoin miners purchase just one-tenth of 1% of all the energy in the world

DU: Bitcoin mining uses more electricity than some countries: over 100 terawatt-hours per year, at a cost of $3 billion to $4 billion. Negative carry costs (similar to currency depreciation) must also be taken into account. Does the value created by Bitcoin truly justify such a cost and a carbon footprint? In my view, this currency only benefits a minority, so it’s an easy win for the planet to say we don’t really need this.

Is a ban on Bitcoin on the horizon?

MC: A ban by some governments may be the biggest potential headwind to adoption, and could hurt prices in the short term. However, attempts to ban it might actually accelerate adoption by people who are already skeptical of government intervention.

DU: Limiting or even banning Bitcoin and other cryptocurrencies remains a possibility in some countries if governments feel like they’re losing control of the financial system. Bitcoin’s success could be its undoing.

Interested in finding out more?