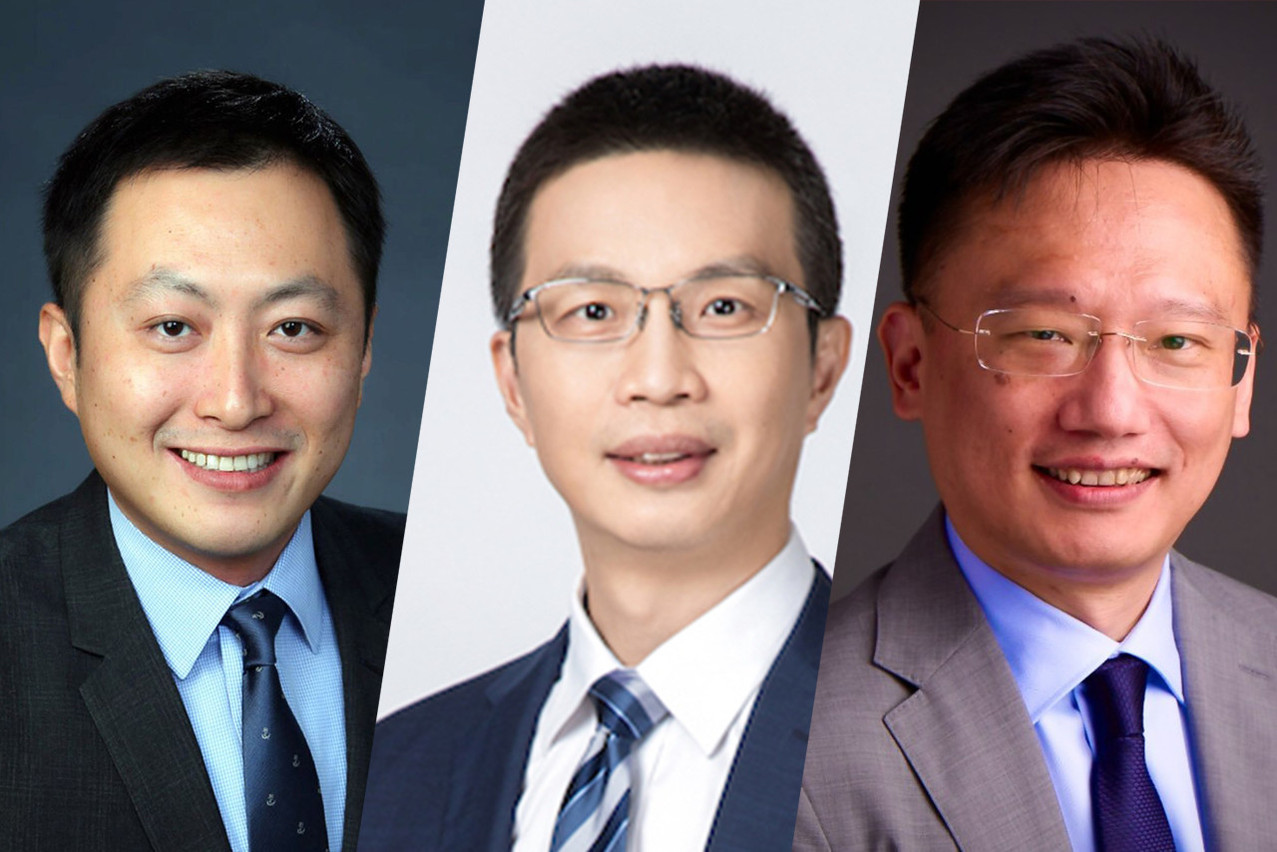

The 2023 China Finance Forum, held online on 21 November, included a panel that focused on what Chinese financial services firms are looking for in the global market, moderated by Luxembourg for Finance CEO and with the participation of Shengzu Wang (global head of asset management at Haitong International Securities Group), Bing Fan (CIO, international index strategies, senior portfolio manager at E Fund Management) and Ning Lin (managing director at CICC Hong Kong Asset Management).

“What we’re going to do now is to look at how Chinese investors and Chinese asset management firms are looking at the markets abroad, but from two dimensions,” began Mackel, introducing the topic of the panel discussion. “First of all, their investments abroad, but then also the way that they raise capital abroad to invest it back into China.”

What are Chinese investors interested in?

Hong Kong serves as a “gateway” between China and the rest of the world, noted Wang. Given the current economic context--high interest rates, high inflation--Chinese investors are are looking for relatively high returns, as well as “safety assets,” given the high interest rate differential in the US and European markets. “What they typically look for are, for example, advanced market equities, and also relatively high saving rate CDs, or more safety assets like US treasuries or other sovereign bonds, given the current high interest rate environment.”

When allocating assets globally, institutional investors are trying to be “growth players,” added Fan. “Basically, they’re looking for the sectors that can deliver a long run return higher than the average GDP growth. The technology sector [around] the globe is definitely one of the hot areas that has been focused [on] by Chinese institutional investors.”

Geographically, investors’ “first stop” is usually the Hong Kong market, thanks to its short distance. “The second destination will be the US, because of the impact on the global system,” said Fan. “After that, recently, investors also pay attention to Japan markets, Indian markets and also the Europe market as well.”

Technology focus and mimicking Silicon Valley

Is it surprising, then, that Chinese investors would prefer the US markets over other Asian markets, such as Japan and India?

“Chinese investors actually are more familiar than you’d expect with the US market,” argued Wang. “In the past, China’s technology sector was trying to mimic what the US high-tech companies were doing in Silicon Valley. So I think, naturally, they have a quite strong focus and an interest in the tech sector.”

“Also, given the performance, for example, of the Nasdaq overall compared to other indexes, there’s a natural interest for Chinese institutional investors,” he said. “Given the very high interest rates and the rate hike environment, [which are] beneficial to the US financial financial sector, the US banks are going to have historically high revenue this year.”

“And given the global weight of the US in the MSCI World Index, it’s natural that they allocate more to the US market, more than Europe or Japan,” said Wang.

Helping international investors understand trends

Turning the discussion to raising capital abroad and investing it into China, Mackel asked the panellists: how do you sell yourself? What is your added value to international investors who want to get China exposure?

“In the past, we focused on US dollar-denominated assets or Hong Kong dollar denominated assets, given the nature and also the source of these funds,” said Wang, speaking as a Chinese asset manager based in Hong Kong. But an interesting trend seen in the past 12 to 18 months has been the increased amount of offshore renminbi-denominated assets available. “So as a Chinese asset manager, in general I think we have a competitive advantage in raising offshore renminbi-denominated funds or products and investing back to China.”

Read also

Fan from E-Fund highlighted the asset manager’s commitment to the “China story.” They understand that institutional investors have concerns on challenges faced by China markets. So how do they add value? “We share what is really happening in the China market and sharing what’s really happening on the ground. That’s number one,” he said.

“We definitely help organise institutional investors globally to come into China for investor day events. We also, during our roadshow, share what is our take-home for China policies, China earnings and we help our institutional investors globally to understand… long-run, long-term trends for China markets,” said Fan. To add value for international institutional clients, they put themselves in client’ shoes, explain things in “language that can be easily accepted or understood by the audience” and acquire staff globally in order to diversify their talent pools, he added.

Need for strong partnerships

Distribution is a topic that often comes up when setting up offshore products, noted Mackel. What is being done to tackle this issue?

“There’s always a challenge that we need to find good partners, which are also competitive and which are also familiar with the local market and the regulations,” said Wang. Regulatory requirements differ from jurisdiction to jurisdiction, “so that’s why we need strong partnerships. And we look to enhance our partnerships with other institutions in Europe.”

Ning Lin from CICC also highlighted the importance of distributing funds with the help of partners. “We are actually promoting European products here in Hong Kong via ETF format,” he said. Moreover, “We’re promoting European investments to our investors; we actually have a strategic partnership with Edmond de Rothschild asset management.”

Promoting cross-border flows

To wrap up the panel, Mackel asked what panellists would suggest as economic reforms or advice they’d give to the Chinese government as relates to the asset management sector.

For Fan, continuing to open up the capital markets is key. “I can see, in the past five years there’s been progress,” he added. Now there are more futures, settlement structures and market mechanisms available.

“I think they have done a lot in terms of capital account liberalisation,” said Wang. But investment channels like Stock Connect and Bond Connect are still quota based. “Our general advice to the government is basically to lower the bar or to remove the quota, to introduce a rule-based, registration-based cross-border flow schemes for most of the asset classes to simplify and promote more cross-border flows.”

Find the replay of the livestream .