Most people associate "financial inclusion for women" with developing countries but inclusion extends to more advanced countries as there are still gaps in products and services, access to finance, not to mention the global pay and wealth disparities that can jeopardise their overall financial well-being.

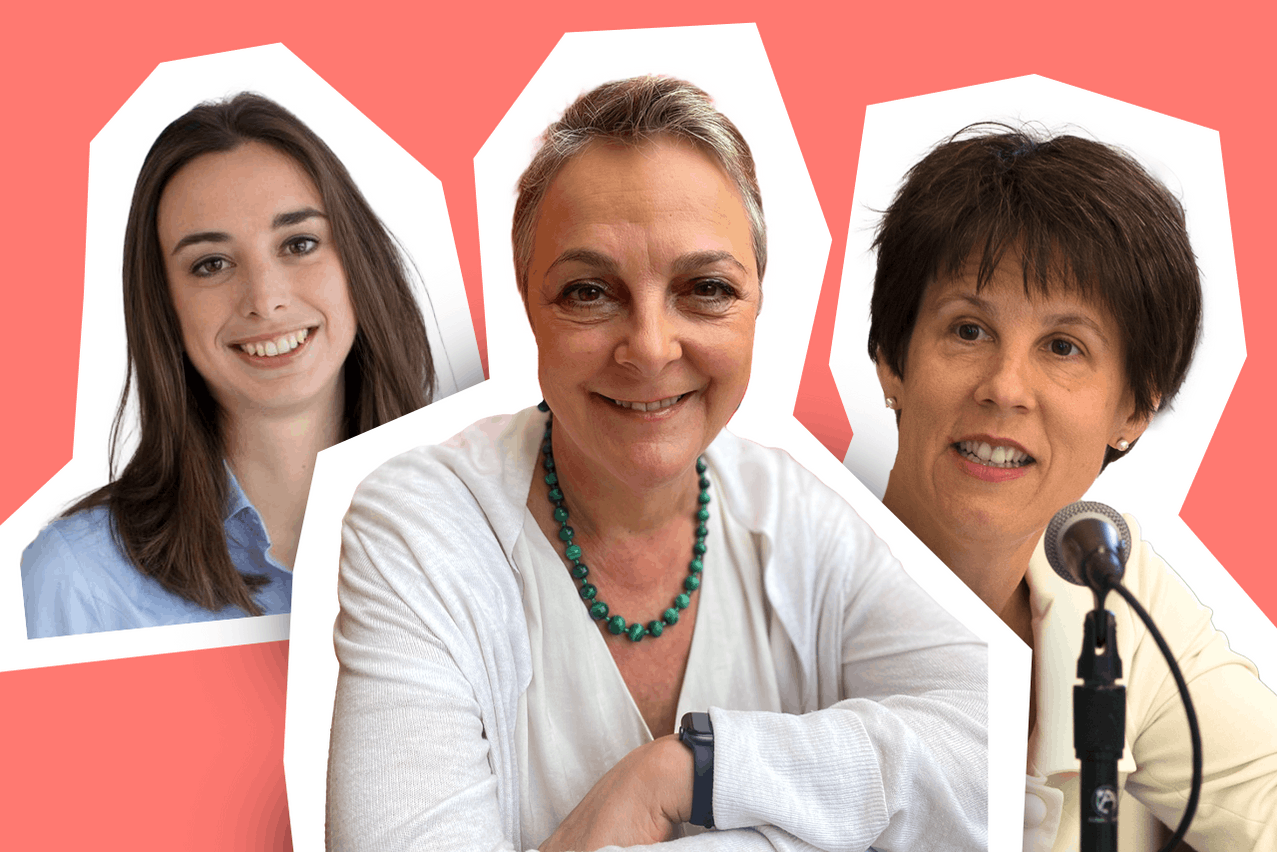

Until November 18, Luxembourg will host the annual European Microfinance Week exploring recent financial inclusion trends and opportunities. Among the speakers are Katharine Pulvermacher, executive director of the Microinsurance Network, Carmen Niethammer, senior gender specialist at the European Investment Bank, and Adriana Balducci, associate director and head of advisory services at Innpact.

They discuss how investors can better reach the female market by improving accessibility and closing the gender gap in access to finance, products, and services. They also provide examples of financial inclusion that works for women.

Consider the gender gap: it is still a global issue

Pulvermacher identifies three major barriers to full access to financial services for women: affordability, lack of awareness, and a lack of customer centricity—particularly products and distribution mechanisms that are not designed with women's needs in mind. In her view, disparities in access to financial services between men and women is widespread, and while it is significantly worse in developing countries and emerging markets, they are still far from being completely addressed even in societies where women have more protection.

For example, societal trends and gender norms that make women more likely to work in informal than formal sectors, making them more difficult to reach, or requiring women to take on more unpaid work are universal. "They may not be living in extreme poverty, but they may not be socially, economically, or financially included," says Pulvermacher, who adds that there is a gender income and wealth gap everywhere you look.

Read also

Balducci takes a similar stance while citing a that shows that, while Luxembourg is far ahead of the EU average, women still earn less than men and typically do more unpaid work than men, such as childcare and housework.

“There are many barriers to women access to finance around the world,” adds Niethammer. She explains that on the demand side, women are often unfamiliar with financial products or tools, or they lack the network to approach banks or financial institutions. On the supply side, financial institutions are sometimes unaware that "incredibly" profitable opportunities exist in the women's market.

“There is a huge business case for many of these financial institutions. When they realise what kind of products and services--both financial and non-financial--women need, then they even become more profitable.”

Implications of disparities in products and services

The World Bank's most recent Global Findex Database shows that the gender gap in account access has narrowed, but to understand the impact on women's lives, one must look beyond how many women can borrow money or have access to bank accounts. "Does it have a positive impact, and does it automatically lead to financial inclusion?" asks Pulvermacher.

Understanding the consequences of these disparities for women strengthens the case for immediate action. According to Pulvermacher, "even where women use insurance services, they are likely to be less well covered than their male counterparts purely due to affordability." Especially when one considers that insurance is linked to the amount of a loan or how much one earns, and thus, given the gender pay gap, women may be given less coverage.

She goes on to give more examples, such as life insurance or pensions. For instance, consider a married couple in Luxembourg in which the woman decides to work part-time in order to raise the children. What happens to her pension if she divorces? She may be at a disadvantage because she will not have contributed to the state system for the same number of years or earned the same amount of money as her spouse, not to mention the knock-on effects on children.

Gaps in financial services and income translates into a whole lot of other poverty gaps or types of inequality where the impact can be very long term.

The situation is also dire in developing countries, where “90% of the population does not have access to insurance and often has very limited access to other financial services.” Uncollateralised loans are still uncommon in many advanced countries, adds Pulvermacher, citing credit guarantee schemes used by banks in Rwanda, where the government can step in to provide a collateral guarantee for women, as one good example.

In other common cases in Luxembourg and elsewhere, most people, including women, can only borrow a percentage of their salary. While this may have little effect in a country with a minimum wage, it raises the question for women in countries with a large informal sector: “how do you prove what you earn?” Things may appear to be fine for those in the formal sector, even in emerging markets, “but when you look at the number of women in this category of living on $2 to $20 a day, literally you know it's close to 2 billion women around the world, so we're talking about a sizeable number,” continues Pulvermacher.

Nonetheless, bolstering Niethammer's opportunities remarks, Pulvermacher explains that a Swiss Re Institute study has already shown that the insurance value chain adopting a more inclusive approach to women represents a market value of $2 trillion. Bridging other persistent wealth and income disparities could result in similar economic benefits.

Towards a type of financial inclusion that benefits women

In concrete steps, "the starting point has to be with the women themselves," says Pulvermacher, who adds that firms that have been doing a lot of customer insight work and investing in women over the years have shown returns on investment. Yet, financial and non-financial solutions for women in general tend not to be to the same extent.

For her, “engaging with women can be done in many ways. You could ask women directly what their financial service needs are, try to understand their customer journey--the things that worry them--how do they spend their money? And what does this foot for? You can also harness technology through big data analysis that's available from network operators where transactions are taking place, [and assess] the value of those transactions.”

The starting point has to be with the women themselves

Niethammer mentions two other key points that have proven to be effective, particularly for financial service providers. First, opportunities for women to get to know providers better in order to build trust—for example, assisting women with business development plans and other non-financial services that add value in the market. Second, designing specific products and approaches to financing the specific needs of women-led businesses while keeping in mind that margins and repayment schedules may differ.

She cites Uganda as an example, where women's incapacity to meet regular banking hours led to the extension of bank hours to Sunday, which increased women's reach. “The banks that I've seen doing incredibly well in reaching the women's market are those that actually track how they're tracking their performance vis à vis women and their portfolio, cross selling [products] and non-performing loan rates. This allows them to see their correlations and impact.”

European Microfinance Week expectations

Pulvermacher's biggest regret is not being able to split up and attend all of the parallel sessions, but she's looking forward to seeing everyone in person again at the event. “What I would really like to see is more of the Luxembourg private sector exploring the [women's] space and seeing how they can translate it in the Luxembourg context and recognise the number of development partners and international organisations that actually come to Luxembourg as a centre of excellence for financial inclusion.” Balducci adds that she's looking forward to networking with contacts, while Niethammer says she's looking forward to lessons that can be taken forward, as well as meeting new people and leveraging these contacts into partnerships.

“If we don't get this gender-lens investing right very quickly, then we will not be able to meet many of our development objectives, including the one on climate action.

“If we don't get this gender-lens investing right very quickly, then we will not be able to meet many of our development objectives, including the one on climate action. [At the EMW], we're going to be able to hear what works, what doesn't work, and how we can scale good practice faster. This is key.”

EMW full programme

On Friday 18 November, Balducci and Niethammer will speak on the panel ‘Gender-lens investment in practice: moving forward and beyond’. Pulvermacher will speak on the ‘Financial inclusion that works for women’ panel.

Other gender-specific sessions include gender diversity and leadership in financial inclusion, policy and regulatory innovation to advance gender inclusive finance, and lessons from emerging markets: what can accelerate women's financial inclusion in Europe. The complete schedule is available .