“There has already been significant progress since the inception of the sustainable bond market,” says Lucas Rabiot, sustainability data manager of the Luxembourg Green Exchange’s (LGX’s) DataHub platform. He is referring to progress in terms of structured data in the realm of sustainable bond publications: the use of tables, templates and formats. The more structured the data, the easier his and his team’s job gets.

That job, namely, is to process the documents written by bond issuers that describe what’s in their bond, including both pre- and post-issuance information. The former comprises commitments by the issuer, eligible project types, reporting standards; the latter how much money was earmarked for which project as well as the ultimate environmental/social impacts of each.

“The information that we’re trying to structure is really heterogenous,” Rabiot explains. “It comes in different formats, different languages. Sometimes in tables, sometimes in texts. Sometimes only partial information is presented by the issuer.” The LGX team of ten professionals must interpret these numbers in their individual contexts in order to add each bond (or not) to the platform, which serves as a resource for asset managers, investment bankers and researchers.

Automation and greenwashing

Asked if this task is a good candidate for natural language processing tools, Rabiot says potentially yes but the technology isn’t there yet. “Of course, it would be ideal,” he says of an artificial intelligence tool that could extract the data in a reliable way. For now, however, human intervention remains necessary. “Since we’re talking about lots of figures, especially post-issuance--looking at the amount that has been allocated, the impact derived in terms of the number of tonnes of CO2, for example… it’s really important that these numbers are carefully interpreted within their contexts.”

The increasing standardisation of the data, however, could lead to more opportunities for automation. “It might be possible in the future,” he comments, noting that the use of templates is what will enable such a transition.

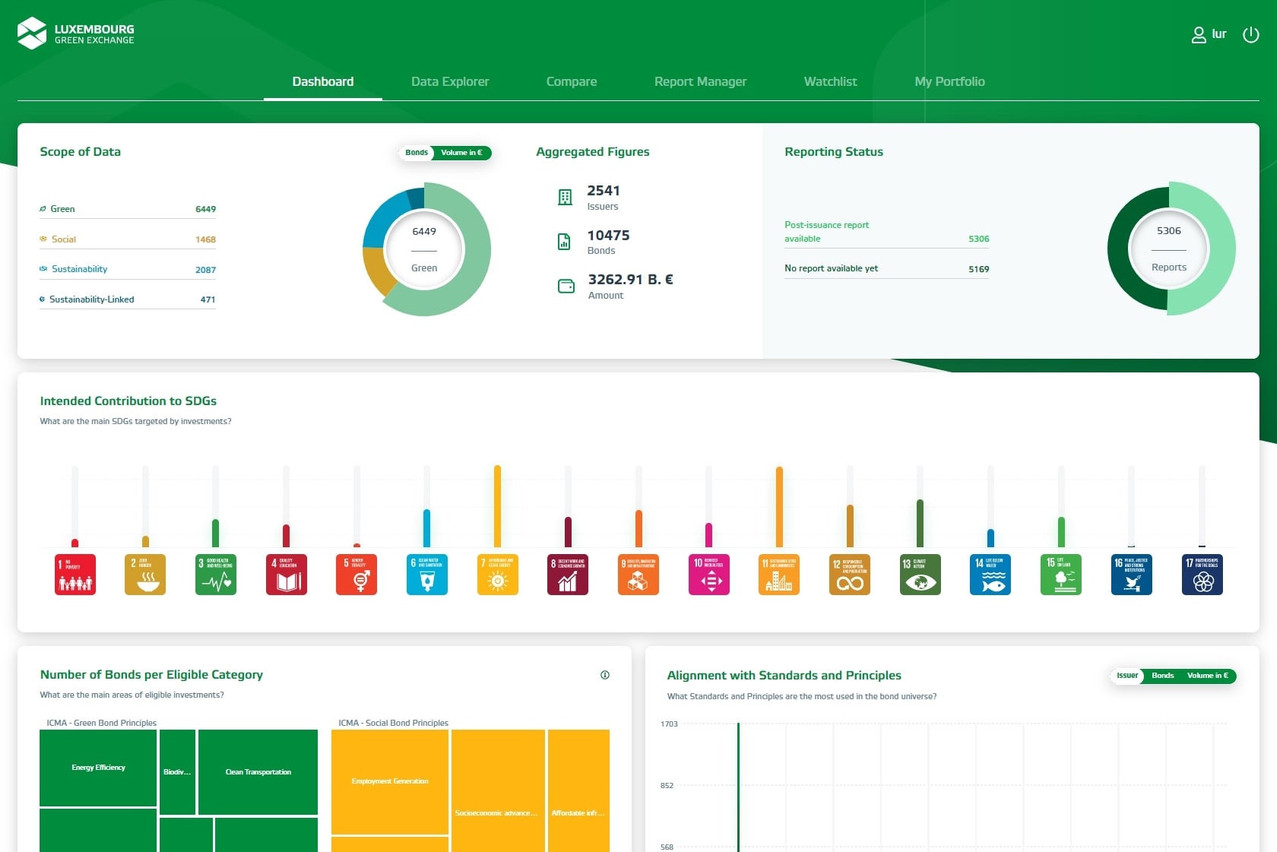

Launched just three years ago, the LGX DataHub now includes over 10,000 sustainable bonds. Image: Luxembourg Stock Exchange

How is the “greenness” of a bond verified? Rabiot explains that this, too, is a job that relies on human discretion: he and his team check the sustainable attributes of each instrument before putting it onto the platform. “Concretely, what we do is make sure we can find the use-of-proceeds language or the sustainability-linked language… [which] we look for in the legal documentation of the instrument or in a dedicated press release from the issuer. That gives us the confidence that a given instrument is indeed green, social, sustainable, etc. and deserves to be included on our platform.”

Zero to 10k

Launched in 2020, the LGX DataHub--a project of the LGX, itself a department of the Luxembourg Stock Exchange--grew naturally from a need for more structured sustainability data in the burgeoning world of sustainable finance.

The LGX, itself only launched in 2016, was the first international platform dedicated to sustainable finance securities.

From its beginning as a database of only LuxSE-listed bonds, the LGX DataHub grew to cover bonds worldwide. In January it announced that it hit 10,000 bonds on the platform, which had already grown to 10,500 by the start of March.

The graph below shows the corresponding uptick in the sustainable bond market, which actually comprises four types of bonds: green, social, sustainability and--the newest type--sustainability-linked bonds. (Together, these are known as “GSSS” bonds.)