Luxembourg corporate banking revenues reached near-record highs in 2022, with an estimated €5bn, representing a 24% increase from the previous year and accounting for 35% of total banking revenues in Luxembourg. However, this growth was met with economic challenges that impacted profits, which saw a 19% decline compared to 2021. on Friday 23 February 2024, as part of the 2023 corporate banking survey, conducted jointly by the Luxembourg Bankers’ Association (ABBL) and PWC Luxembourg, the findings suggest that the tightening of monetary policies and uncertainties surrounding economic growth have exerted pressure on profits within the sector.

Furthermore, the contribution of funds industry to corporate banking revenues has seen a notable increase, rising by 14%, while revenues from corporate entities declined by 19%. The survey also indicated significant growth in non-interest-based services, particularly those provided to the asset and wealth management industry, highlighting the evolving revenue streams within corporate banking.

Sustainability and the integration of new technologies are anticipated to be the primary drivers of change in the corporate lending sector, said the report. The survey respondents believe that environmental, social and governance (ESG) financing will play a pivotal role in the industry’s future, with artificial intelligence identified as the second most influential factor.

Despite the challenges, the survey reveals a strong global outlook for Luxembourg’s corporate lending, with 75% of respondents engaged in activities beyond grand duchy’s borders. However, there is a consensus that long-term revenue growth is expected to primarily come from Europe, despite an 11% rise in revenues from the Americas region in 2022 compared to the previous year.

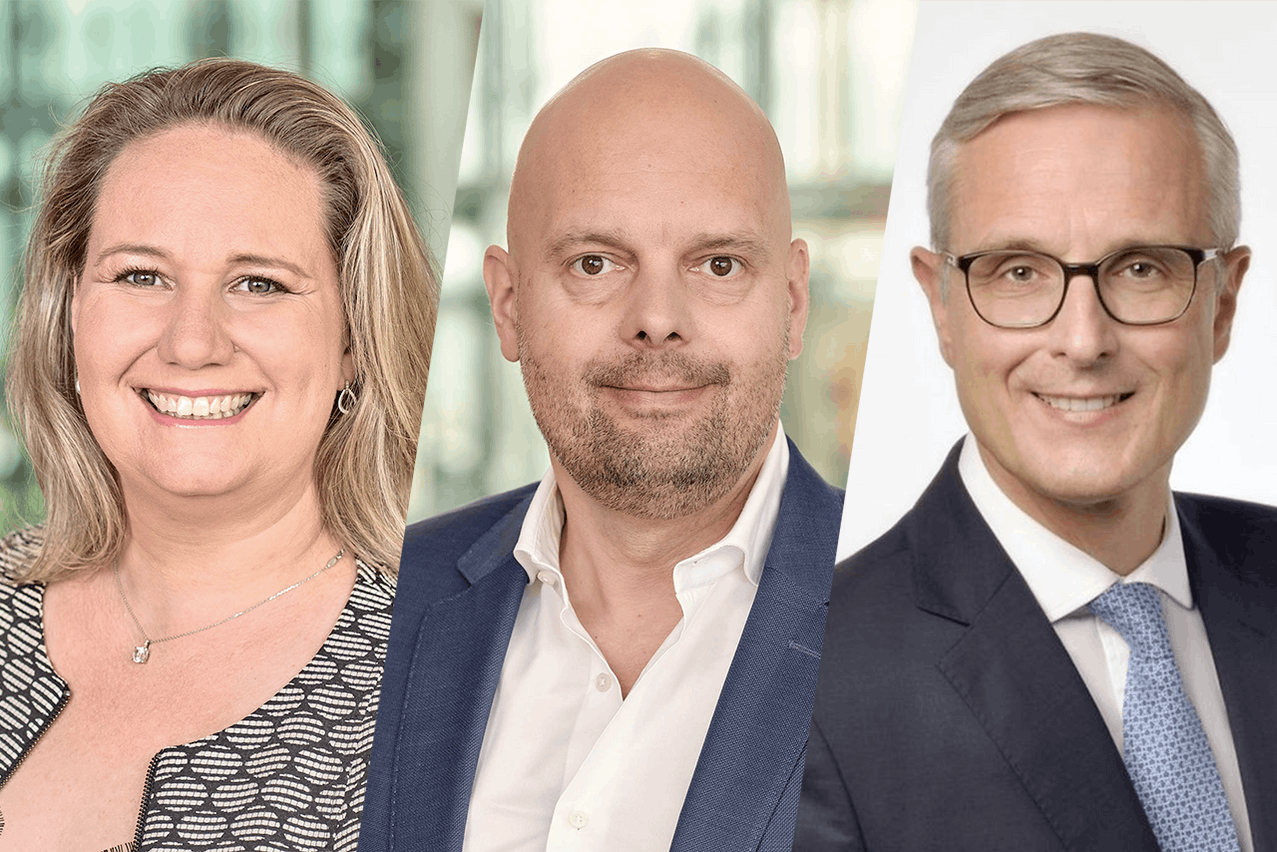

, banking and capital markets leader and assurance partner at PWC Luxembourg, commented on the findings in a press release, stating that the corporate banking sector is adapting to the new economic realities and is poised for change. Jörg Ackermann, consulting partner at PWC Luxembourg, further emphasised the role of corporate lending in the green transition and the strategic adoption of new technologies by banks.

Frank Rückbrodt, chair of ABBL’s corporate and institutional banking cluster and CEO of Deutsche Bank Luxembourg, highlighted the critical role of bank loans in corporate financing within Europe and Luxembourg’s strategic position as an international financial centre in addressing both immediate and long-term challenges faced by societies and economies.

The full 48-page report in available .