American pop-star Taylor Swift would advise extreme caution. After intense negotiations, the singer who dethroned Barbara Streisand in the sales charts turned down a $100m contract with Sam Bankman-Fried’s company FTX, which goes to trial on 2 October. Adam Moskowitz, Taylor Swift’s lawyer, told The Scoop podcast that she has been the only celebrity to question the regulatory vagueness surrounding cryptocurrencies.

Cryptocurrencies have rocked the financial world since the advent of bitcoin in 2009. This digital currency, created by a person (or group of people) named Satoshi Nakamoto, kicked finance--conceptually--into high gear. Unlike the usual currencies issued by countries, cryptos represent a decentralised currency that works thanks to innovative computer technologies. No more need for central banks! A democratic revolution, it seemed.

Since bitcoin, other cryptos have invaded the field: Ethereum, USDT, Ripple, Litecoin, to name but a few. They have won over many people, seduced by the promise of financial freedom (as long as you don’t lose it all in the blink of an eye), the simplicity of cross-border transactions, and of course, anonymity, offering significant differences from traditional banking systems.

Behind the technological scene of cryptocurrencies

Cryptocurrencies are based on the concepts of blockchain and cryptography. To better understand how they work, let’s focus on bitcoin.

Imagine that a user wants to send bitcoins to another user. To do this, they create a transaction. To guarantee the authenticity and integrity of this transaction, the user signs it electronically using a pair of cryptographic keys that he or she holds. This authenticated transaction is then transformed into a block with the aim of adding it to the blockchain.

A blockchain is like a decentralised database that keeps an indelible record of every event that occurs on it--in this case, bitcoin transactions.

Once the transaction block has been created, it is then distributed through the decentralised network of “miners” (more properly “network guardians”), who compete with each other to solve a mathematical problem, commonly known as the “proof of work.” This process guarantees the validity of the transaction.

The miner who solves the problem first shares their result with the other miners. Once the majority of miners agree with the solution, the transaction block is verified and added to the blockchain. This new piece of the blockchain is then distributed throughout the network.

How a transaction is organised. Source: Benoit Poletti

Ultimately, blockchain offers transactional transparency and immutability unheard-of in other contexts. Once a transaction is recorded on the blockchain, changing it is a challenge; it would be like trying to put out the sun with a water pistol. This is due to the use of cryptographic fingerprinting functions and the fact that each new block is securely linked to the previous blocks. It’s as if each transaction had a unique number plate, which reduces the risk of fraud.

Between legal recognition and use for illicit transactions

In some parts of the world, cryptocurrencies are commonplace. Take El Salvador, for example, which decided in 2021 to adopt bitcoin as legal tender, a world first.

This decision was met with both approval and horror. Two years on, its limited use by the local population and its volatile nature (bitcoin lost more than 65% of its value between January and December 2022) have cast a negative light on the decision.

El Salvador is not the only country to have travelled this road. The Central African Republic also adopted bitcoin as legal tender in April 2022, only to backtrack a year later. Many other countries, notably within the European Union, have legalised the use of bitcoin without making it their legal tender.

Cryptocurrencies also have a dark side. Despite their legitimate uses, cryptos are being exploited for various illegal activities because of their unique features such as anonymity. Crypto transactions, although publicly recorded, hide behind wallet addresses that look more like a string of alphanumeric characters than a human identity. In other words, identifying the true owner of these addresses is a real headache.

Criminals can move their funds between countries without ever passing through the customs of traditional financial institutions. The darknet markets, where everything from drugs to forged documents and weapons can be found, prefer cryptos, particularly Bitcoin, Monero and USDT.

Various scams are also associated with cryptocurrencies, such as Ponzi scams where criminals lure their victims with promises of high returns on cryptocurrencies, while using the investments of new participants to pay off old ones, until the criminal absconds with the funds, leaving many victims with losses (the OneCoin case is perhaps the most illustrative example).

Here is an example:

Various scams are also associated with cryptocurrencies, such as Ponzi scams where criminals lure their victims with promises of high returns. Source: Benoit Poletti

We have also identified and analysed certain crypto wallets active in Luxembourg, based on their IP addresses. The criminal activity that can be linked to this remains low, but it does exist…

If we delve into the details of two portfolios in particular, which we will call wallet 1 and wallet 2, we discover a series of transactions between Luxembourg and Kyiv, totalling around 250 operations between 2015 and 2016.

Where did the funds that wallet 2 sent to wallet 1 come from? Wallet 2 held more than 8,000 bitcoins… Source: Benoit Poletti

At first glance, there are no links with the darknet. But on further investigation, we discover that wallet 1 had received a fair amount of bitcoins from anonymous wallets, particularly wallet 2.

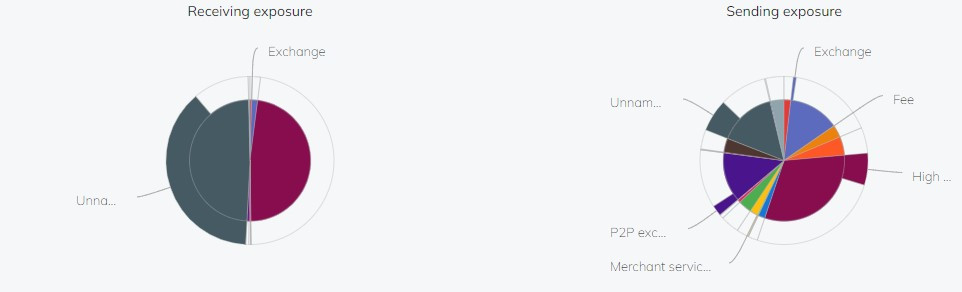

An idea of the circulation of bitcoins. Source: Benoit Poletti

Wallet 2, for its part, shows a total of 8,099 bitcoins in circulation over three years of activity, at a time when the cryptocurrency had already reached new heights. And where did these funds come from? Portfolios associated with scams, darknet markets, fraud, gambling and other such activities…

Luxembourg and its cautious approach to cryptocurrencies

Bitcoin has gained 75% since the start of 2023, and is on course for its best annual performance since 2020. In mid-August, its price plummeted following (according to some traders) the decisions of Tesla CEO Elon Musk. While bitcoin started September 2023 at $25,927, experts believe it will end the month at around $19,691. It will nevertheless retain its position as the “best cryptocurrency.”

In the rankings of holders of digital currencies, Luxembourg is near the bottom, far behind Germany and France. The Vietnamese are in first place, the Ukrainians second and the Americans third. Europeans are often more conservative when it comes to technological innovations.

Luxembourg has been a pioneer in monitoring trading platforms. It is both curious and cautious. In other words, Luxembourg seems to be taking Taylor Swift’s approach. It remains to be seen whether bitcoin’s good digital health will be enough to shake up habits in the grand duchy. Time will tell…

*Benoît Poletti is director general of the public agency , considered to be a centre of expertise in the fields of cybersecurity and digitisation. The agency manages critical national and international IT infrastructure, as well as developing solutions used in identity management and cryptography. Poletti represents Luxembourg in European and international bodies such as UN agencies, and also works internationally on cybersecurity and digital governance issues in emerging countries.

This story was first published in French on . It has been translated and edited for Delano.