The eurozone’s inflation rate reached 8.1% at the end of May, driven by record energy price inflation of 16.3%. These figures are interesting to put into perspective with the recent falls in the respective prices of bitcoin and ethereum, due to the high energy consumption required to mine them.

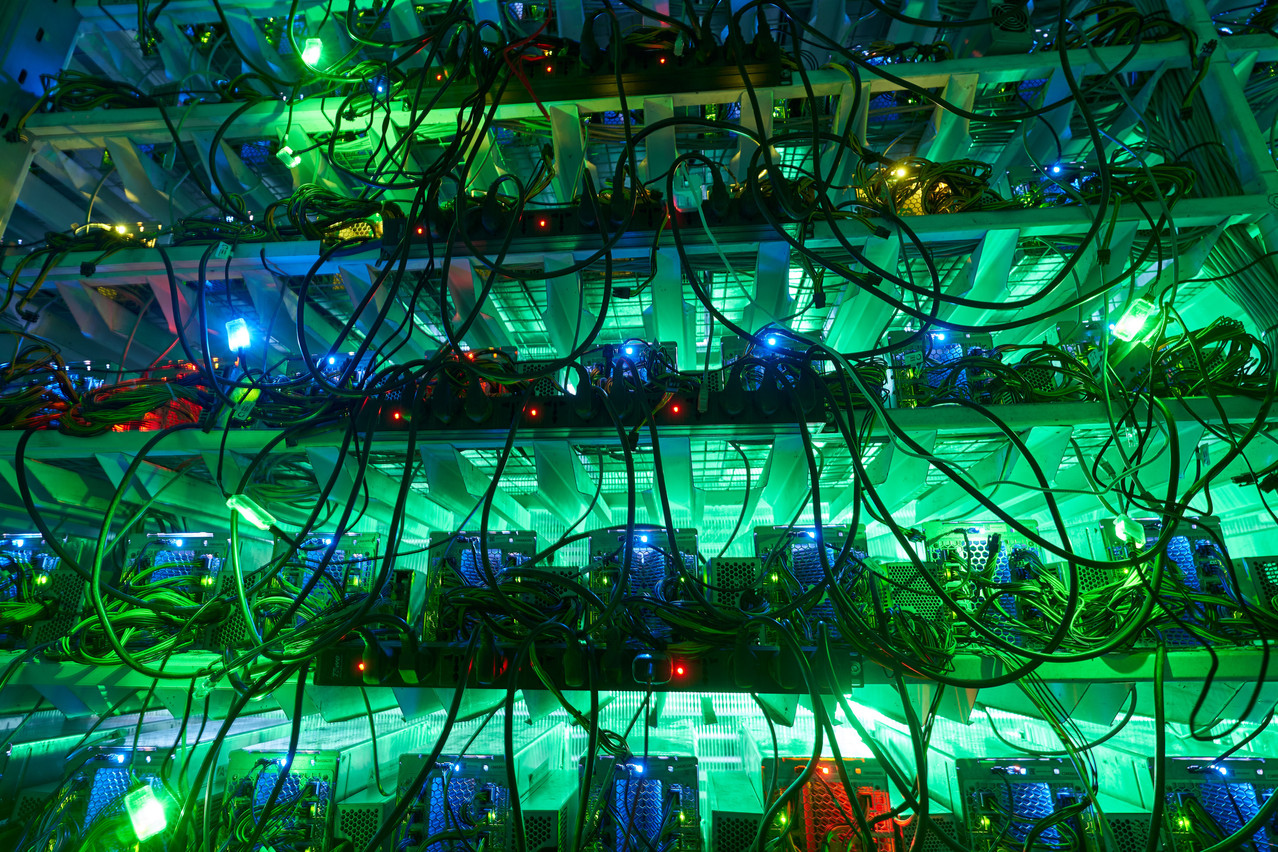

In recent weeks, the European Central Bank has embarked on a crusade against cryptocurrencies. Last May, as part of its Financial Stability Review, the Frankfurt-based institution put forward the argument of the high energy consumption of cryptocurrencies.

Much earlier, in January, Erik Thedéen, vice president of the European Securities and Markets Authority, told the Financial Times that cryptocurrencies pose a risk to achieving the climate goals set out in the Paris Agreement. At the time, he called for a ban on mining methods based on “proof of work”, a form of cryptographic proof in blockchain that a certain amount of computational effort has been expended. The mining of the two most important cryptocurrencies, bitcoin and ethereum, is based on this method.

In its April report, the UN’s Intergovernmental Panel on Climate Change rightly stated that the energy needs of cryptocurrencies are becoming a growing climate concern.

According to the Cambridge Bitcoin Electricity Consumption Index, bitcoin’s monthly electricity consumption was 10.67 terawatt-hours, up from 0.62 in January 2017. A study published on 7 June by the International Monetary Fund reported, in turn, that a transaction involving a proof of work cryptocurrency consumes between 100 and 1,000 kilowatt-hours, while a credit card transaction consumes only 0.001 to 0.01 kilowatt-hours.

Rising energy prices therefore increase the costs of mining bitcoin and ethereum, leaving the door open for their intrinsic value to be determined by the energy spent, making them energy derivatives.

The price of bitcoin was €19,736.55 on 17 June, compared to €29,322.56 on 6 June. The price of ethereum has also fallen recently, from €1,851.34 on 30 May to €1,036.28 on 17 June.

Originally published in French by and translated for Delano. This article was published for the Paperjam + Delano Finance newsletter, the weekly source for financial news in Luxembourg. .