The objective of these talks is for Oxford Economics, a British research and consulting outfit, and Statec, the Luxembourg statistics bureau, to share their insights with the general public, and make sure that their research and analysis is accessible to the people who live and work in the grand duchy, organisers said.

Speaking at the event:

- Oliver Rakau, chief German economist and deputy head of Europe at Oxford Economics

- Ferdy Adam, head of the economic forecasting and modelling division at Statec

- Bastien Larue, head of the economic climate unit at Statec

- Serge Allegrezza, director of Statec

The roundtable was moderated by Delano’s Aaron Grunwald.

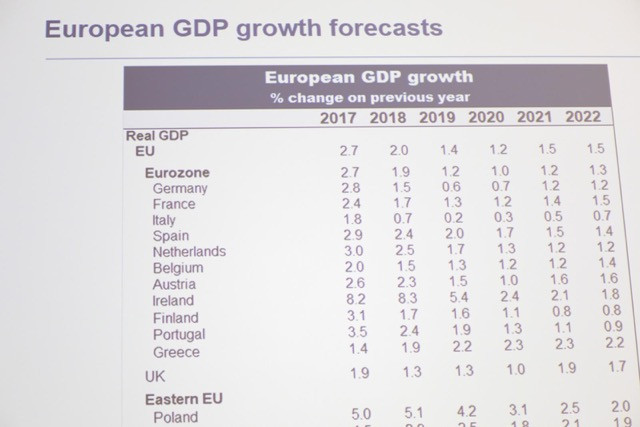

Rakau provided an overview of the global and eurozone outlook. He stated that:

- The phase one China-US trade deal has “reduced significantly” downside risks and with less uncertainty “firms may be less cautious with their spending”.

- More clarity on Brexit meant “less uncertainty” which means “maybe firms will invest more in the UK”. While the future EU-UK trade relationship remains unknown, however, there will still be “ongoing uncertainty”.

- He expected “rather modest” global trade growth of around 1.5%, which is “one of the weakest rates in recent years.”

- Rakau anticipated that Germany would exit recession in early 2020, or “right about now”.

- Uncertainty will persist as a drag on eurozone investment, which he forecast to expand by 1%-2%, as firms pushed out their investment plans, especially on German capital goods orders.

Adam and Larue commented on recent Statec forecasts, notably its latest economic climate reports, “Note de conjoncture 2-2019” and “Conjoncture Flash December 2019”, both published last month. Statec predicted that the Luxembourg economy would grow 2.4% this year. That’s compared to 2.8% in 2019 and more than 3% each year between 1995 and 2018.

The Statec researchers stated that:

- Employment in the financial sector has continued to rise, partly due to a “Brexit effect”. Larue said that firms shifting operations to Luxembourg ahead of Brexit have created around 800 jobs (out of roughly 2,000 new positions added in the past couple years).

- Within the financial sector, investment funds have been growing at a healthy clip, while the banking segment has been far softer.

- The construction sector, which employs about 10% of Luxembourg’s workforce and contributes about 5% to GDP, continues to expand, but at a relatively slower pace. Bosses cite labour shortages as a major challenge.

- Adam stated that the next round of indexation (automatic rises in wages and pensions) is currently predicted to take place in approximately 18 months, or mid-2021.

In response to audience questions, the Statec researchers had “no opinion” on the impact of Luxembourg’s nascent space mining sector on the overall economy. Nor did last summer’s tornado have any notable impact on the country’s economy.

Allegrezza commented on rapidly rising housing costs, which remain a global trend, particularly--as The Economist observed in a special report last week--in English speaking countries.