It’s only fools who don’t change their minds, as the saying goes. Applied to cryptoassets, the popular maxim shows not only that the gurus who run the big institutions, such as Blackrock, Goldman Sachs and JP Morgan are not, but that their strategic reversals are driving the adoption of these next-generation assets at an unprecedented rate.

“Fidelity offers access to bitcoin to more than 36m retail clients worldwide. Goldman Sachs, JP Morgan and all the others are all deeply involved in building a digital assets infrastructure,” stressed the programme manager of the Cambridge Digital Assets Programme, Christopher Jack, keynote speaker at the event organised on Tuesday evening by PWC and Lhoft in the former’s atrium. “Tokenisation is no longer just a talking point, but is actually an active part of the roadmap in capital markets boards. It’s not just the future of finance. It’s already happening now. What we are witnessing is the gradual integration of cryptoassets into the mainstream of global finance. And yet there is tension, because whilst momentum is building, scepticism persists. Regulatory uncertainty, legacy infrastructure, strategic hesitancy, all remain real barriers to adoption. But make no mistake, we are at a crossroads.”

“At the end of the first quarter of 2025, the total market capitalisation of cryptoassets was $2.8trn, down from $3.8trn at the start of this year, but much higher than the $800bn we saw at the lows in 2022. To put that in perspective, $2.8trn makes crypto bigger than the entire US high-yield bond market,” said the expert. “It is also larger than the market capitalisation of most European stock exchanges. But even more important than size is its composition. In 2017, the cryptoasset market was largely driven by retail trading speculation. But institutions are no longer on the sidelines. We now have ETFs [exchange-traded funds] listed and regulated around the world. We have major global crypto custodians. We have pension funds, family offices and sovereign wealth funds gaining exposure every week. This is a market that is undergoing a major structural change. Of course, volatility has not disappeared and there are still quite a few risks,” he added.

“At the beginning of 2025, more than 560m people around the world hold some form of cryptoasset. Now that’s 7% of the world’s population,” he said. “Even governments are getting involved with more than 130 countries around the world currently looking at central bank digital currencies, representing 98% of countries today.”

The programme manager of the Cambridge Digital Assets Programme, Christopher Jack, described--with the help of numerous figures--the momentum that the cryptoassets industry is experiencing. Photo: Maison Moderne

“In the first quarter of 2025, crypto exchanges handled $5.4trn in spot trading volume and a further $21trn in derivatives trading. This demonstrates that crypto is no longer just a small, marginal emerging market. It’s here now. And what’s equally important is the variety of activity we’re seeing. Whilst Bitcoin and Ethereum are still big volume drivers, we're seeing growing interest and liquidity in stablecoins, tokenised assets and onchain treasury products. This development really signals something critical. We are seeing a growing overlap between on-chain and off-chain activity. Institutional desks around the world are routing transactions to regulated exchanges. Custodians are integrating digital asset workflows and compliance tools to enable KYC and AML [know your client and anti-money laundering] checks on an institutional scale. And it’s all happening now.”

Luxembourg’s unique positioning

This is also what emerges from the third edition of the survey, conducted every two years among 128 respondents, and presented by PWC Luxembourg’s Global AWM Market Research Centre Leader, Dariush Yazdani, and Lhoft’s research manager, Oriane Kaesmann. What also emerges is Luxembourg’s unique positioning as a strategic differentiator--something to be taken positively in a globalised financial world where the slightest uncertainty is enough to dampen the ardour of the less conservative...

“The EU’s Mica [Markets in Cryptoassets] regulation, which came into force in December 2024, provides a unified legal framework for crypto-asset service providers across the 27 member states. This global approach gives you credibility and service for issuers, service providers and investors. Luxembourg has also positioned itself very well with its two laws. The law on blockchain 4 that we presented at Luxembourg Blockchain Week in December last year and the law that came out on 6 February, which dealt with cryptoassets and green bonds. Now, let’s compare that to the US. The US is undergoing a fairly radical change in its regulatory approach. The SEC’s crypto working group has begun discussions on how applicable securities laws apply to crypto assets. This could signal a positive move towards crypto-assets, but the landscape is still very fragmented in the US, with various bills under consideration and Congress having many divergent views among regulators. This divergence represents a strategic opportunity for jurisdictions like Luxembourg,” Jack assured.

Luxembourg is now at a decisive turning point in the evolution of digital assets.

“Luxembourg is now at a decisive turning point in the evolution of digital assets,” said Jack. “We have a legal framework, a forward-looking regulatory environment and a commitment to innovation. Luxembourg’s proactive position has already attracted major financial institutions. For example, across the EU. On top of all this, we also have many government-funded Luxembourg strategic initiatives, such as the Luxembourg House of Financial Technology, Luxembourg for Finance.”

“Risk is part of opportunity,” insisted Yazdani, who showed that decision-making power remains or is largely in Luxembourg. “When asked how they would assess the current global cryptoasset market, we see a point of inflection. Clearly, conviction has strengthened, you see the change from 33% to 50%. It’s partly the Trump effect, but it’s mainly this institutionalisation! … Major traditional players are taking serious positions in cryptoassets, and this is a sign of confidence that marks a key moment of maturity. Digital assets are increasingly integrated into traditional finance. Crypto is no longer a niche. It is entering the financial system.”

Talent: still the achilles heel of development

According to the survey, those who see moderate or high potential are still more numerous, although 17% still see “limited” potential, and those who see no investment logic are also still present. “Maybe your customer base isn't asking for it, so you’re not moving in that direction. Maybe you don’t have the expertise,” said Yazdani, who--like all the speakers--welcomed the CSSF’s commitment to being at the service of the market and technologically neutral. Talent is, behind risk, still a decisive element in the deployment of cryptoassets.

Faced with Mica and new regulations, “19% are already completely ready; 52% are in the process of doing a gap analysis. Another 21% are in the process of obtaining a CSP [crypto service provider] licence. So clearly, those engaged in the crypto market are getting ready, or are already ready,” commented Yazdani. “Finance and financial services, by definition, it’s a globalised industry. And if you have to adopt different regulations, consult different regulatory frameworks and comply with all of them, that represents a cost--and a risk, right? And this uncertainty is clearly one of the major elements.”

The PWC expert in front of his slide on the tasks to keep in mind to continue developing the ecosystem in Luxembourg. Photo: Maison Moderne

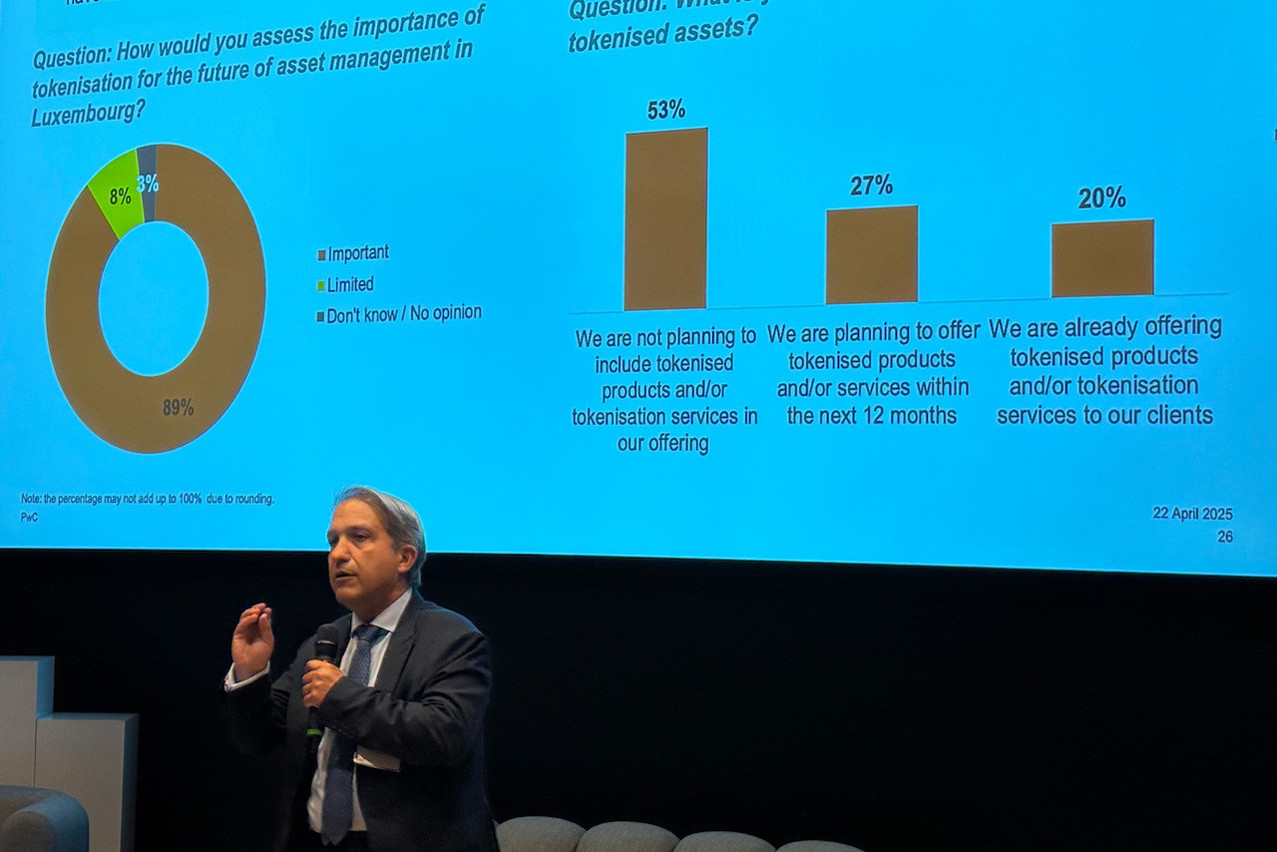

“Regarding tokenisation: if you are in the asset and wealth management industry, particularly in private markets, this is one of the major trends that we are seeing at PWC, in the Global Asset and Wealth Management Research Center that I lead. We are forecasting a compound annual growth rate of 51% for tokenisation worldwide, in investment funds alone. This should exceed $300bn by 2028. So, clearly, we’re anticipating very strong growth in tokenisation,” added Yazdani. “And when asked how important they consider this to be, almost 90% replied that it was a crucial issue for the future of asset management in Luxembourg. As you know, one of Luxembourg’s areas of leadership, in addition to Ucits, is private market assets. And as we move towards a democratisation of these private markets, tokenisation will play a key role in this area.”

Time to invest

Just over half (53%) of respondents are not planning anything yet. Only 20% already have tokenised assets and 27% are planning to launch them.

What are the main challenges we see when talking about tokenisation? The lack of standards. “Everyone can use their own standards to implement tokenisation solutions. And then there are the implementation costs and the technical requirements,” added Yazdani. “It always comes down to the same thing. When I talk about digital transformation--whether it’s AI, cryptoassets or tokenisation--you have to invest. You have to put money on the table. There’s no such thing as a free lunch. If you want to seize this opportunity, you have to go for it.”

As there is clearly this need for a multi-chain approach to creating liquidity, as well as secondary market infrastructure. Infrastructure still remains a key point around tokenisation.

“If you don’t do something, someone will do it for you,” concluded Standard Chartered Luxembourg CEO , during a roundtable that placed heavy emphasis on the need for all stakeholders to get started, communicate with each other and communicate with the regulator.

This article was originally published in .