The European Central Bank is poised to trim key banking rates by 25 basis points at its upcoming rate-setting meeting in Frankfurt on 12 September 2024. A Delano survey of leading economists confirms strong consensus around this move, with almost as many predicting a further cut in December, likely marking the final rate adjustment for the year. They added that the ECB is likely to remain “data-dependent” on metrics such as services inflation, labour costs, productivity and profits before committing to further cuts.

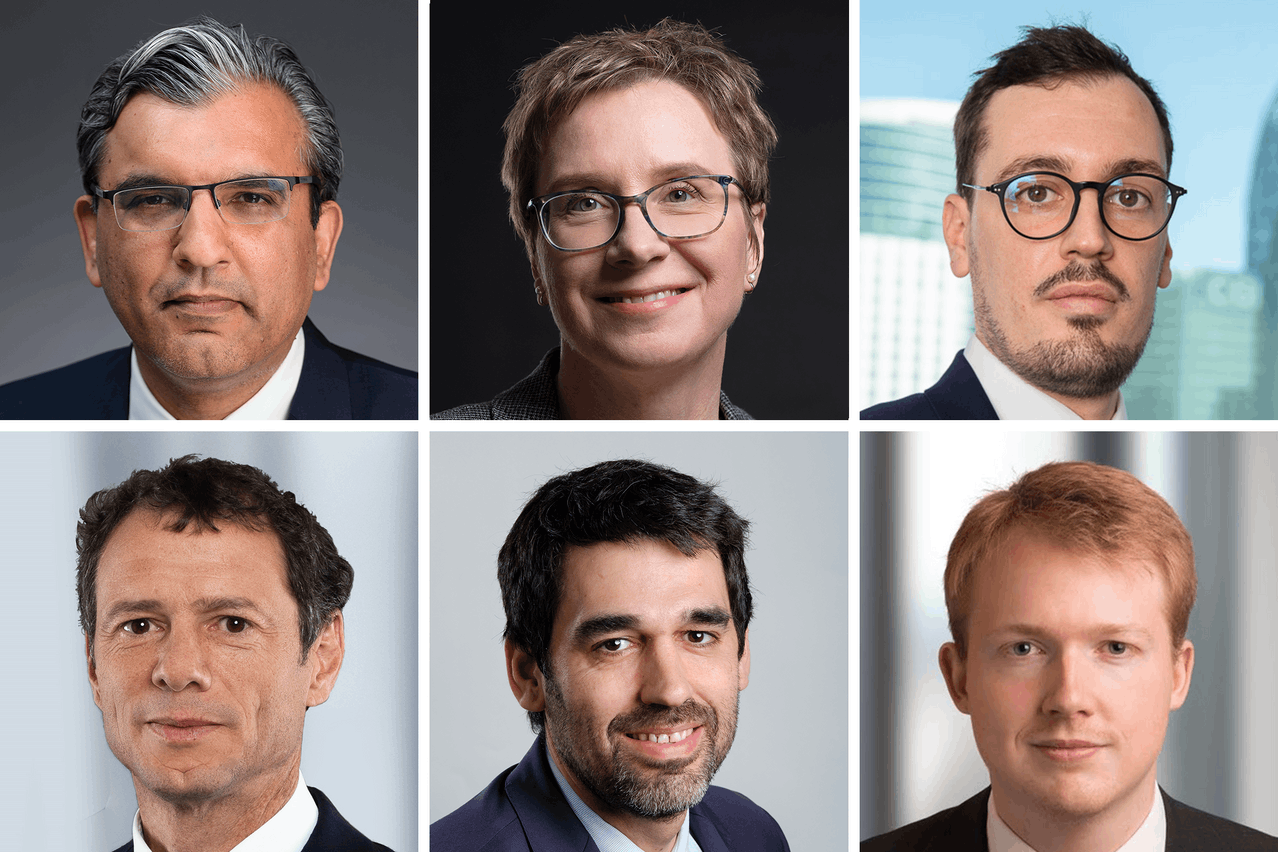

Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International, predicted that the ECB would cut rates twice more this year, by 25bps, on 12 September and 12 December. Ahmed pointed to weak growth, tight credit conditions and sluggish bank lending in the euro area as factors necessitating easier financing conditions. While services inflation remains stubbornly high, wage growth has moderated faster than expected, which could lead to a quicker cooling of core inflation in 2025 than ECB projections currently suggest, Ahmed told Delano. He noted that the current economic forecast for Q4 2024 is three-tenths higher than the ECB’s June staff projections.

David Chappell, senior fund manager fixed income at Columbia Threadneedle Investments, pointed out that the ECB has signalled caution, aiming to temper expectations of consecutive rate cuts in September and October. He believes the ECB is on a path to normalise rates at a pace of every other meeting, though the US Federal Reserve’s decision on 18 September could influence the ECB’s discussions in October.

Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management, stated that recent data confirmed the likelihood of a September rate cut, bringing the ECB’s deposit facility rate down to 3.50%. He expects modest revisions to the ECB’s growth and core inflation forecasts for 2024 and 2025, with inflation still projected to reach the 2% target by the end of 2025. Ducrozet also highlighted the ECB’s decision to reduce the spread between the main refinancing operation rate and the deposit facility rate, which he said would encourage greater participation by banks in the ECB’s conventional refinancing operations. Assessing the possibility of an October rate cut, Ducrozet said, “While [ECB president Christine] Lagarde is likely to hold back and mention that the ECB is not dependent on the Federal Reserve, a larger-than-expected cut by the Fed could increase pressure on the ECB and could make the October meeting live.”

Ulrike Kastens, senior economist at DWS, agreed with the forecast of a 25bps cut in September, citing the moderation in wage growth and a decline in inflation to 2.2% in August. Kastens also highlighted weak domestic demand and industrial sentiment, which she said are likely to lead to a downward revision of the GDP forecast. Despite these factors, she expects the ECB to remain cautious, with further cuts to be gradual and dependent on data.

Michael Krautzberger, global CIO fixed income at AllianzGI, noted that softer global inflation readings have vindicated the ECB’s decision to cut rates earlier in the year, making a further 25bps cut on Thursday likely. Both economic growth and inflation have been weaker than expected during the summer, prompting Krautzberger to predict modest downward revisions to the ECB’s growth and inflation forecasts for 2024 and 2025. He also suggested that a possible 50bps cut from the US Federal Reserve in October could influence the ECB’s decisions later this year.

Volker Schmidt, portfolio manager at Ethenea, expressed complete certainty about the 25bps rate cut on 12 September, driven by the continued decline in annual inflation to 2.2%, primarily due to falling energy prices. However, Schmidt ruled out sharper cuts for now, as core inflation--excluding volatile components like energy and food--remains at 2.8%, above the ECB’s target range. Schmidt cited comments from ECB chief economist Philip Lane, who indicated that wage growth would decline in the coming months, supporting future rate cuts.

Ruben Segura-Cayuela, head of Europe economics research at Bank of America, also predicted a 25bps rate cut in September, followed by another in December. Segura-Cayuela expects only short-term changes to the ECB’s forecasts, with slightly higher inflation and lower growth for 2024, but no major shift in the overall policy trajectory. He emphasised that inflation is still expected to reach the ECB’s 2% target by the end of 2025, which would support the central bank’s gradual approach to easing monetary policy.

Andrzej Szczepaniak, senior European economist at Nomura, stated that support for a September rate cut is almost certain, with the exception of Robert Holzmann, a member of the ECB’s policy-setting governing council. He noted weaker-than-expected wage growth in Q2 2024 and declining inflation, with August’s harmonised index of consumer prices (HICP) dropping to 2.2%. Szczepaniak believes any emphasis on downside growth risks by Lagarde could increase the chances of consecutive rate cuts, though he considers October too soon for another adjustment.

Yasser Talbi, fixed income portfolio manager at Indosuez Wealth Management, affirmed that a 25bps rate cut is expected at this week’s meeting, driven by weaker growth and lower-than-expected inflation. He noted that wage growth had also come in lower than expected, further supporting the continuation of the ECB’s rate cut cycle. Talbi told Delano that he expects the ECB to revise its growth and inflation forecasts slightly downward, with a mildly dovish outlook for 2024. He anticipates the ECB will maintain a cautious approach, with the terminal policy rate likely around 2.5% by next year.