Since September 2023, the European Central Bank’s governing council has held four monetary policy meetings, maintaining the key banking rates in the eurozone steady. The council is scheduled to meet again on Thursday 11 April 2024, with leading economists surveyed by Delano unanimously predicting no change for the upcoming meeting. Most economists are confident of a 25 basis points decrease during the June meeting.

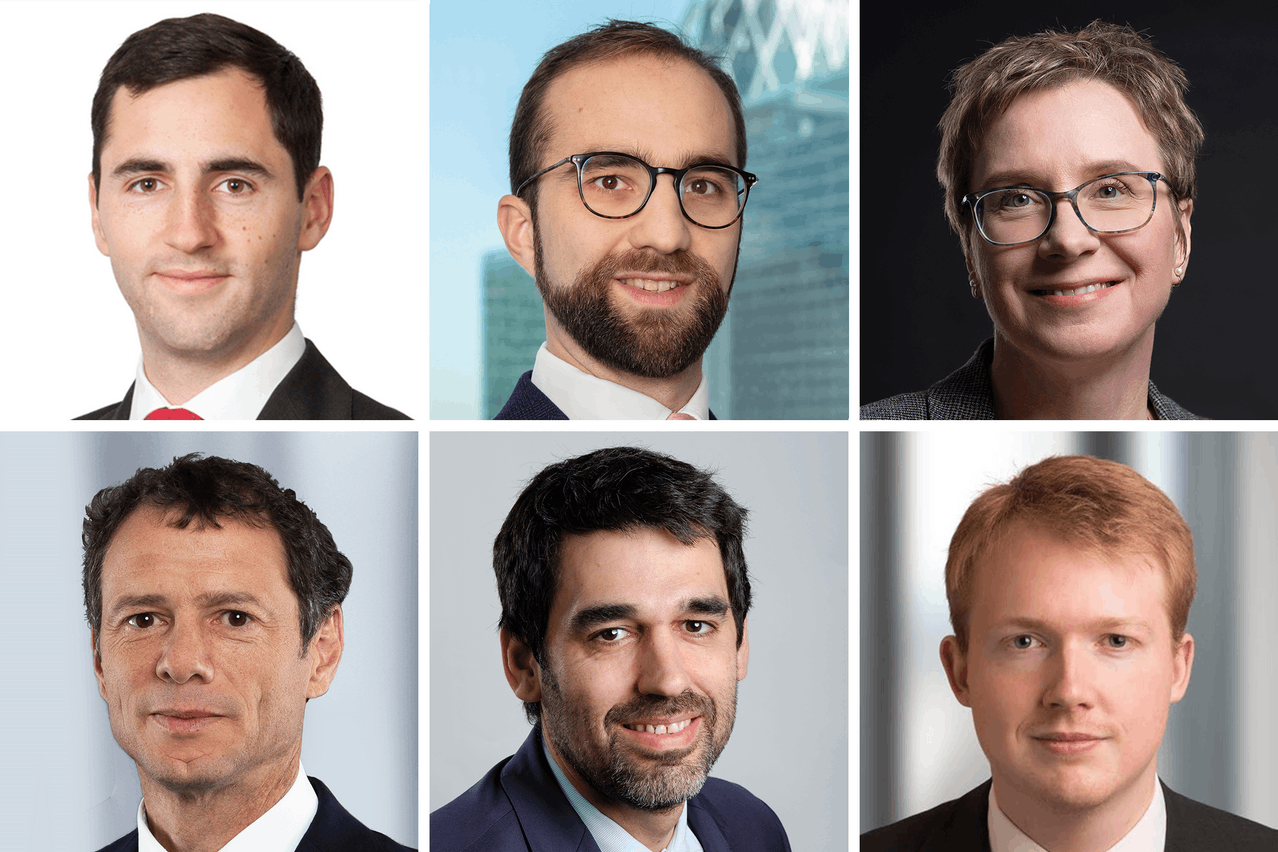

François Cabau, senior eurozone economist at Axa Investment Management, noted that the upcoming ECB governing council meeting is not expected to yield any major decisions. He anticipates that the deposit rate will remain at 4%. Given that this is an “interim meeting”, the significance is relatively low, pending the release of key data and updated forecasts for the June meeting. Cabau also predicts that although a consensus is forming around the likelihood of the first rate cut occurring in June, both within the markets and the council, the meeting on Thursday could provide cues regarding the pace of the easing cycle. Cabau expects the “first rate cut to occur in June followed by two more at forecast meetings by year-end.”

Ulrike Kastens, who serves as a senior economist for Europe at DWS, emphasised that ECB officials have consistently highlighted the need for more data to assess the underlying inflation trend. This theme is expected to be reiterated by ECB president Christine Lagarde during Thursday’s meeting, especially considering that key wage data is not expected for release for another few weeks. As a result, “the key interest rate of 4% is likely to be reaffirmed in April, but with the prospect of a first rate cut in June, as we have long expected,” said Kastens. She added, “Although wage growth is likely to have peaked, uncertainty remains high as to whether wage growth momentum will sufficiently moderate to reach the 2 percent inflation target.” Consequently, Kastens anticipates that ECB will continue to emphasise data dependency and follow gradual rate adjustments.

Ruben Segura-Cayuela, the head of Europe economics research at Bank of America, expressed a clear stance regarding rate adjustments, stating “a cut in June, 25bp, none in April nor July.” Despite potential signals of increased confidence from recent data, Segura-Cayuela maintains that it's not yet sufficient to warrant immediate action. The outlook from Segura-Cayuela includes a forecast of total 75bps in cuts for 2024 and 125bps for 2025, with an acceleration in the rate of cuts expected over time due to persistent inflation undershooting the target.

Alexander Batten, who serves as the fund manager for fixed income at Columbia Threadneedle Investments, argued that the upcoming meeting is expected to be “uneventful,” primarily serving as a precursor to the June meeting. Recent communication indicates that the ECB plans to initiate a cutting cycle in June, driven by the accumulation of wage-related data rather than positive developments in wage trends, said Batten. He says that while a cut of 25bp is “overwhelmingly favored”, the eurozone’s very poor growth dynamics “warrant back-to-back cuts,” expecting a 25bp cut in July meeting as well.

Volker Schmidt, senior portfolio manager at Ethenea, highlights that the majority of central bank members are leaning towards a rate cut in June. Schmidt recalls that during the March meeting, the ECB projected inflation rates for 2025 and 2026 to align with its 2% symmetric target, with an expected higher average inflation of 2.7% in 2024. “The ECB has not yet reached its target, but believes it is already within reach. We do not believe that the ECB is interested in weakening the euro,” said Schmidt, and concludes “No, there will be no surprise,” on Thursday.

Andrzej Szczepaniak, senior European economist at Nomura, states that March inflation data, where services inflation appeared heavily at 4% y-o-y for the fifth consecutive month, suggests that “a change in policy at the April meeting is largely impossible.” He emphasises, “The ECB is likely to begin cutting in June,” as services inflation is expected to come down sufficiently by then, allowing for rate cuts in July and potentially at every meeting throughout the year.

Paul Jackson, global head of asset allocation research at Invesco, observes that the eurozone economy presents a mixed picture, with Germany facing challenges while some other economies show better performance, and inflation has significantly decreased. “The ECB has been signaling that the first rate cut will come in June. Though I believe the governing council would prefer to wait for the Fed to make the first move, they may be forced to cut first if the Fed continues to prevaricate,” remarks Jackson.

Franck Dixmier, global CIO fixed income at AllianzGI, expresses that the ECB now has fewer reasons to delay normalising its monetary policy. The low point in eurozone activity appears to be in the past, and there are indications that inflation is moving towards the ECB’s target, argues Dixmier. He adds that the latest inflation data from March, at 2.4%, is positive news, and this trend is also reflected in core inflation figures.

Frederik Ducrozet, head of macroeconomic research at Pictet Wealth management, agrees that the governing council would remain “dovish” on Thursday, given “one piece of information is still missing… the moderation in wage growth.” Ducrozet elaborates, “Barring an upside surprise in Q1 wage growth on 23 May, the ECB is set to cut rates by 25bps in June.” He cautions, however, that “despite recent wage data and leading indicators suggesting that wage growth may have peaked in Q4 2023, a surprise to the upside in Q1 cannot be ruled out.” Ducrozet sees a 70% chance of a 25bp decrease and a 30% chance of a hold during the June meeting, as well as a near half and half split between a 25bp decrease and a hold during the July meeting. He reasons, “Stickiness in services inflation and wage growth could argue for the ECB to opt for gradualism and pause in July.” However, “everything will depend on the upcoming inflation prints and the staff’s updated June projections,” concludes Ducrozet.