This could almost be good news: “The economic cycle is not as bad as feared with the Ukrainian crisis. If growth slows down to the point of recession, we are far from a depression or a financial crisis like the one in 2010-2012. This is good news.”

Olivier de Berranger acknowledged, however, that while economic momentum is stabilising, the outlook remains downward. “Growth for 2023 will be weak.” LFDE expects growth of 3.1% in 2022 and -0.1% in 2023 in the euro zone and 1.7% and 0.4% in the US.

If the concern in 2022 was inflation, the concern in 2023 will be growth

“We remain at very low levels. If the concern in 2022 was inflation, the concern in 2023 will be growth.” In both services and industry, activity is contracting, he noted. “That movement that affecting all economies, including emerging markets.”

In the US market, LFDE expects increased risks to profits and margins. “Labour productivity is collapsing, it’s not clear why,” while margins and profits are starting to fall. They are down from a historic high of 15%.

In the European market, “consumer and industrial confidence is at its lowest, due to the war in Ukraine. But we are seeing a stabilisation in the economic cycle. The pressure on production is beginning to ease, while gas prices have fallen sharply. Prices have returned to pre-war levels.”

Inflation at a plateau

On the inflation front, de Berranger believes that even if its level remains very high, it has reached a peak. “The bad surprises seem to be behind us,” he said.

At the global level, the post-covid disruptions that were primarily responsible for the inflationary surge are subsiding. This is not being felt in Europe because of the spike in energy prices following Russian aggression in Ukraine. The other major difficulty Europe faces in dealing with inflation is the disparity between countries. While the average price increase in the eurozone is 10.7%, three countries--the Baltic states--have inflation above 21%. At the other end of the scale are France (7.1%), Spain (7.3%) and Malta (7.4%).

“The current signals are positive, but the decline will be slow.”

As a logical consequence, de Berranger expects central banks’ monetary policies to remain clearly restrictive, despite fears for growth. “The ‘whatever it takes’ approach is taking on a new meaning,” in contrast to the support for the economy of the first two versions.

In his view, monetary tightening will continue, led by a Fed that is acting “at full speed” and a European Central Bank in its wake that is beginning to wonder about the impact of its policy on growth.

On the positive side, “large savings reserves, strong labour markets, moderate debt, high corporate profitability: the safety nets are there.” De Berranger also believes that the private sector “is in much better shape than in 2008.”

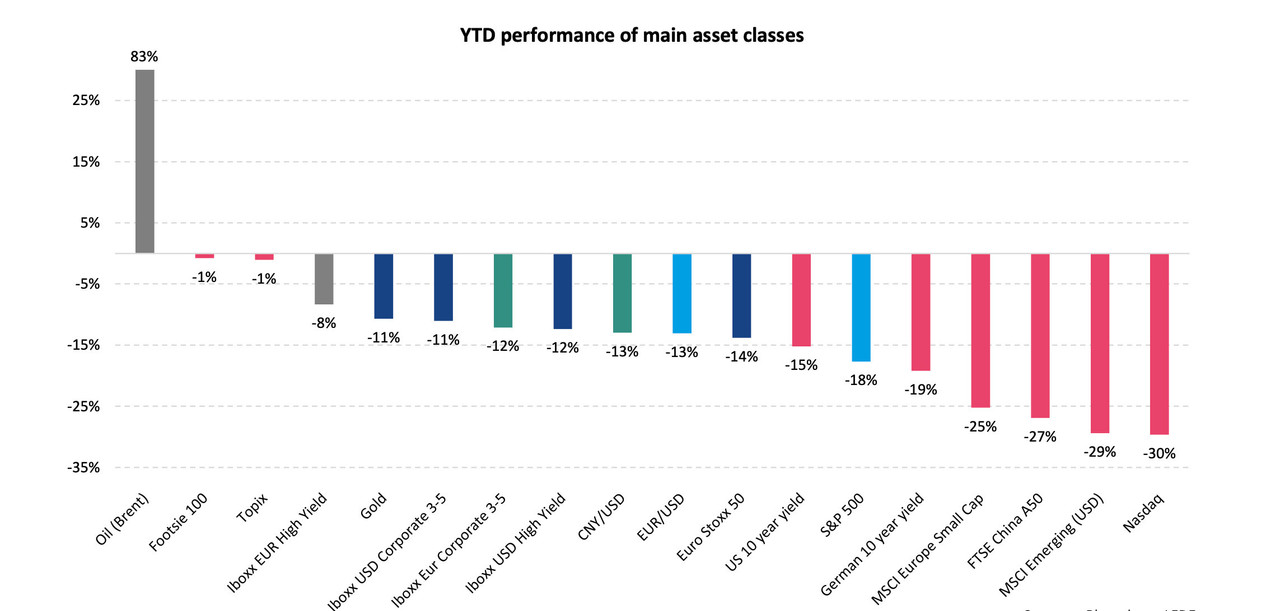

2022 is the worst year since 1931 in terms of asset class performance, except for oil. Source: Bloomberg/LFDE

In the markets, apart from oil (+83%), all asset classes are performing negatively. “2022 is a painfully unusual year, the worst year since 1931. There was nowhere to run.”

In the equity markets, valuations are a clear decline. This is the right time to buy, he said: “if you buy today, within three to five years you will be a winner.” Moreover, investors have not deserted equities. The flows invested since the beginning of the year remain stable.

The bond market, for its part, is becoming more attractive. “You get paid for the risk you take.” And while de Berranger does not claim that there will be no defaults, he does not see any systemic risk in the market.

Read the original version of this article in French on the site. This article was published for the Paperjam+Delano Finance newsletter, the weekly source for financial news in Luxembourg. .