The European Central Bank’s policy-setting governing council is expected to continue cutting interest rates in the coming months, though economists remain divided on the pace and extent of further reductions. While some anticipate a steady path of easing, others warn that economic risks could force the ECB to act more aggressively.

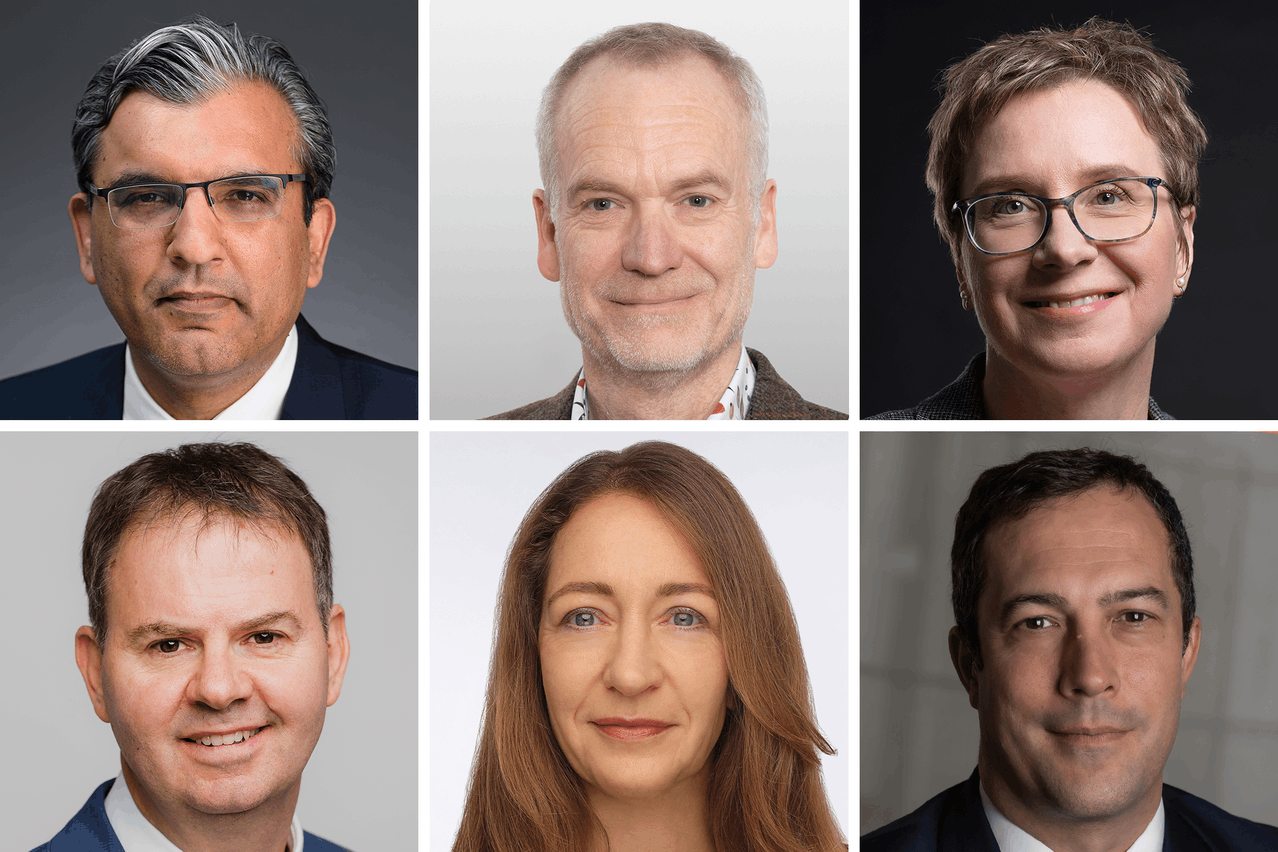

“The relative resilience of economies to sharply higher nominal interest rates and continued high inflation has led most major central banks to revise their view of the long run neutral real interest rate up by around 0.5 percentage points,” said Katharine Neiss, chief European economist at PGIM Fixed Income. She expects the ECB to deliver three more 25 basis points cuts this year, bringing rates to 2.0% by June. However, she cautioned that if economic malaise in core eurozone economies spreads to countries such as Italy and Central and Eastern Europe, “we could see the ECB respond more aggressively and cut rates into accommodative territory.”

Paul Jackson, global head of asset allocation research at Invesco, sees the decision-making process becoming more delicate. “As the ECB has already cut rates on five occasions since June 2024, I suspect the pace of reductions will now ease,” he said. Jackson believes three more 25bps cuts could be in store but notes that each meeting will present a “50/50 probability of cuts,” making the path ahead more uncertain.

Ulrike Kastens, senior economist at DWS, predicts that political uncertainty will keep the ECB cautious, maintaining a meeting-by-meeting approach. She expects a 25bps cut in the deposit facility rate while noting that forthcoming ECB forecasts will likely show a downward revision of GDP growth for 2025. “Both factors would suggest further cuts in the deposit rate, which should be around 2.0% by the summer,” she said.

“The ECB is continuing its rate-cutting cycle this week, but the path from April onward has become less clear,” said Salman Ahmed, global head of macro at Fidelity International. He pointed to persistent inflationary pressures, highlighting that near-term projections now indicate almost four-tenths of upside risk compared to the ECB’s December forecasts. While he still expects rate cuts in April and June 2025, he noted that “the ECB does not seem to be on autopilot anymore.”

Beyond monetary policy, geopolitical concerns are also weighing on the outlook. Michael Krautzberger, global CIO for fixed income at AllianzGI, noted that US-EU tensions, including trade disputes and defence spending pressures, could complicate economic conditions in the euro area. Despite these risks, he pointed to slowing wage growth--Euro area negotiated wages eased to 4.1% year-on-year in Q4 2024 from 5.4% in the previous quarter--and a softening labour market as factors that “still leave the door open for the ECB to get the deposit rate back towards 2% or below in the coming months.”

David Chappell, senior fund manager for fixed income at Columbia Threadneedle Investments, also expects the ECB to move forward with a 25bps rate cut this week but sees the bank offering little forward guidance given ongoing geopolitical risks. “Uncertainty around trade policy with the US remains highly elevated and geopolitical risks are increasing--neither of which are good for consumer nor business sentiment,” he said.

Axel Botte, head of market strategy at Ostrum Asset Management, anticipates that the ECB will maintain its easing stance through the first half of the year. “Bank credit conditions have tightened in Germany and France, growth remains moderate and inflation is gradually moving lower,” he said. While he considers a steady 25bps per meeting approach to be appropriate, he acknowledged that “the threat of tariffs and the need to finance EU defence argue for a prolonged easing bias.” However, “It leaves the door open, for a 50bps cut if need be,” remarked Botte.

Kevin Thozet, a member of the investment committee at Carmignac, argued that “the direction of travel often put forward by [ECB president] Christine Lagarde isn’t that clear anymore.” He noted that key debates within the ECB now revolve around whether policymakers should pause their easing cycle ahead of a potential shift in economic conditions, push rates to or below neutral levels quickly due to the weak growth outlook, or maintain a steady pace of cuts as long as major risks remain absent. The upcoming meeting is also expected to bring a fresh set of quarterly projections, with inflation risks skewed to the upside and growth forecasts likely to be revised lower. Thozet believes that the number of cuts currently priced into markets represents the minimum that the ECB is likely to deliver this year.