Demand for electric mobility is booming. In Europe, new EV sales has quadrupled over the past two years, rising to 20% in 2021 for both fully electric models and plug-in hybrids. China reached 15% last year. According to estimates, both these figures are forecast to reach at least 60% by the end of the decade, a figure driven by consumer demand and government regulation. The US is behind but is set to hit 50% by 2030.

Traditional car manufacturers are ramping up output as they seek to close the gap on Tesla. “While Tesla is the clear market leader, it only has four models and this gives competitors opportunities to grow,” Ms Dickson said. All the more so as production costs are falling, with this segment on course to become profitable in the near future.

For this future to materialise, several pinch points need to be addressed. “Mass market adoption requires the industry to create EVs that are both cheap and convenient to own,” Ms Dickson noted.

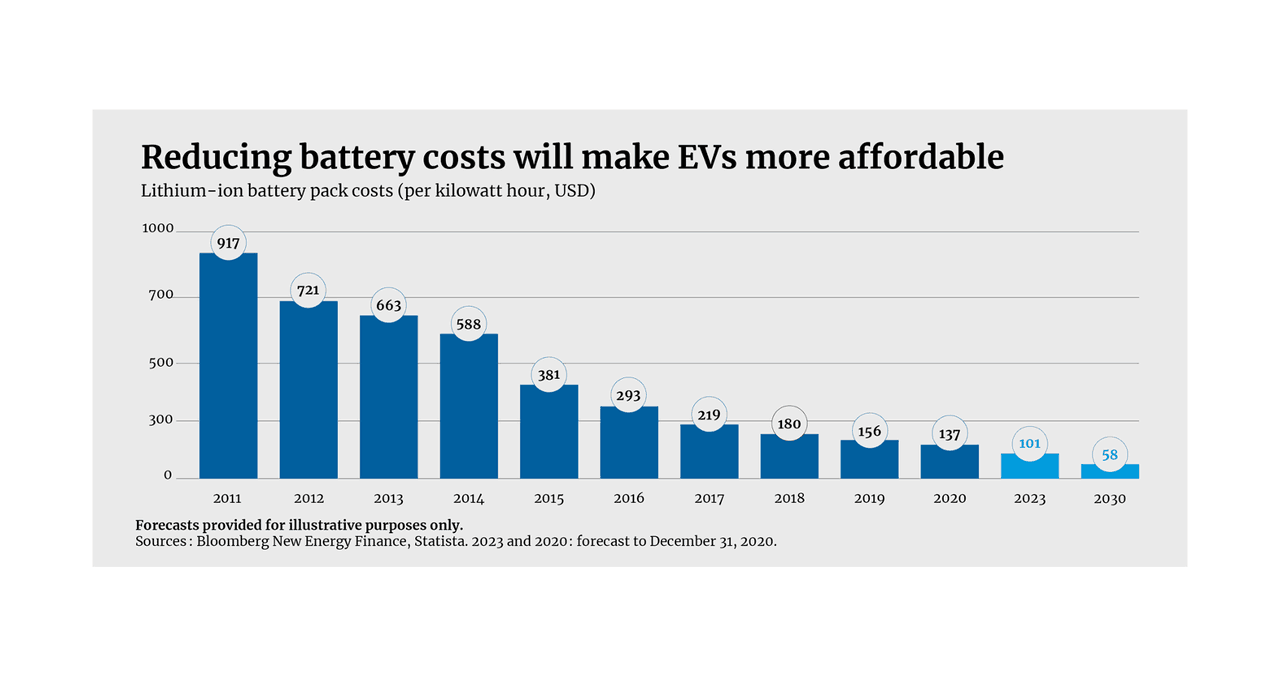

“Battery costs are falling, with innovation expected to offset higher raw materials costs,” she said, highlighting a challenge with the most expensive systems in EVs. She pointed to analyst predictions that the price of lithium-ion batteries would drop by well over 50% this decade.

Forecasts provided for illustrative purposes only Bloomberg New Energy Finance, Statista. 2023 and 2020 are forecasts as at 31 December 2020

Making these power packs is a material- and power-intensive business, and this has its own ESG considerations. Some producers have committed to using only renewable energy in this work, while others are investing in battery-recycling capabilities.

“There are social aspects too, such as ensuring that raw materials are sourced in safe conditions, and that employees are helped through this transition,” she added. EV production and maintenance for EVs are less labour-intensive compared with traditional cars, which involve internal combustion engines. Workers will need retraining to help them adapt as workforces shrink.

“Solving the recharging bottleneck will be key to making EV driving convenient,” she said. There need to be more charging stations supplied by public authorities, retailers, car parking businesses and employers, and recharging speeds also need to increase. As well as these investments, electricity distribution infrastructure must be adapted to cope with new demand peaks.

“Even more fundamental is that the electricity powering these vehicles has to be generated using low carbon emitting methods if there is to be a net environmental benefit,” Ms Dickson noted. Some analyst models suggest that even though Chinese consumers are embracing EVs, the net benefit for the climate has been negligible as so much electricity generation in that country is fuelled by coal.

Also, central to the success of Tesla is that it is a cutting-edge software company. Traditional manufacturers are having to buy in this expertise. This is yet another example of the exciting opportunities for entrepreneurs and investors the EV revolution is creating. Seizing these, while taking account of the various ESG considerations, is a fresh challenge.

Interested in finding out more?

Source : IEA, Global EV Outlook 2021