1. Inflation is relatively contained

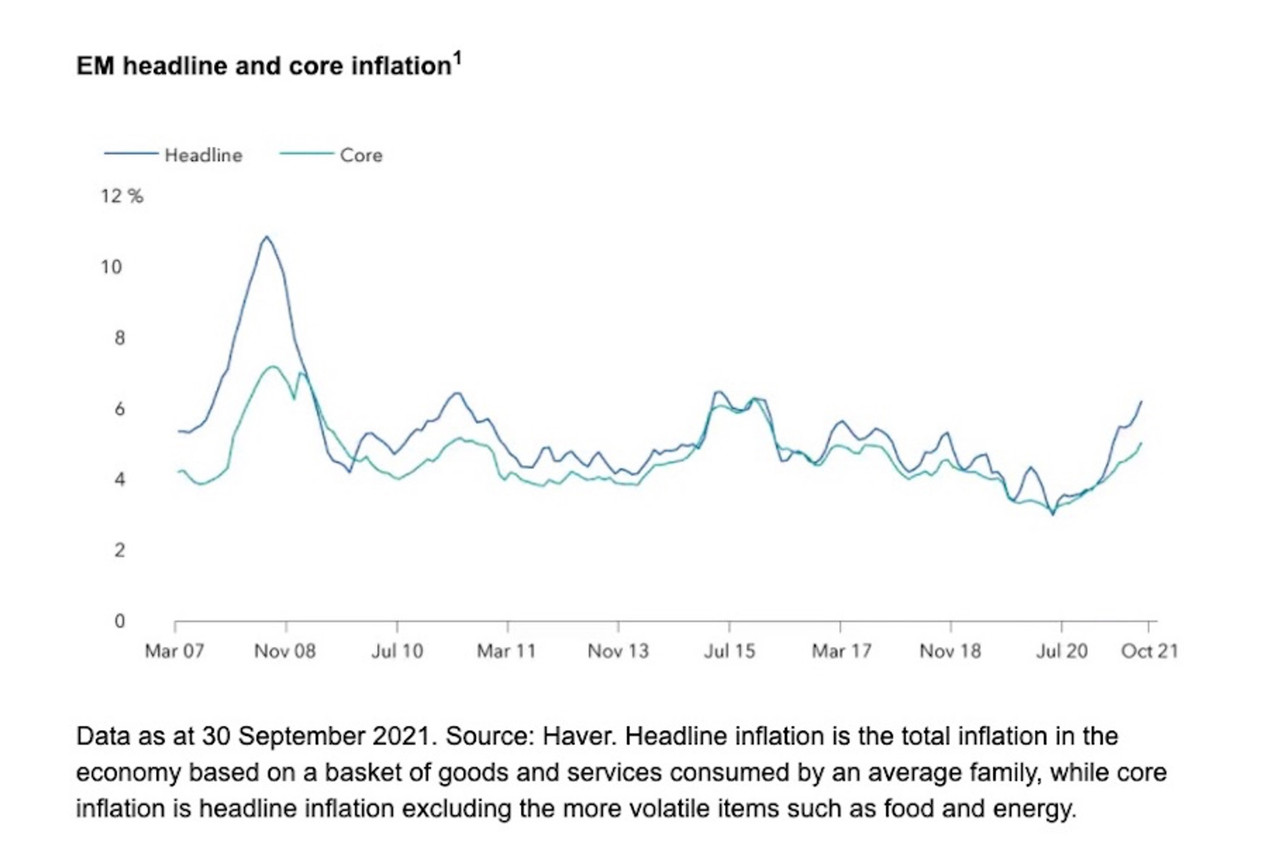

2021 saw higher inflation and rising inflation expectations in both developed and emerging markets. There are several factors driving this trend in EM, including base effects from the pandemic shock, supply-side bottlenecks, soaring commodity prices and a recovery in domestic demand. However, these factors should ease over time.

EM headline and core inflation Haver

Interested in learning more? Further data and analysis by Kirstie Spence, fixed-income portfolio manager at Capital Group, is available

EM countries, along with developed markets (DM), have seen sharp contractions in gross domestic product (GDP) brought about by the pandemic. As EM countries saw less pandemic-induced fiscal spending, they are now lagging behind DM countries, showing weaker economic recoveries and lower inflation rates. Monetary policy in EM countries will likely play a major role in these longer-term inflation dynamics and expectations. Tighter domestic financial conditions implemented by central banks should therefore help curb the price hike.

2. Global growth set to slacken

The IMF forecasts the global economy to grow at 4.9% in 2022, slowing from 5.9% in 2021. “This reflects the slowdown in developed economies due to supply issues and restrictions related to the virus. Economic growth in EM countries, meanwhile, has actually proved quite resilient to these challenges and to new variants.”

This reflects the slowdown in developed economies due to supply issues and restrictions related to the virus

EM growth is therefore expected to remain robust, although the situation varies from country to country. Those countries that are at the earlier stages of reopening their economies and the commodity exporters should generally see significant economic growth, while countries that are further along in the process are more likely to see growth slow down.

3. Fiscal and external balances at acceptable levels

After a decade of weak growth, stagnant trade and falling commodity prices, EM countries have been forced to increase fiscal spending drastically with the pandemic. Fiscal deficits are now higher and public debt levels are continuing to rise, despite still being well below developed market levels. For the most vulnerable economies, this increase in debt levels can translate into higher inflation, lower bond yields and weaker currencies.

Meanwhile, current account deficits (when the total value of goods and services imported exceeds the total value of goods and services exported) have improved across many of these countries. COVID-19-related restrictions impacted domestic demand more in EM countries (as developed markets were able to deploy fiscal stimulus measures), but this trend may be reversed in EM non-commodity-exporting countries as demand rebounds and restrictions ease.

4. Gradual rate hikes in store

In 2022, developed-market central banks are expected to pull back from their expansionary monetary policy. The US Federal Reserve had argued that inflation was temporary, but it appears to be reconsidering its stance as price pressures feed into longer-term expectations. The Fed could therefore take action to curb inflation.

In contrast, many EM countries opted to maintain more orthodox monetary policy. With economic activity picking up and inflation on the rise, their central banks have started gradually raising interest rates.

5. Relative impact on debt

US tightening cycles have generally been a source of stress for EM economies in the past. EM local currency debt has tended to sell off as Fed rate hikes start to be priced in, but often don’t move once Fed hikes are delivered. As such, much of the negative impact of the Fed’s moves may be behind us, although EM local debt could still see pressure from inflation and fiscal deficits.

External debt tends to be less affected by Fed rate hikes. If US rates rise sharply, however, there could be consequences for the external financing requirements for EM countries.

Uncertainties lie ahead

Like the future of the pandemic, inflation remains an uncertainty. A more benign inflation outlook that could be helped by easing supply constraints would allow the Fed to keep interest rates low. This could allow a combination of disinflation and strong growth, potentially supporting emerging markets. Alternatively, if the Fed hikes rates more rapidly than expected, this could present downside risks to EM debt.

Interested in finding out more?