In addition to the diversification benefit, exposure to commodities provides protection against geopolitical risks, rising inflation, and threats related to natural resource supply risks.

More specifically, precious metals (gold, silver, platinum, and palladium) help cushion shocks in times of a market crisis. That’s what the figures show: precious metals have shown greater resilience during events such as the September 11 attacks in 2001, the 2008 financial crisis, and the devaluation of the Chinese yuan in 2015.

Performance of precious metals versus performance of equities DNCA

Central banks have accelerated their diversification into gold and have significantly increased their gold purchases over the last three years, rising from an average annual volume of around 400 tonnes to 1,000 tonnes.

The freezing of $300 billion of Russian assets, in retaliation for the invasion of Ukraine, was carried out in coordination with the United States’ allied countries, with most of these assets being held by European central banks.

This situation has led to a structural shift in gold demand, making central banks less sensitive to fluctuations in gold prices.

Change in demand for gold from central banks (in tonnes): they have become net buyers since 2008 DNCA

Beyond this threat, central banks also fear a lasting return of inflation, as well as greater political and economic instability than in the past.

Currently, the majority of gold reserves are concentrated in a few developed countries: the United States, Germany, France, and Italy. Together, these countries hold 50% of central banks’ gold reserves.

As for central banks in emerging markets, they remain relatively underexposed to gold: China holds only 5 to 6% of its reserves in gold, India 10%, Saudi Arabia 6%, Indonesia 4%, and Brazil 3%.

In addition to precious metals, strategic metals used for electrification also have their relevance in the context of portfolio allocation.

Metals such as copper, aluminium, tin and zinc are essential for electrifying our world and enabling the necessary transition toward a lower carbon, more digitally driven future.

In addition to precious metals, strategic metals used for electrification also have their relevance in the context of portfolio allocation.

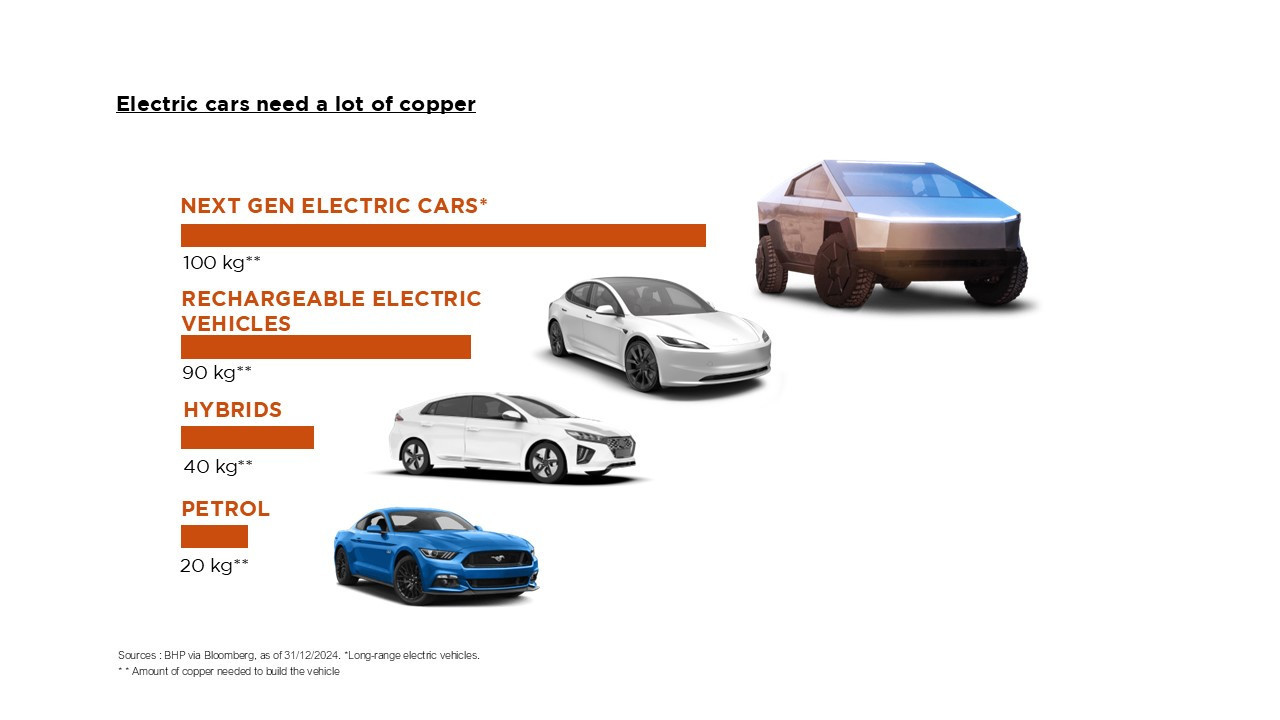

Beyond its use in construction and infrastructure, copper also plays a key role in the production of electric vehicles (an electric vehicle requires four times more copper than a conventional combustion engine car), the manufacturing of wind turbines, and the development of data centers (27 tonnes of copper are needed for each megawatt of deployed capacity).

Electric cars need a lot of copper DNCA

According to a study by the International Energy Agency, one third of the transmission lines in the European power grid are now over 40 years old.

Globally, more than 80 million kilometers of power grids will need to be replaced by 2050! It is clear that these electrical networks have a huge appetite for copper.

Length of the electricity grid (millions of km) – Scenario of announced commitments, 2021–2050 DNCA

It is also worth noting that tin has become an essential component of modern technologies, being present in every electronic device we own that contains a circuit board – this industry alone accounts for half of the global demand for tin.

As for silver, the most conductive of all metals, it is increasingly popular for photovoltaic projects, with this sector now representing 20% of total demand.

These strategic metals used for electrification thus stand out due to a structurally growing demand on the one hand, and limited resources on the other.

Indeed, the demand for higher capital returns, more responsible environmental investments, and stricter permits has led to a slowdown in the growth of mineral and metal supply.

For example, taking a closer look at copper, studies indicate that the copper market could face a structural deficit over the next 4 to 5 years.

These strategic metals used for electrification thus stand out due to a structurally growing demand on the one hand, and limited resources on the other.

The lack of new discoveries of copper deposits can be explained by the chronic underfunding of mining companies in recent years.

Moreover, studies show that it generally takes more than 17 years between the discovery of a deposit and the extraction of copper ore!

In a world where uncertainty is a constant and monetary policies are largely expansionist, integrating commodities with limited resources, especially precious and strategic metals, not only makes it possible to strengthen the resilience of a portfolio in the face of crises but also to capture the growth dynamics coming from the digital and energy transitions.