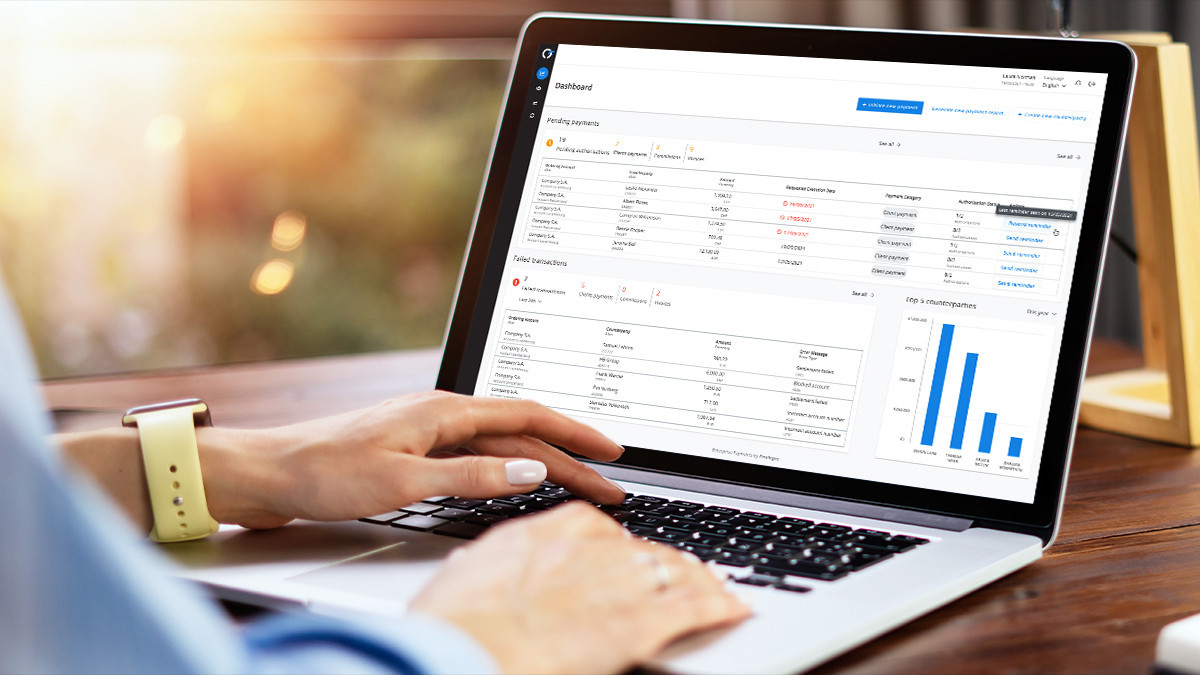

"An entity pulls out the payments to be made, whether it's for customers, for suppliers or for payroll, on lists. They print and go around to get the right signatories internally, a double or triple signature, and they fax that to their bank. The bank calls back by phone to validate the original, and then they manually encode all these transactions into their systems and validate them. You can find thousands and thousands of transactions there that are taken out of the system, printed, validated on paper, faxed back and re-encoded... Not all players work like this, but we were surprised to encounter this reality."

More than 20 years and four start-ups after his entrepreneurial beginnings, Raoul Mulheims can still be surprised but has the same desire to develop solutions, as part of his latest baby, Finologee.

"It can make a real difference in Luxembourg. We've been asking ourselves for years: why isn't anyone tackling this issue? The answer is probably because it is difficult! You have to be a regulated player, you have to get all the agreements with all the players. We started the project in development last year, but we have been preparing it for two-and-a-half years. We've done the trick as we did with Digicash in 2011. A new player would most often not have the same economy of scale," says the CEO of Finologee.

On the strength of its experience and the status of supporting PFS that the finance minister granted it in January 2019, Finologee also chose to have its technological infrastructure audited to obtain the label according to the ISO27001 standard, which certifies operational excellence in IT security.

The group, which has an annual turnover of €7 million and reinvests an average of €2 million a year in the development of new products--an area to which it devotes a third of its workforce--has planned an investment of €3 million for Enpay, to which the two ministries (economy and finance) have given their financial support via the Aid for Process and Organisational Innovation programme.

After three years of reflection and one year of development, Raoul Mulheims, Georges Berscheid, Jonathan Prince and Didier Spick have come up with a solution to a problem that few players could have tackled. (Photo: Finologee)

The solution combines advantages: universality, since all banks connected to the Swift network can be linked to the system; and automation, because it allows the use of Luxtrust certificates, but also any other security and identification product, and relies on company software to automate repetitive payment or reporting tasks.

A first customer, Crédit Agricole Life Insurance Europe, has already adopted this product, while others are expected to license this fully customisable solution hosted by Finologee.