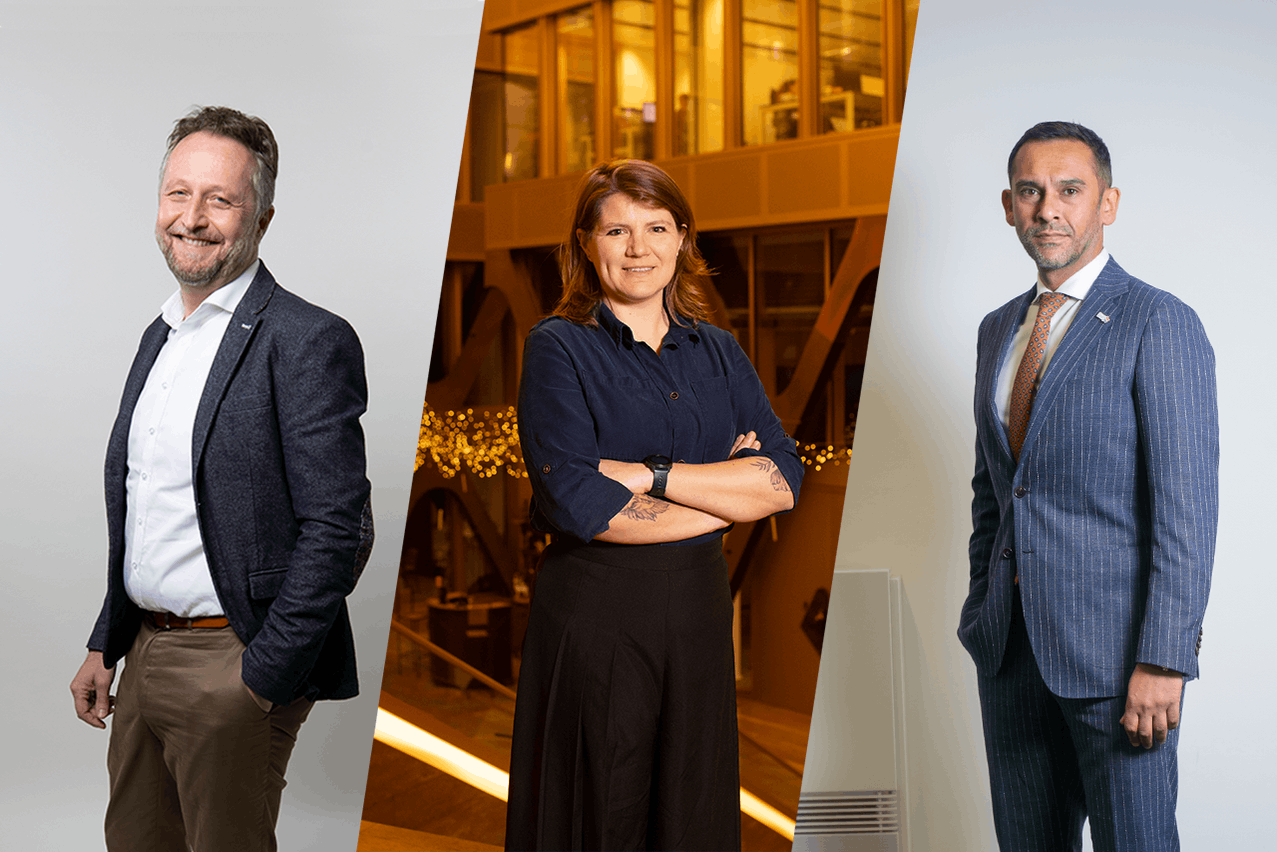

Georges Bock, founder & CEO, Moniflo

“The main challenge, when we talk about ESG issues, lies in integrating these questions at a strategic level,” says . “What do we mean by this? A company’s position on ESG issues can vary considerably. Some managers will meet their obligations, content to do the ‘bare minimum,’ while others will seize the opportunity to question themselves and seek to optimise the process.”

“If a positive and innovative approach is adopted, top management must take an active stance on the subject, set a strategic direction and develop a corporate culture that incorporates the social and environmental dimensions, capable of influencing processes, products and practices. The more minimalist approach, on the other hand, involves complying--technically--with regulatory requirements, through the implementation of robust reporting. Whichever approach is adopted, each company will have to report--faithfully--on its impacts, to avoid accusations of greenwashing.”

Julie Castiaux, partner, sustainability lead, KPMG Luxembourg

“After several decades of standardised financial reporting, the CSRD (Corporate Sustainability Reporting Directive) extends the publication obligations to non-financial data,” says . “Beyond the compliance exercise, companies--and holding companies in particular--will have to analyse the impact that the CSRD will have on them, both in terms of the scope of application and the consolidation rules to be adopted.”

Read also

“The other major challenge of the CSRD is the ability of companies to gather the information they need to present their impacts, risks and opportunities (IROs) and demonstrate the actions they are taking to achieve their sustainability objectives and promote access to new financing. This is as important as it is necessary in Europe’s strategy for the transition to a low-carbon society.”

Nasir Zubairi, CEO, Lhoft Foundation

“The quality and availability of data are among the major challenges linked to the integration of ESG issues at the level of the financial sector and beyond, as highlighted in our 2023 Fintech for Sustainable Finance report, produced in collaboration with Deloitte,” says . “Companies must develop intensive efforts to collect, standardise and verify ESG data in order to obtain accurate reports and meet regulatory requirements.”

“The second challenge relates to the complexity of regulation and the multitude of standards. For companies, this is a headache and requires substantial resources and expertise to navigate. Thirdly, the Sustainable Finance Disclosure Regulation (SFDR) suggests the creation of a two-tier capital market. Financial institutions required to report on sustainability criteria will include them in their capital allocation. As a result, many SMEs risk being excluded, unable to provide the necessary data due to knowledge or cost constraints. To accelerate the transition and foster a more sustainable financial ecosystem, the only way to understand ESG data is through fintech innovation.”

This article was written for the supplement supplement of the published on 19 June. It was originally published in and is published on the website to contribute to the complete Paperjam archive.