In the report, the auditors found that “legal, political or economic circumstances at the time each instrument was created” were why these financial instruments were kept separate from the EU’s budget. Instruments based on borrowing and lending to provide financial assistance, for example, must be developed outside the EU budget as loans cannot be raised within it. Even if there was a valid justification for the creation of these instruments, “many instruments lacked appropriate prior evaluations,” noted a press release from the European Court of Auditors (ECA) on 1 March.

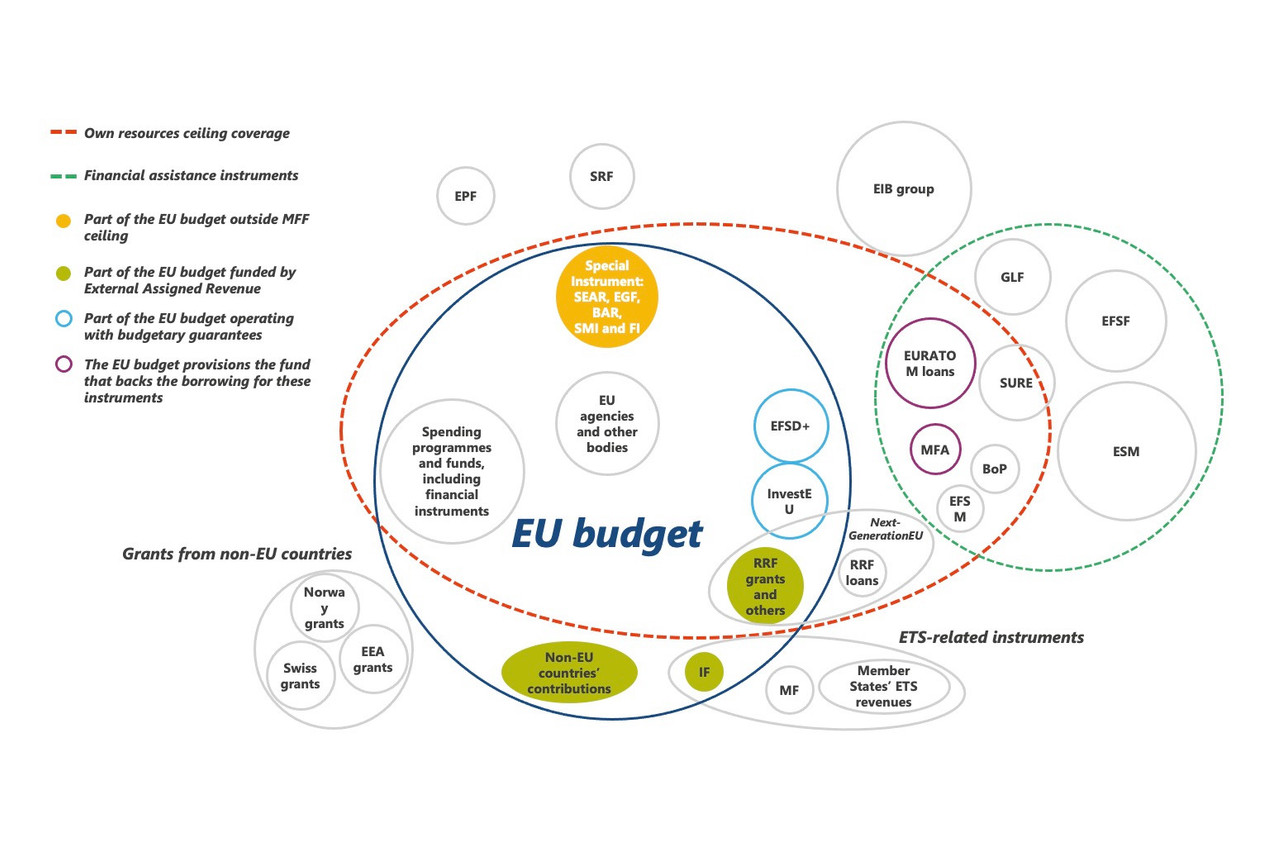

“The EU’s current financial landscape has been described by the European Parliament as a galaxy of funds and instruments surrounding the EU budget,” said François-Roger Cazala, the ECA member who led the audit, in the press release. “While there have been reasons for their creation, we believe that further simplification and accountability are necessary to improve efficiency and transparency,”

EU financial landscape needs simplification and accountability

The objective of the ECA report was to give a “clearer picture” of the “financial landscape and of its complexity” in order to find ways to simplify this “financial patchwork,” Cazala said during a press briefing held on 1 March.

The EU’s financial landscape has been described as a “galaxy of funds and instruments surrounding the EU budget.” ECA

The report covers three topics, explained Cazala. “First we checked if there were good reasons for not fully integrating a number of financial instruments into the EU budget,” he said. “Second, we analysed if such off-budget instruments are subject to appropriate reporting, audit and public scrutiny. And third, we looked if appropriate action was taken to improve the integration of the EU financial landscape over time.”

This led to three messages. First: even if there were valid legal, economic or political reasons--often associated with emergency situations--to create new types of financial instruments outside the EU budget, the “piecemeal approach” has resulted in a “patchwork construction of different sources of finance and governance arrangements.”

A recent example is the NextGenerationEU (NextGenEU) programme of 2021, which was created to respond to the economic effects of the covid-19 pandemic. NextGenEU is the European Union’s €800bn instrument to support member states with their economic recovery. “Even though there was a reason for the creation, there was often no formal justification for the off-budget nature, off-budget character of these instruments,” said Cazala. As a result, “governments’ arrangements of similar instruments may vary substantially from one instrument to another.”

The Modernisation and Innovation Funds, for instance, have similar sources of funding, types of support and share the objective of supporting the transition to cleaner energy, noted Cazala. The Innovation Fund, however, is integrated into the EU budget, but the Modernisation Fund is not, leading to “significant” impacts and differences in the governance arrangements of the funds.

EU financial landscape “only partially publicly accountable”

“The second message is that the EU financial landscape is only partially publicly accountable,” added Cazala. Despite improvements in reporting, the auditors’ report found that “there is currently no report that includes an overview of all instruments of the EU financial landscape. In addition, there is no democratic scrutiny by the European Parliament over a number of such instruments outside the budget,” he said.

The third and last message focuses on the further potential for simplification. The Modernisation Fund, for example, could be integrated into the EU budget.

“There are currently eight financial assistance instruments, which overall are quite similar, as they use borrowed money to provide financial assistance to member states and some non-member countries,” Cazala said, offering another example. The European Commission has unsuccessfully attempted to reform some of these instruments, and the ECA considers that “reforms remain necessary.”

The European Stability Mechanism is an additional example. The ESM is an intergovernmental organisation that aims to enable the countries of the eurozone to avoid and overcome financial crises and to maintain long-term financial stability and prosperity. “The [European] Commission proposed to bring the ESM into the EU legal framework to strengthen governance and decision making,” said Cazala. There was support from the president of the commission and of the European Council, the European Central Bank, the European Parliament and the Eurogroup, but the council did not approve the proposal.

Recommendations from the auditors

The ECA had several recommendations in its report, including that the proposal for any new instrument include “an assessment of the design chosen, its impact, and the need to create the instrument outside the budget,” stated Cazala. “We also recommend the commission to publish consolidated information on all instruments of the EU financial landscape, and to integrate the Modernisation Fund into the EU budget. Finally, we propose integration and consolidation of existing financial assistance instruments.”

The ECA report analysis included 16 different instruments, such as the Modernisation Fund (€51bn of support will be provided from 2020-2030, according to estimates), the ESM (which has a €500bn capacity but only €89.9bn of usage at 31 December 2021), the NextGenerationEU programme (€750bn capacity), and the Support to mitigate Unemployment Risks in an Emergency instrument, or SURE (which has a €100bn of capacity but only €91.1bn of usage at 31 December 2021).

The European Court of Auditors, which is one of the EU institutions, was established in Luxembourg since 1977. As the European Union’s independent external auditor, it checks that EU funds are collected and used correctly, and helps improve EU financial management.

Read the full ECA report .