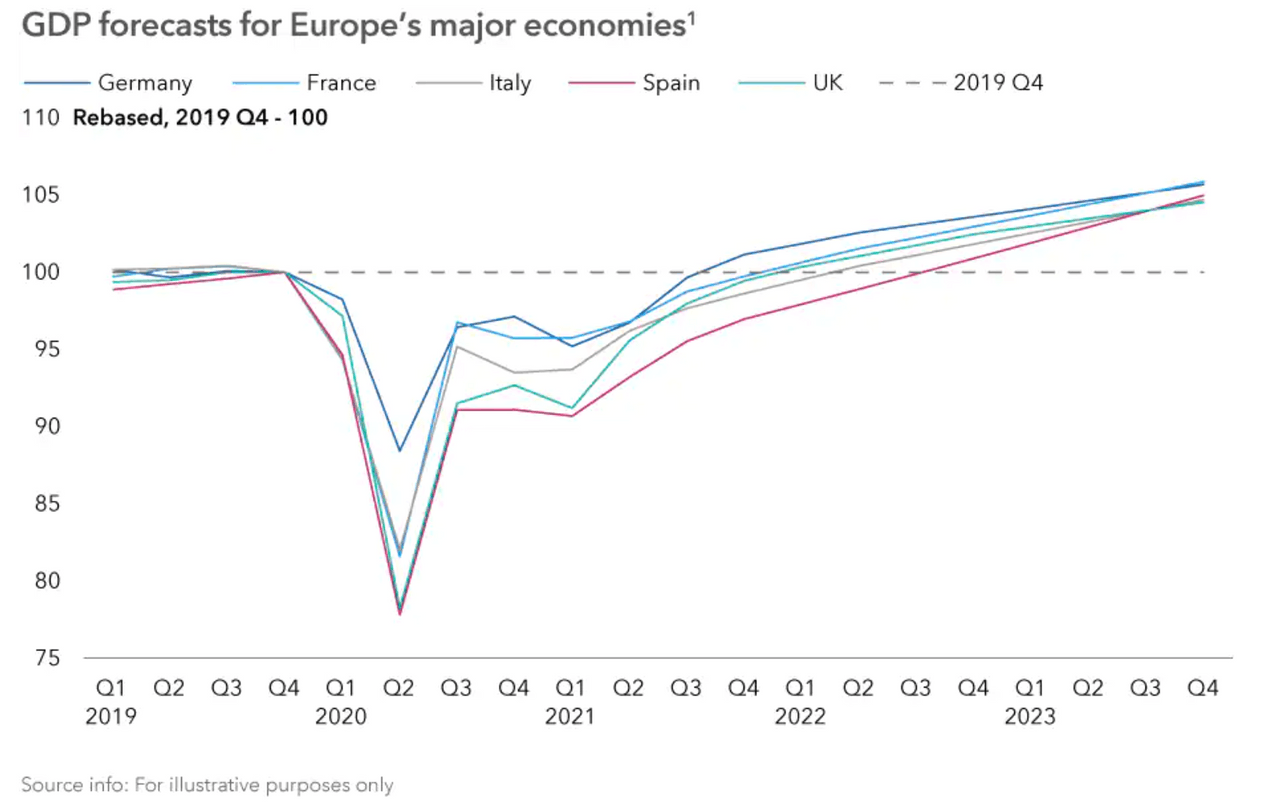

Good news: Europe’s economy is roaring back. Gross domestic product growth in Europe’s major economies was stronger than expected over Q2, notably in Spain and Italy. With mobility restrictions easing, service-sector activity has surged – a welcome change for these two countries, which rely heavily on the tourism and hospitality industry. Manufacturing activity is another driving force behind the recovery. “Europe’s major economies could regain their pre-pandemic GDP levels earlier than expected,” says Capital Group economist Robert Lind.

Positive signs

With governments protecting household incomes and consumers unable to maintain their usual levels of consumption, saving rates have jumped. This could trigger a release of pent-up consumer demand, benefiting many companies. Early evidence of this can be seen in retail sales and consumer confidence becoming more buoyant.

GDP forecasts for Europe’s major economies Capital Group

Interested in learning more? Further data and analysis by Martyn Hole, Investment Director at Capital Group, is available

This optimism about Europe’s economic recovery coupled with strong corporate earnings have helped drive European equities even higher since the beginning of the year. Between January and the end of August, the MSCI Europe Index rose nearly 20% in euro terms.

Slower growth ahead?

Despite these positive signs for growth, we believe there are two key headwinds that could cause it to slow down over the next few months.

First, the rapidly spreading Delta variant, which could undermine the economic recovery, though governments appear reluctant to reimpose tight lockdowns. The situation varies from country to country, however. Spain’s latest upsurge in cases has encouraged a marked acceleration in vaccinations. In France, authorities have responded to slower progress in vaccinations by tightening some restrictions again. Italy and Germany have taken a cautious approach to loosening restrictions, helping keep case rates low until Autumn (and now seeing a pike again). They have sustained their vaccination programs, though there has been a slowdown.

The UK’s example suggests that another wave of infections could hit economic growth, either in response to tighter government restrictions or because of a persistent change in behavior by consumers and companies. With the country’s infection rates rising and a slow pace of vaccination, people in the UK are still cautious in their behavior, which has an impact on growth.

The second factor involves concerns that growth in the US and China might have peaked already, with Europe hampered by the subsequent slowdown among its trading partners. In the US, hopes of a return to normalcy by the end of the year are fading due to the trajectory of the virus and vaccinations. Certain states have also reintroduced restrictions, making it harder for the supply and demand for goods, services and labor to return to equilibrium. In China, growth has retreated more quickly than expected. The Delta variant, flooding, an industrial slowdown and the new outbreak may disrupt consumer-sector business operations.

Sheltered European markets

Despite these headwinds, current valuations should help to insulate European equity markets from any growth disappointment, and it is possible to find interesting long-term investment opportunities among Europe-listed equities. The slowdown in GDP growth and corporate earnings is likely to be mild, while the major European economies should benefit from the loosening of mobility restrictions.

Current valuations should help to insulate European equity markets from any growth disappointment

Against the backdrop of the pandemic, companies in several sectors have been resilient in the way they’ve adapted to the changing economic and market environment. Betting and gaming companies, for example, are benefiting from the surge in online gaming and the reopening of betting shops. Online retailers should also continue to do well thanks to the shift to online grocery shopping, as should aerospace and defense companies as international travel resumes. Luxury goods may be boosted by pent-up demand, and utilities are set to benefit from economic stimulus plans focused on clean energy.

Interested in finding out more?