During the first six months of this year, 511 companies in Luxembourg were declared bankrupt, down from 650 for the same period in 2021. The services sector led the closures at 356 cases, compared to 47 construction companies, three manufacturers and 105 commerce businesses.

“The decrease in bankruptcies by 21.38% […] represents the lower figure since 2017 and is not realistic,” said Credireform managing director Herbert Eberhard in a statement. “The economic consequences of the various crises in Luxembourg will only occur with a delay.”

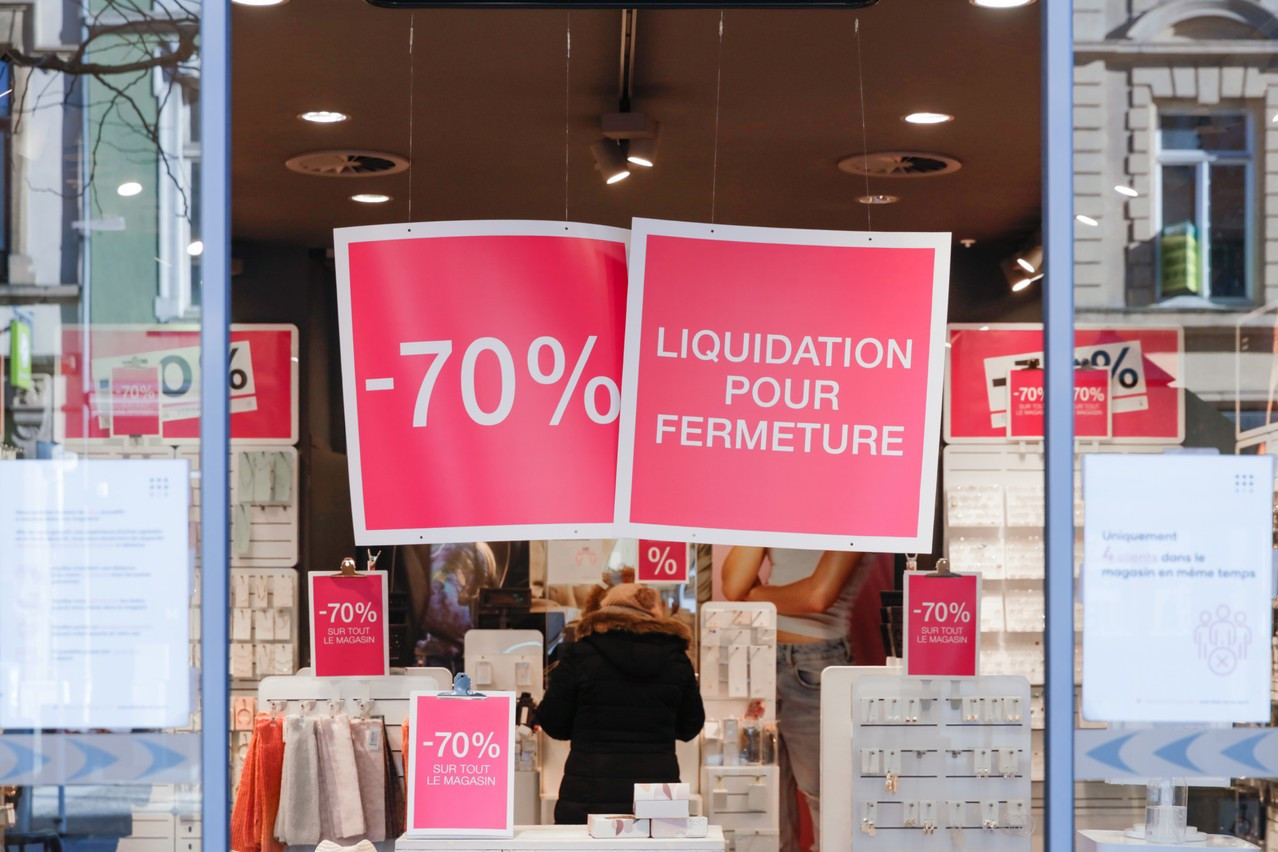

The bankruptcy statistics do not include the number of businesses who closed before running into financial difficulties and were ordered shut by a court, referred to by Creditreform as “silent business failures”.

In the greater region, bankruptcies rose by 10% in Belgium and 25% in France, the credit analyst said. In Germany, they dropped, although to a much lesser extent than in the grand duchy at just 3%.

Entrepreneurs struggle

Companies younger than five years accounted for a quarter of bankruptcies. And simplified limited liability businesses (Sàrl-S), a legal structure introduced to facilitate setting up a company for entrepreneurs as it requires as little as €1, saw bankruptcies increase from nine in the first half of 2019 to 27 last year and 62 in 2022.

“The susceptibility of this legal form to crises is very clear here,” said Creditreform, adding that government subsidies had helped keep corporate companies afloat. But “companies with low margins or a low capital base are struggling,” it said.

The finance ministry on Wednesday signed an agreement for to help provide liquidity for businesses impacted by inflation and rising energy prices. This came one day after the European Commission approved plans to spend on companies suffering under the impact of the war in Ukraine.

“In the longer term, Luxembourg will not be able to decouple itself from the internationally rising bankruptcy figures, even if the country has come through the crisis well so far due to government measures and structure advantages,” the credit analyst said. “Overall, Creditreform expects the number of insolvencies to rise sharply by winter 2022 at the latest.”