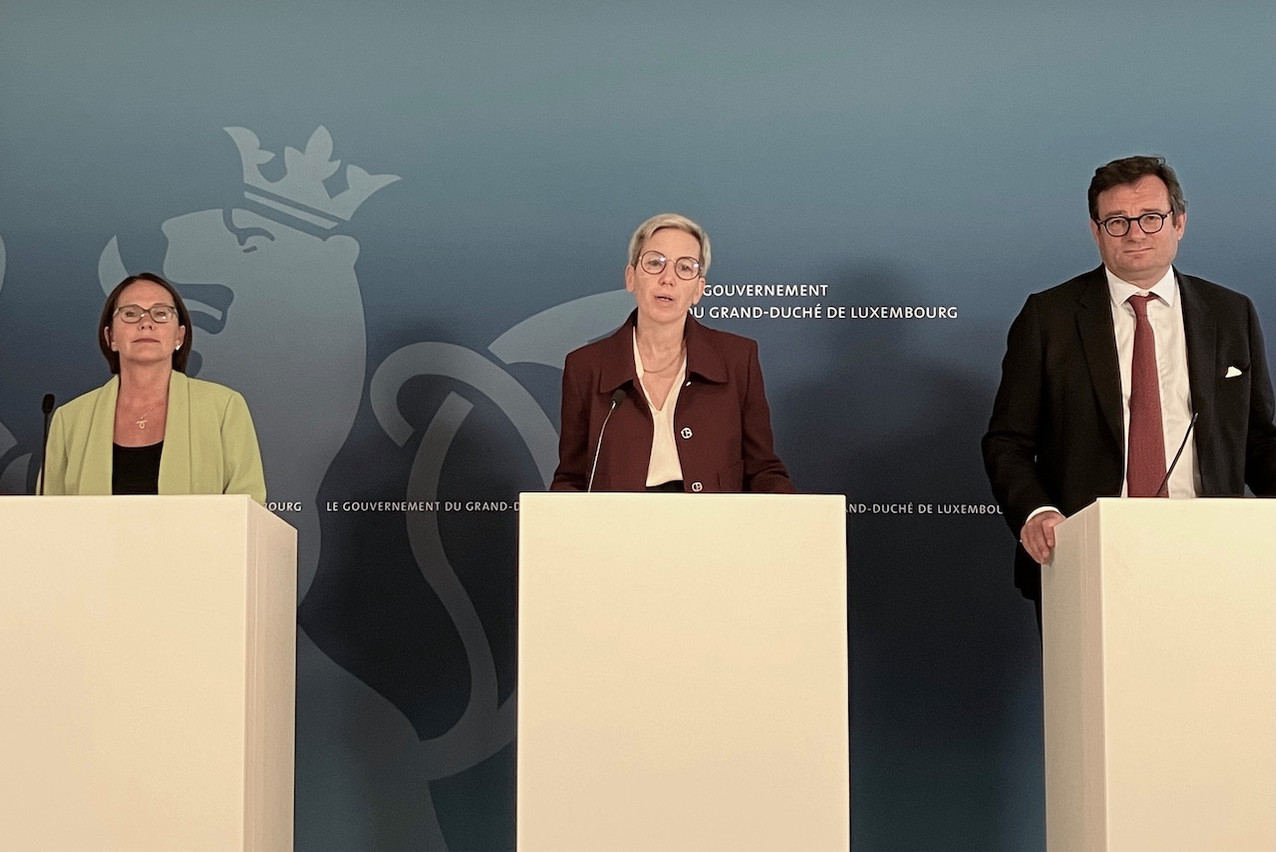

"The grand duchy is one of the best evaluated countries,” , head of the déi Gréng list and minister of justice, and , one of the DP’s leading figures and minister of finance, said with less than ten days to go before Luxembourg’s parliamentary elections.

The fourth mutual evaluation report on Luxembourg published on 27 September by the Financial Action Task Force has come at a good time for the current coalition, underlining “the work of the team that has been in place for 10 years,” comments Tanson, even though its conclusions had already been partially made public before the summer.

She blames (CSV), who was in charge at the time, for the long road Luxembourg has had to travel since it was placed on the OECD’s “enhanced watch list” following the previous report assessing the country’s 2010 status and its inclusion on the grey list, but did not cite him.

(DP) did not hesitate to do so at the with the seven heads of list of the parties represented in parliament, ahead of the legislative elections on 8 October. “The country has suffered a great deal from the old practices,” the prime minister said during the roundtable, inciting nervous laughter in the audience.

A sacred union

But let’s wipe the slate clean... on Wednesday, Tanson and Backes were delighted by the recognition that Luxembourg has a “high-quality” system for combating money laundering and the financing of terrorism, and salute the “team spirit” that prevailed during the experts’ visit, highlighting the joint involvement of the administration and the private sector.

The justice minister also welcomed the fact that FATF had described the AML/CFT system as “compliant, effective and providing high-quality penalties.” Tanson stressed: “An effective system that strengthens Luxembourg’s credibility at international level. Illegal activities are not welcome in Luxembourg.”

Backes, furthermore, emphasised: “the transparency and compliance of the system, which is positive for the attractiveness of the economy.”

FATF distinguishes between FIU and RBO

What can we learn from the 2023 version of the FATF report--302 pages long and providing a comprehensive overview of the fight against money laundering and terrorist financing?

First, “a good understanding of the risks of money laundering” and more particularly “good mechanisms for coordination and national cooperation at both legislative and operational levels.” The FATF also noted the key role played by the Financial Intelligence Unit, “whose reports are of high quality and widely used by the authorities to meet their operational needs.”

Satisfaction was also expressed for "the proactive nature of investigations into terrorist financing and the excellent international cooperation with counterpart authorities.” The register of beneficial owners has also fulfilled the role assigned to it by contributing “to the efforts made in terms of transparency of legal entities and legal arrangements.”

The mutual evaluation report also gives high marks to the Luxembourg supervisory authorities, “whose supervisory and sanctioning powers have been extended,” as have their human and technological resources.

Anti-money laundering department to be set up soon at the Luxembourg Registration Authority

Satisfaction was also expressed for financial institutions “that have a solid understanding of the risks of money laundering, of their obligations and that have implemented the appropriate mitigation measures.” This is not the case for non-financial players... While the financial sector has received overall satisfaction, the non-financial sector still has shortcomings in this area, said Michel Turk, former national AML/CFT coordinator and director of the Asset Management Office.

Notaries, bailiffs and estate agents are specifically targeted. For these players, there is a safeguard: the Registration Authority. And more specifically, the administration’s anti-money laundering department. It’s a department that has the distinction of existing without any legal basis. Backes’ department has prepared a bill to remedy this shortcoming. The bill has not been tabled, but is ready to be used by the next government.

After-sales service to be provided

With the FATF report adopted, Luxembourg must now prepare the after-sales service. A follow-up report will be published in 2026.

This will give the next government time to work on the points for improvement and the FATF recommendations: work on training and raising awareness of the risks of terrorist financing among public and private players, improve supervision of ASBLs and the non-financial professions mentioned above and put in place a system of sanctions and corrective measures for legal persons and legal vehicles that are “proportionate and dissuasive.”

Originally published in French by and translated for Delano