The government’s balance sheet is bound to deteriorate considerably in the coming months as state measures to combat inflation and the energy crisis take effect.

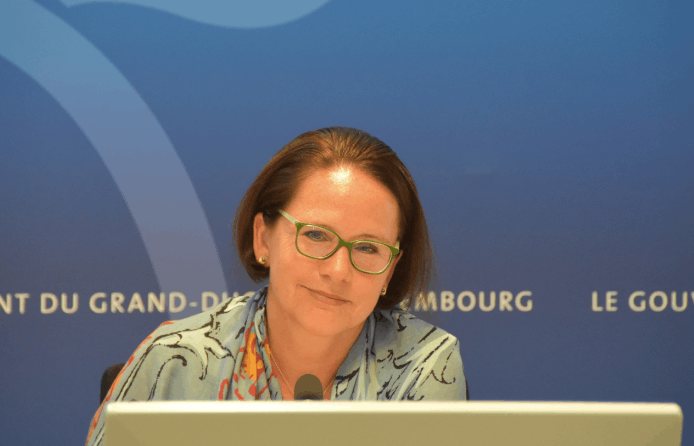

The finance minister on 18 July met the parliamentary committees in charge of finance and budget control to present the country’s current state of affairs.

“The financial situation of the state at the end of the first half of this year is less serious than might have been feared a few months ago, with revenues showing some growth, expenditure remaining stable overall and the balance remaining positive at present,” Backes (DP) said in a statement.

“In view of the continuing tense and volatile global situation, the continued deterioration of the international economic situation, high inflation and the uncertain geopolitical context constitute major challenges for our public finances,” Backes also stated. “In view of these factors, the state's financial situation is expected to deteriorate in the coming months.”

Slower revenue growth

As Backes points out, “revenues are growing more slowly than last year.” With a progression of 10.3% compared to 2021, revenue collected by the tax administration until 30 June 2022 amounted to €10.3bn and made up 53.7% of the budget that was approved by parliament. Last year, they made up 56.4% of the voted budget.

Tax revenues are also set to fall. With two indexations--in October 2021 and April 2022--the tax withheld on wages brought in revenues that increased by €445m (+18.1%). With the government delaying the next indexations to April 2023, this revenue is unlikely to evolve positively.

VAT revenue was up by 9.1% (€206m), whereas revenues from fuel taxes remains stable. The CO2 tax introduced in 2021 seems to also have an effect on consumer behaviour, as the quantities sold decreased by 3.3% over a year.

Expenses to continue increasing

Government expenditure stood at €11.1bn at the end of June 2022. “This relative stability of expenditure in comparison with the previous year can be explained in particular by the gradual dissipation of expenditure related to COVID-19 aid,” said the finance ministry. Public investment--going towards challenges of the future, according to the ministry--reached a total of €1.2bn during the first six months.

This state of stability is set to be shaken in the months to come, as the government prepares to face the expenses linked to the and “Energiedësch”, as well as remaining covid-19 measures. Delayed payments as well as inflation are likely to put pressure on the government’s expenditures too. The annual deficit is likely to be marked, as expenses will exceed revenues. The ministry will present the estimated deficit on 12 October.

Though “caution and rigour are therefore still required”, Backes remains positive and pointed to the help that has and will be granted to those most vulnerable to the current crisis.