The first measures to reduce the tax burden created by recent rounds indexation, which pushed salaries and pension payments up, were outlined at the first meeting of the new parliament’s finance committee, chaired by , with the tabling of , introduced on 27 November. But the finance minister (CSV) was unable to put a precise figure on the gains for taxpayers.

Opposition MPs were apparently annoyed by this situation and listened to the minister repeat the government’s programme for public finances, the financial centre and tax policy again. The previous day, during the government’s investiture debate, these same MPs had criticised the vagueness of how these tax cuts would be funded.

On Thursday, Roth unveiled the potential gains for taxpayers. The figures were published by the finance ministry in French:

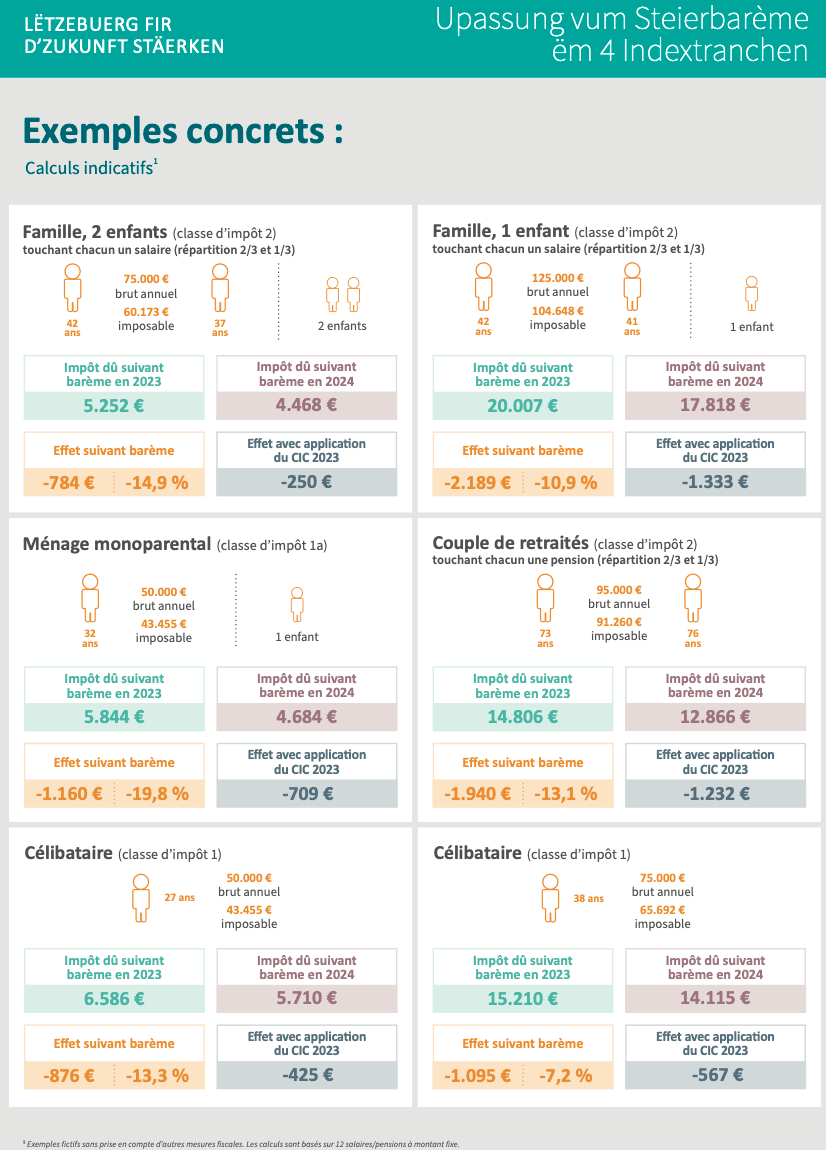

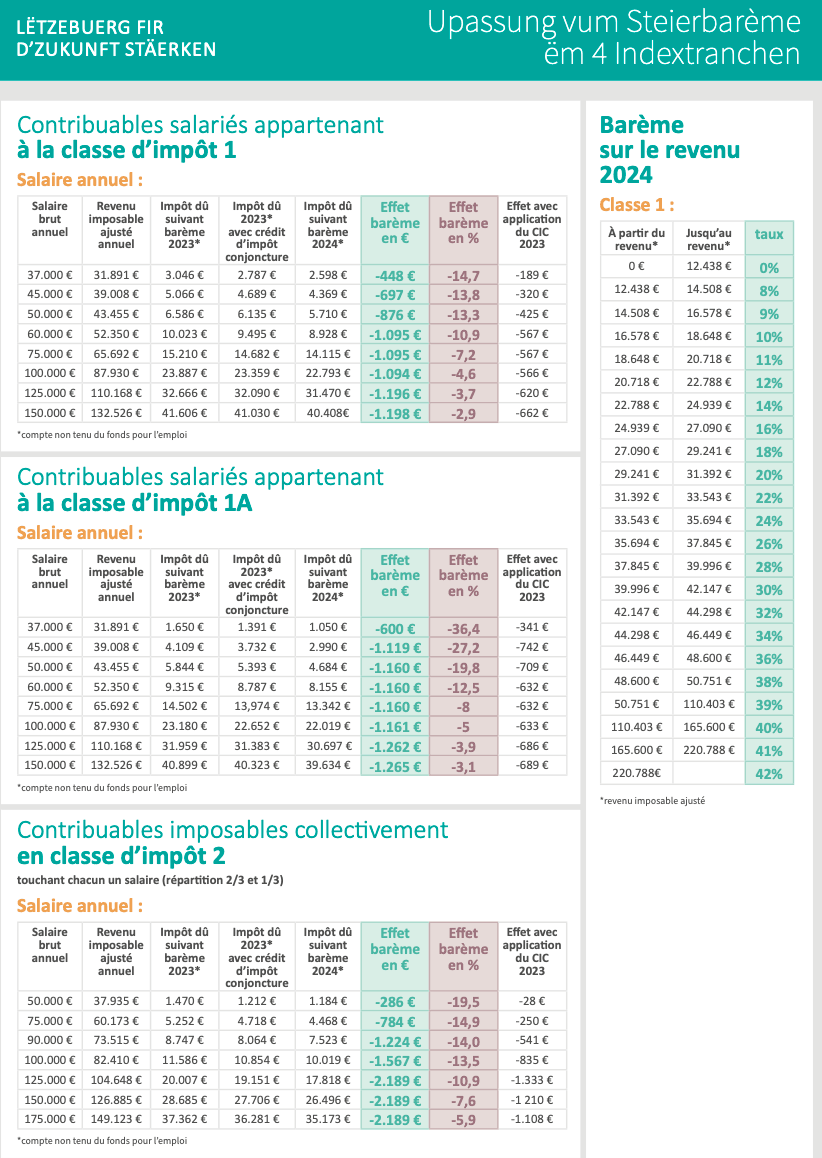

Depending on the taxpayer’s specific situation, the tax savings range from €448 for a class 1 taxpayer with a taxable income of €31,981 to €2,189 for a family with one child and a net income of €2,189 per month.

For a single-parent household--the households most likely to be affected by poverty according to Statec--the annual gain will be €1,160 on a taxable income of €43,453. The finance ministry provided this chart in French:

While these figures will put a smile on the faces of taxpayers, they are unlikely to do so for the opposition parties, who are likely to criticise the lack of social selectivity in these tax breaks.

Coincidentally, however, the Luxembourg Central Bank published its on Wednesday 29 November. Although it has risen slightly, it remains historically low, weighed down by household expectations of the country’s economic situation and the financial situation of households.

Originally published in French by and translated for Delano