witness the perspective of this market and its potential.

Among one of the biggest players in the European asset management market is . The company offers a variety of trust management methods for its clients. Today, we talked with Julia Khandoshko, CEO at Mind Money. Ms Khandoshko is keen on sharing recent companies’ updates and discussing asset management trends which are shaping the industry today.

Julia, tell us more about Mind Money. What is the primary focus of the company?

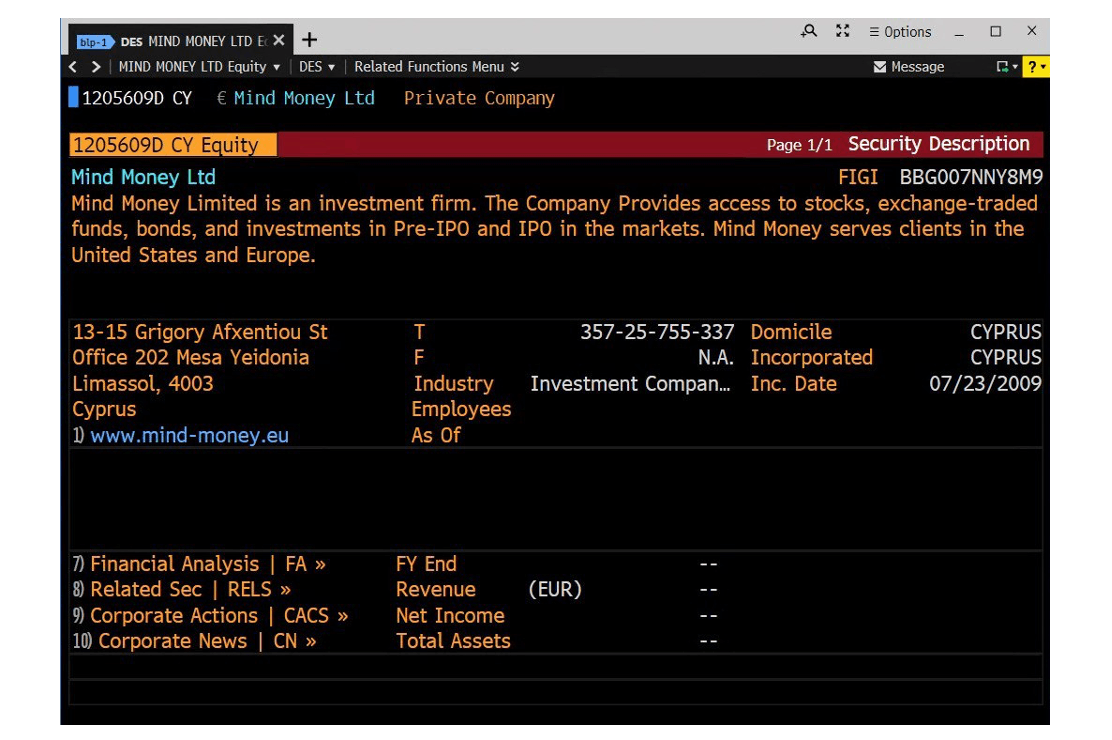

Julia Khandoshko: Mind Money is headquartered in Limassol, Cyprus and operated under CySEC CIF License 115/10. Over 15 years ago, we began offering access to stocks, ETFs & bonds of the leading stock exchanges as well as pre-IPO and IPO investments in global markets to our clients.

Mind Money provides a diverse array of investment options, such as gas and calendar spreads on commodity futures, access to Chinese markets, ADRs and GDRs, and savings strategies. The company is also actively engaged in the real economy, especially in gold mining ventures. Additionally, Mind Money enables clients to invest in 35,000 companies across America, Europe, and Asia.

Mind Money also provides access to major exchanges, with CME being our primary focus. Additionally, we offer custodial and securities storage services in the USA, the UK, Dubai, Cyprus, Armenia, and Kazakhstan. Mind Money also collaborates with clients based in Monaco.

How do you maintain your position as a leader in asset management? What’s the key?

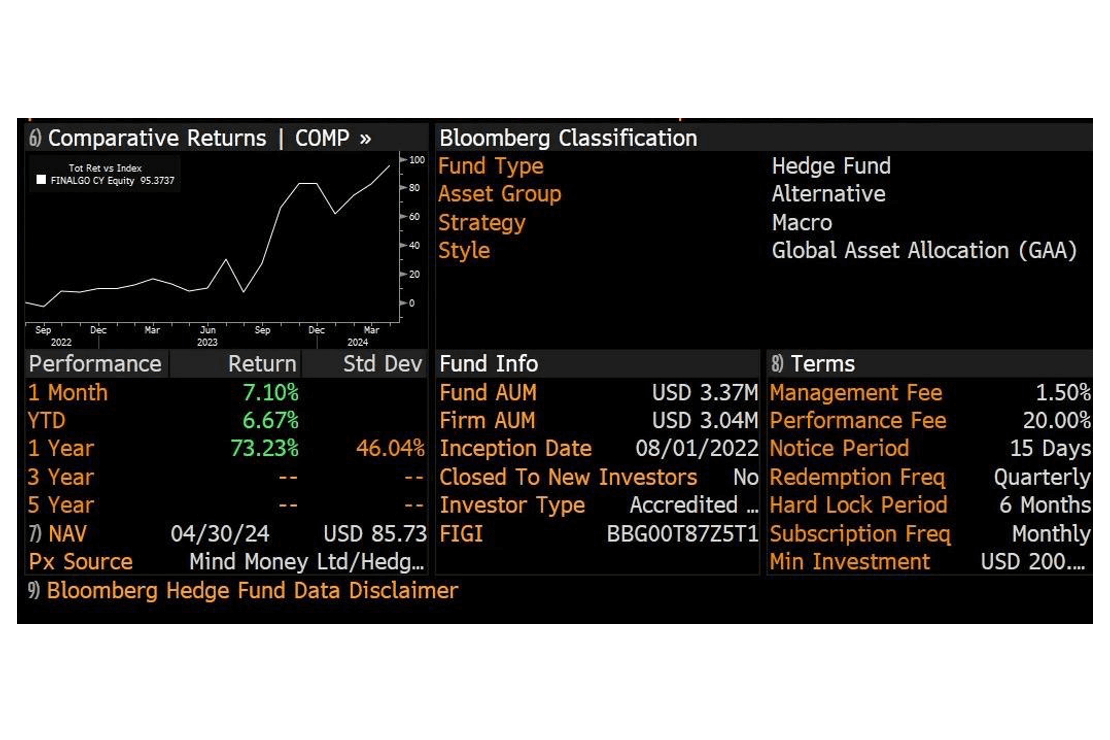

Julia Khandoshko: Above all, Mind Money offers innovative solutions in trust management. Instead of following a traditional fund structure, the company employs a flexible and scalable strategy model. This approach allows for agile trading activities across multiple brokers, segregated accounts, and customized terms and conditions tailored to the unique needs of each client.

Our investment strategies have been rigorously tested and have demonstrated only a positive track record since 2019, as reflected on Bloomberg Terminal under FIGI BBG007NNY8M9. Furthermore, Mind Money undergoes regular audits by one of the world’s largest audit firms, underscoring our commitment to transparency and professionalism.

We also actively collaborate with leading brokerage houses in commodity trading, including StoneX and Joe Bryant. These companies are industry leaders, consistently ranked among the top brokerage firms globally. Our special conditions with these brokers highlight our exclusivity and advantageous market position.

What market trends do you see, and how is Mind Money adapting to them?

Julia Khandoshko: Asset management field experiences the impact of AI technology. AI has already replaced many workers in different spheres. So if we speak about the expectations for hiring in asset management, primarily, similar to other sectors, the anticipation lies in automating routine tasks using advanced technologies. AI can assist asset managers with routine tasks, allowing them to concentrate on the more challenging duties of senior specialists.

AI-Enabled gains can improve productivity across the value chain BCG’s Global Asset Management Benckmarking Database, 2023, expert interviews; BGC analysis

One of the key trends is team specialization. We at Mind Money have groups of different types of commodities analysts. Moreover, our analytical teams consist of practitioners and scientists with advanced degrees in technical fields such as climatology, geology, physics, and agriculture.

It is worth noting that there are quite a few specialized teams dealing with commodity markets, and we are one of them. That is, we try to go deep into the industry, providing our customers with the most complete service. For example, calendars spread for gas and our gas analytics are based on a fundamental study of factors and have a predictive effect in 90% of cases.

Moreover, the market a shift towards ecosystems rather than individual solutions. Customers increasingly prefer accessing all necessary services in one place. As a standalone entity, your options are limited to either targeting a very niche market or merging with other companies. The paradigm is shifting, necessitating agility in formulating new approaches, sometimes through collaboration with fresh talent and innovative ideas.

Overall, asset managers, like other businesses, must constantly adapt to change and carve out specific pathways accordingly.

What challenges do you see in the asset management market, and how are you adapting to them?

Julia Khandoshko: First challenge of the current paradigm is that the low-rate environment challenges asset management firms as they compete with traditional banks offering higher deposit rates.

Despite the uncertain timing of rate reductions, asset management firms should proactively adjust their processes. This anticipation fuels the competition for top talent, as firms prepare for future demand.

To confirm this thesis, we can see that the asset management field experiences a huge lack of qualified workers and to hunt the most relevant candidates now.

In general, today’s world is facing a complex situation. Many long-standing principles of financial markets no longer apply, and traditional financial literacy appears outdated in our BANI (Brittle, Anxious, Non-Linear, and Incomprehensible) world. That’s why we, at , adapt our solutions to this new paradigm, ensuring we meet our customers’ evolving needs.

In particular, we assist our customers in solving their most challenging problems by employing long-term strategies with an average holding period of three months. In these circumstances, we prioritize selecting solid assets with high liquidity. Additionally, we only trade in areas where we have deep expertise. For instance, if we offer a bond issued by a Chinese firm to a client, it must be available at the best market price and facilitated through direct contact with all key players involved in these securities.

You can find more information about Mind Money on our .

About Julia Khandoshko

, CEO of European broker . Ms Khandoshko is a finance industry professional with 10 years of experience in technology and capital markets. Ms Khandoshko’s extensive familiarity with technology applications in financial services is underscored by 5 years of managing business development initiatives in the IT education sector. During this period, she collaborated closely with esteemed clients, such as Deutsche Bank, T-Systems, Luxoft, and JetBrains. This background proved to be a valuable asset when navigating Mind Money's transformation into a financial hub guided by a scientific, data-driven approach.