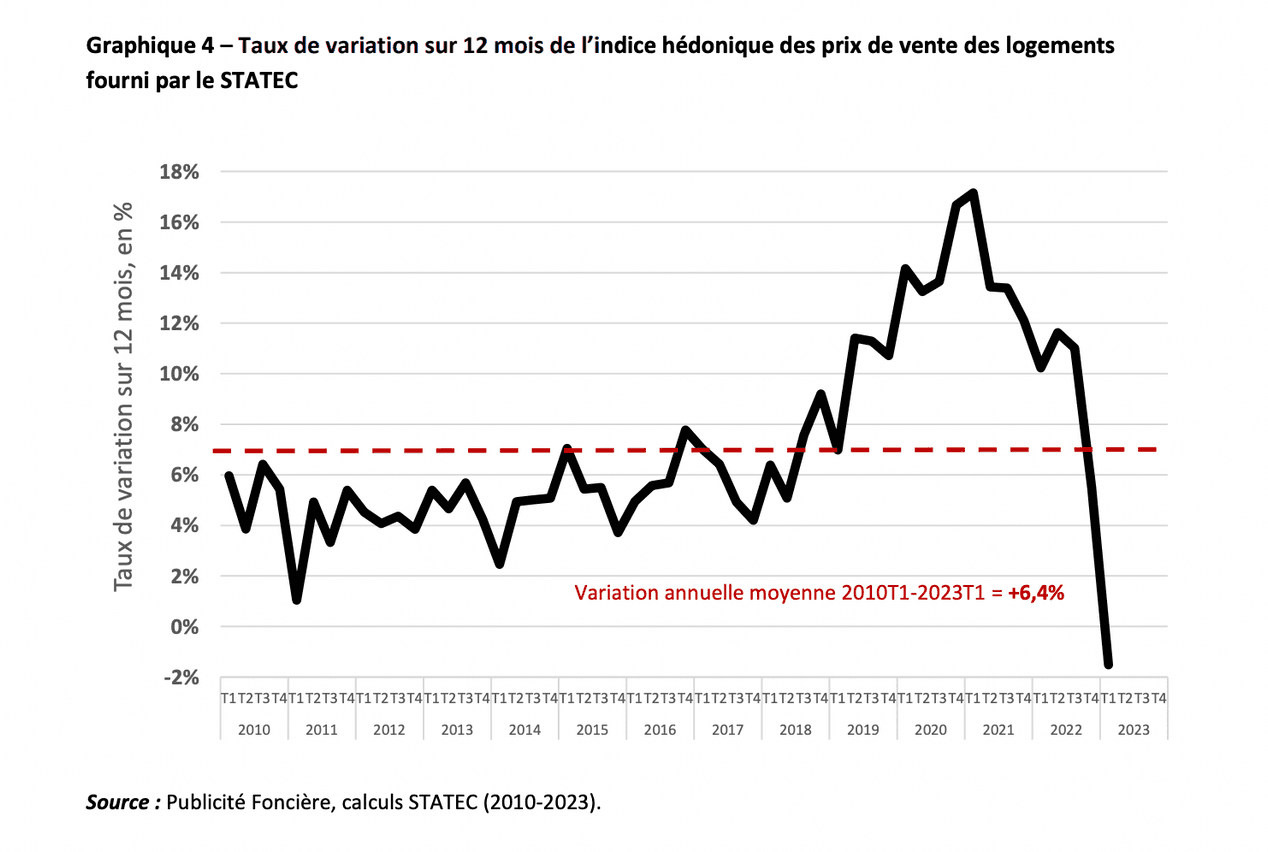

House sale prices in Luxembourg fell by -1,5% in the first quarter of 2023, compared to the same period in 2022. This is the “first year-on-year fall in prices since the third quarter of 2009,” reveals the Observatoire de l’Habitat in its latest report, published on Tuesday 27 June. The report is based on the Observatoire’s own data, as well as that of Luxembourg’s statistics bureau Statec, the registration duties, estates and VAT authority for sale prices, and Immotop.lu for rents.

Sale prices fell by an average of 0.4% for flats under construction and by 4.3% for existing houses, but rose by 0.4% for existing flats. Comparing this with the last quarter of 2022, this means -4.1% overall, -2.6% for existing flats, -4.2% for existing houses and -6.2% for flats under construction.

In the first quarter of 2023, prices saw a year-on-year decrease for the first time since 2009. Screenshot: Observatoire de l’habitat

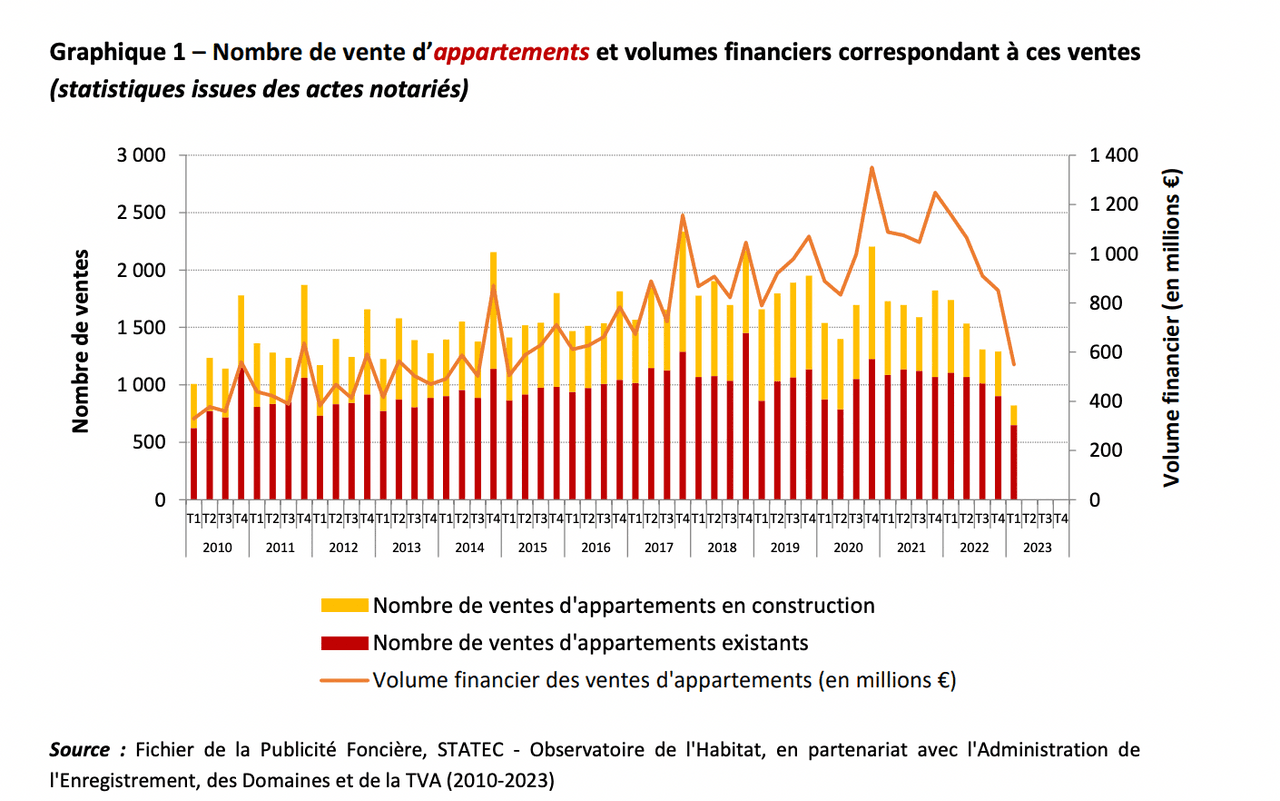

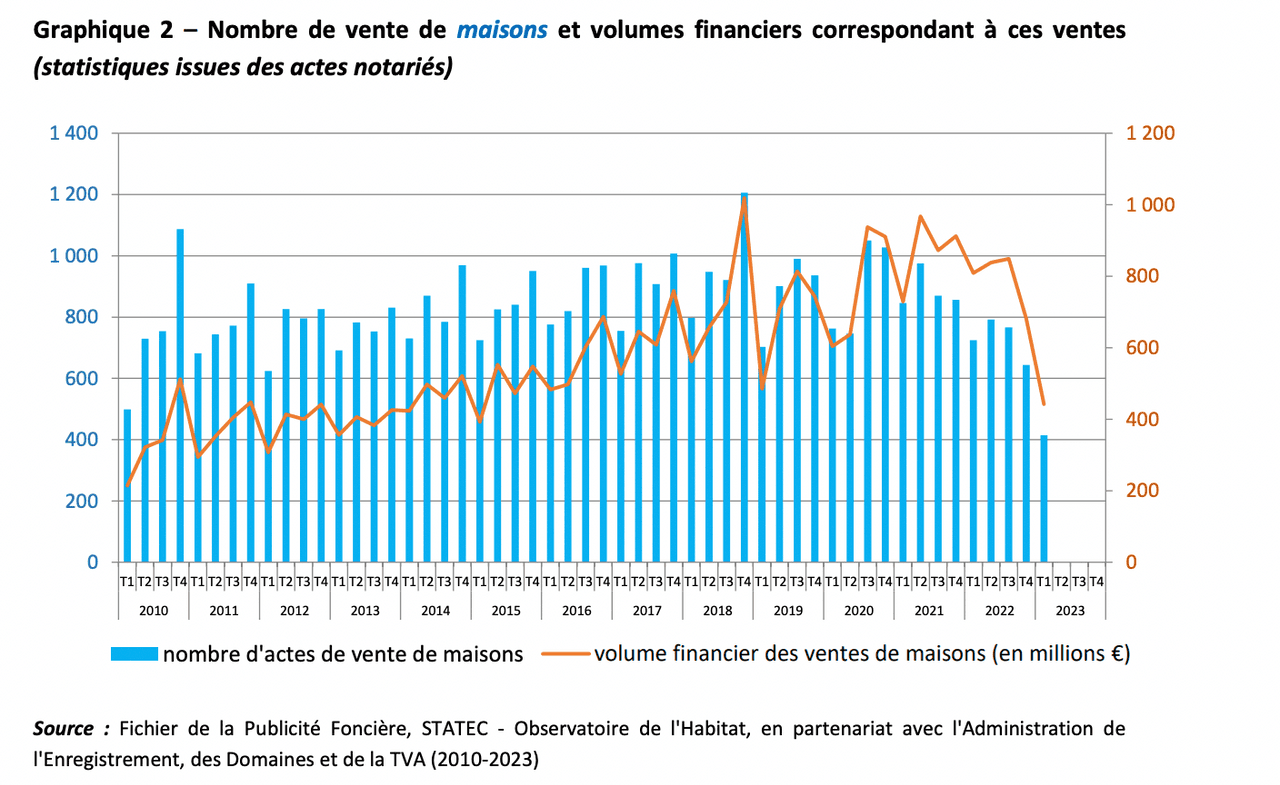

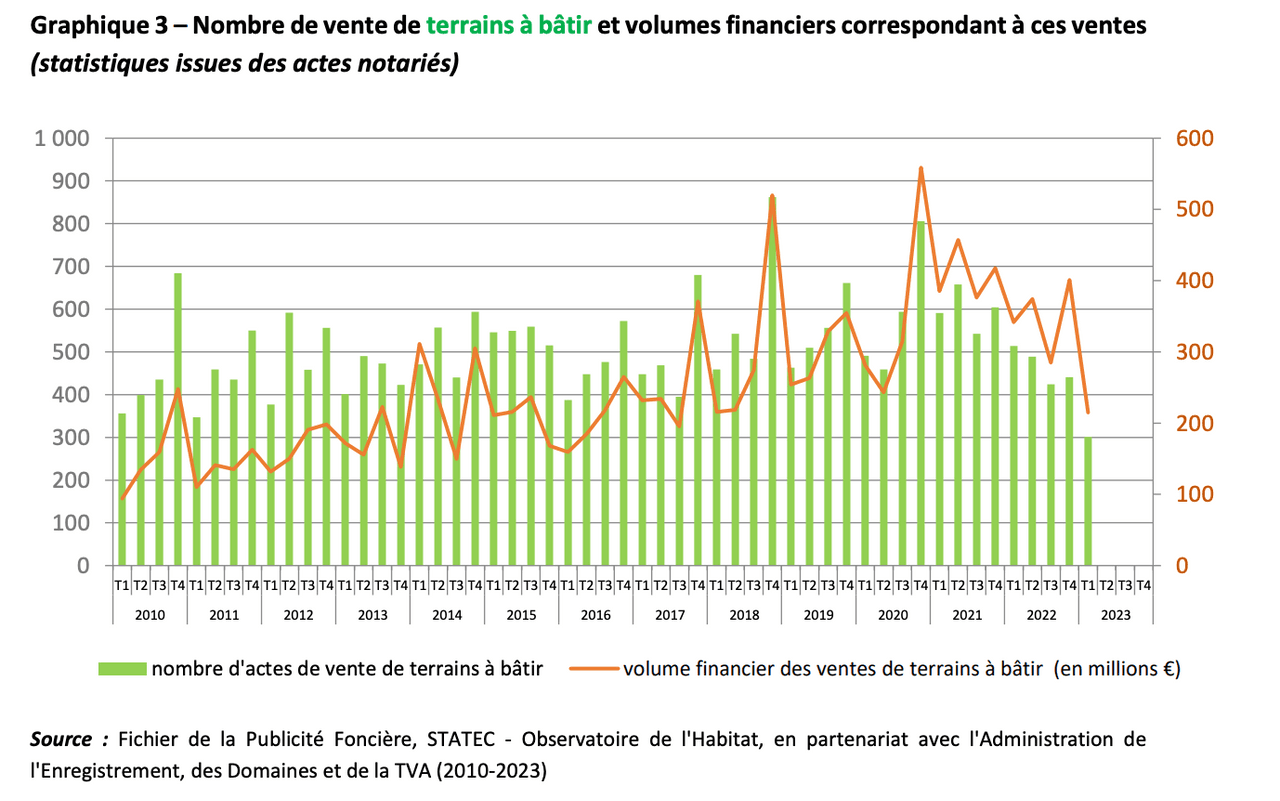

This deterioration in the property market can also be seen in the number of transactions.

822 flats and 414 houses sold

822 flats were sold this quarter, down 52.7% year-on-year. This figure represents “around half the number of transactions recorded on average in the years preceding the health crisis” and “the lowest recorded over a quarter since the statistics were created in 2007.” A comparable figure was recorded in 2009, during the economic and financial crisis, with 853 flat sales in the first quarter.

The biggest fall was in flats under construction (-72%). This can be explained by a “decline in the attractiveness of rental property for investors due to the rise in interest rates, a decline in the purchasing capacity of first-time buyers due to the rise in interest rates, which is forcing them to postpone their projects or refocus on other options, and uncertainties over the future price of a home that is purchased under construction.”

These transactions represented just under €550m (down 52.5% in one year).

822 flats were sold in the first quarter of 2023. Screenshot: Observatoire de l’habitat

As for houses, sales fell by 42.9% to 414. Again, this is “almost half the level of the years preceding the health crisis,” with 752 sales per first quarter on average between 2017 and 2019.

The associated financial volume fell by 45.3%.

414 houses were sold in the first quarter of 2023. Screenshot: Observatoire de l’habitat

Finally, sales of building land slowed by 41.4%, with 301 transactions, compared with an average of 457 per first quarter between 2017 and 2019. The fall in the associated financial volume--31.7%--is “slightly less marked.”

391 building plots were sold in the first quarter of 2023. Screenshot: Observatoire de l'habitat

Prices expected to continue to fall

The Observatoire de l’Habitat points out that “price trends relate to notarised deeds registered in the first quarter of 2023, and therefore to sales agreements signed for the vast majority of properties before the end of January.” In addition, “the fall in sale prices must be interpreted in parallel with the fall in activity on the property and land markets: we can put forward the hypothesis that sellers who agree to a lower price than their initial expectations are often forced to sell (for example, in the case of bridging loans), and that the number of transactions remains limited precisely because some potential sellers prefer to wait rather than lower their price.”

In the medium term, it is essential to adjust quantities and/or prices.

Using advertised prices as an indicator (taken from property advertisements recorded by the Observatoire de l’Habitat and transmitted by Immotop.lu), we arrive at -4.7% for houses and -7.2% for flats in one year.

“A continuation of the aggregate fall in sales prices in the second and third quarters of 2023 cannot therefore be ruled out. In any case, an adjustment in terms of quantity and/or price is essential in the medium term, given the sharp rise in the cost of credit for buyers,” concludes the Observatoire de l’Habitat.

+11.1% rise in flat rents

With rising interest rates making it more difficult for people to buy property, they seem to be turning more to renting.

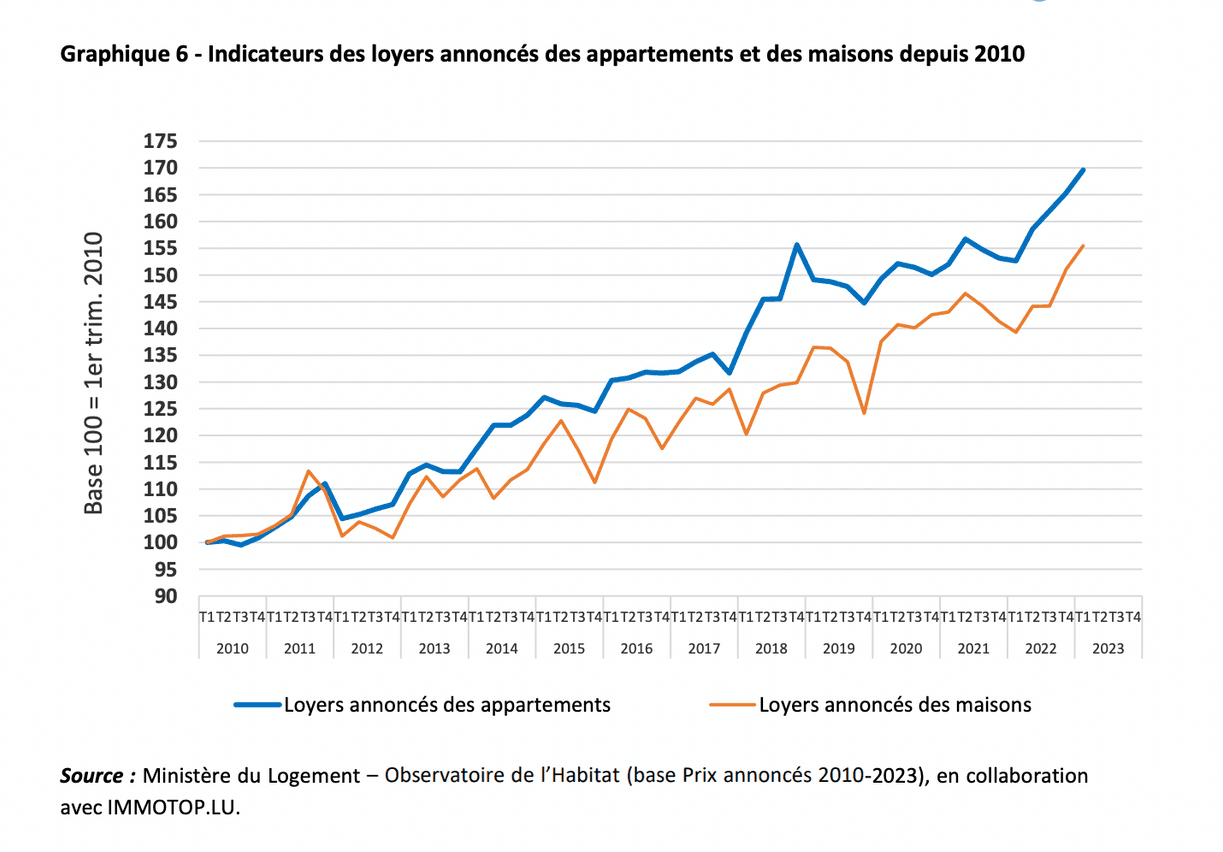

Advertised rents for flats have risen by 2.6% in one quarter and by 11.1% in twelve months. This increase is “significantly higher than the rise in consumer prices measured by the NICP (+4.2%) over the same period,” notes the Observatoire de l’Habitat.

For houses, rents rose by 2.9% in three months and by 11.6% in one year. These figures are less significant given that “only 13% of rental advertisements have been for houses in Luxembourg since 2010, a proportion that has been falling sharply for several quarters.”

Unlike purchase prices, rental prices are rising. Screenshot: Observatoire de l’habitat

These figures concern new rental contracts. For existing tenants, the increase is +1.7% in one year.

This story was first published in French on . It has been translated and edited for Delano.