Fear of missing out is a powerful force in investing. And it’s difficult to ignore an asset that has gained more than 500,000% in just a few years. Bitcoin and other cryptocurrencies have captured the imagination of investors. Rather than dismissing them as a passing fad, financial professionals such as bankers and other financial advisors should see them as an opportunity to gauge clients’ risk tolerance. “If you have a client who really wants to buy Bitcoin, just saying ‘don’t do it’ isn’t doing them a favor,” says equity investment analyst Barbara Burtin. “In fact, owning a small amount can be a learning experience.”

The Bitcoin rollercoaster

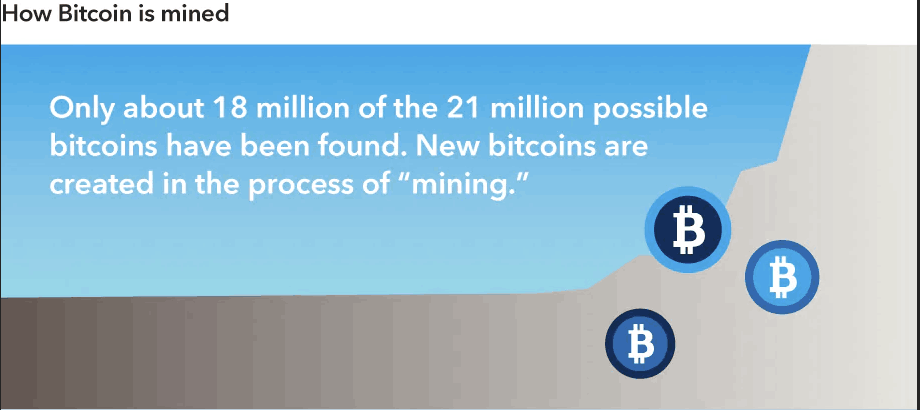

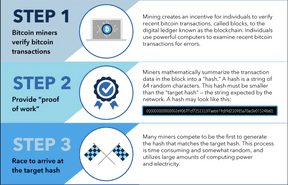

Bitcoin is by far the most popular digital currency created through advanced cryptography, but not the only one. Other popular cryptocurrencies include Ethereum, Ripple and Litecoin. Bitcoin was created in 2008 by an anonymous programmer using a process known as mining. Unlike traditional currencies, Bitcoin operates without central authority or banks and is not backed by any government.

Interested in learning more? Further data and analysis by Barbara Butin, equity investment analyst at Capital Group, is available

“Bitcoin tends to garner a lot of attention every time it has one of these steep run-ups in value,” explains Capital Group portfolio manager Alan Wilson. “But keep in mind, at some point it may go in the other direction, too. Anyone speculating should be prepared for extreme volatility in either direction.” For example, Bitcoin and other cryptocurrencies rose as the trading platform Coinbase went public, attracting an $86 billion valuation.

Caution is key

With Bitcoin basics out of the way, there are a few key issues to consider when discussing cryptocurrencies with clients, starting with the fact that spectacular past results are not predictive of future performance. You might tell clients who are convinced they must own it to dedicate no more than 1% of their portfolio to any cryptocurrency, Burtin suggests. “If a client insists, ‘I’ve got to put money into this,’ advise them to invest no more than they can afford to lose,” she adds. “Owning a small amount of cryptocurrency could be useful as an educational exercise. Having ‘skin in the game’ is a good way to learn about this asset class.”

Owning a small amount of cryptocurrency could be useful as an educational exercise. Having ‘skin in the game’ is a good way to learn about this asset class.

Risky business

“Some clients might reconsider the idea of buying Bitcoin once they learn its limitations,” says Douglas Upton, an equity investment analyst at Capital Group. What are the main risks? First of all, the fact that it’s not a standard means of exchange. Governments are also unlikely to allow its usage to flourish without controls, Upton says. “Bitcoin seeks to replace sovereign currencies,” he notes. “If allowed to proliferate, it could reduce the ability of governments and central banks to set monetary policy, and to tax earnings and wealth.” Countries such as South Korea, China and the US have taken steps to make the use of cryptocurrencies more difficult.

While many investors may be drawn to cryptocurrencies thinking they’re an asset to store value, in reality Bitcoin is not a store of stable value. If you lose your private digital key or your funds are stolen, there’s no one to contact for assistance.

Unlike other major interest-bearing currencies, holding Bitcoin can cost you more than it earns. Lastly, Bitcoin does not always provide optimal downside protection when equity markets decline. “It remains an open question whether Bitcoin can act as a hedge,” says Capital Group currency analyst Jens Sondergaard. “Investors should be careful assuming too much about how it will behave in various market environments.”

It remains an open question whether Bitcoin can act as a hedge. Investors should be careful assuming too much about how it will behave in various market environments.

Major potential

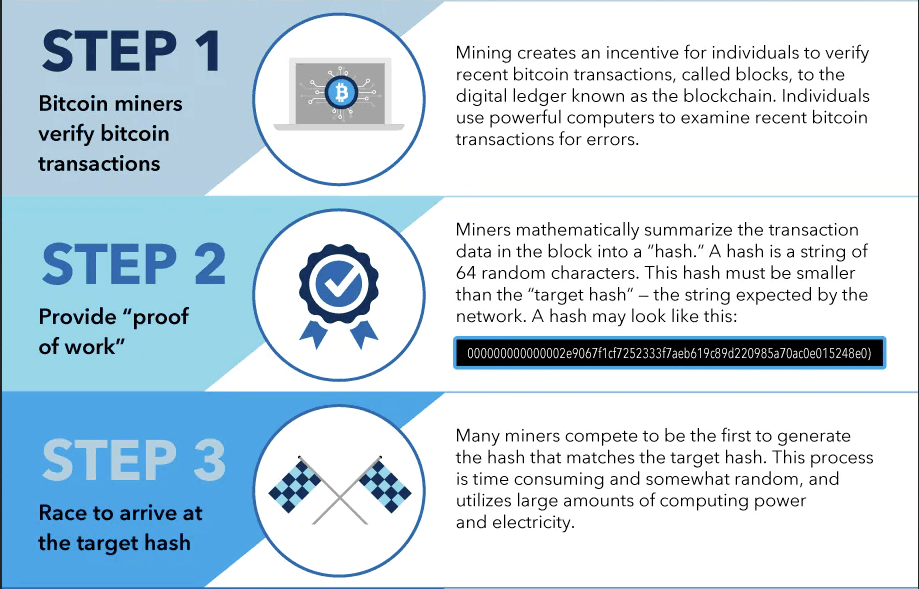

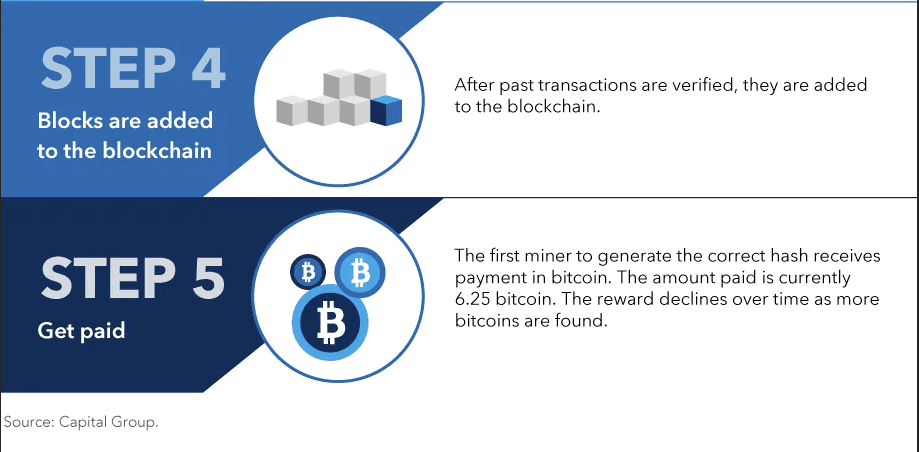

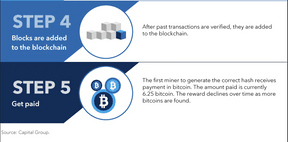

While there are certainly risks associated with cryptocurrencies, there are also groundbreaking innovations, starting with the underlying technology: blockchain. Think of Bitcoin as the first application of blockchain, an immense digital ledger where transactions are tracked and recorded as blocks of information, providing an easier and more efficient way to handle financial transactions.

Cryptocurrencies also let investors own, trade and use “tokens” to buy goods and services, giving companies a way to raise money and fund projects, although they are not immune to fraud. Lastly, cryptocurrencies may be seen as attractive alternatives and a way to store value in some parts of the world with less stable currencies.

Exploring the options around cryptocurrencies can be a good way to gain insight into investors’ psychology, their reaction to high levels of volatility, their risk tolerance and ultimately how to craft the best asset allocation plan for their portfolio, Burtin explains. “Behavior is so important when investing,” she says. “It’s more than Bitcoin. It’s a social experiment.”

Interested in learning more about cryptocurrencies?