Now that the U.S. Federal Reserve and many other central banks around the world have committed to hiking rates and cutting stimulus measures, investors face an important question: Is the era of easy money coming to an end? As usual in the financial markets, the answer isn’t a simple yes or no.

“It's probably the end of free money, but I don't think it's the end of easy money,” says David Hoag, a keen Fed watcher and portfolio manager “Central banks will do what they need to do to get inflation under control, but I don’t think they will be able to go too far before the real economy starts hurting.”

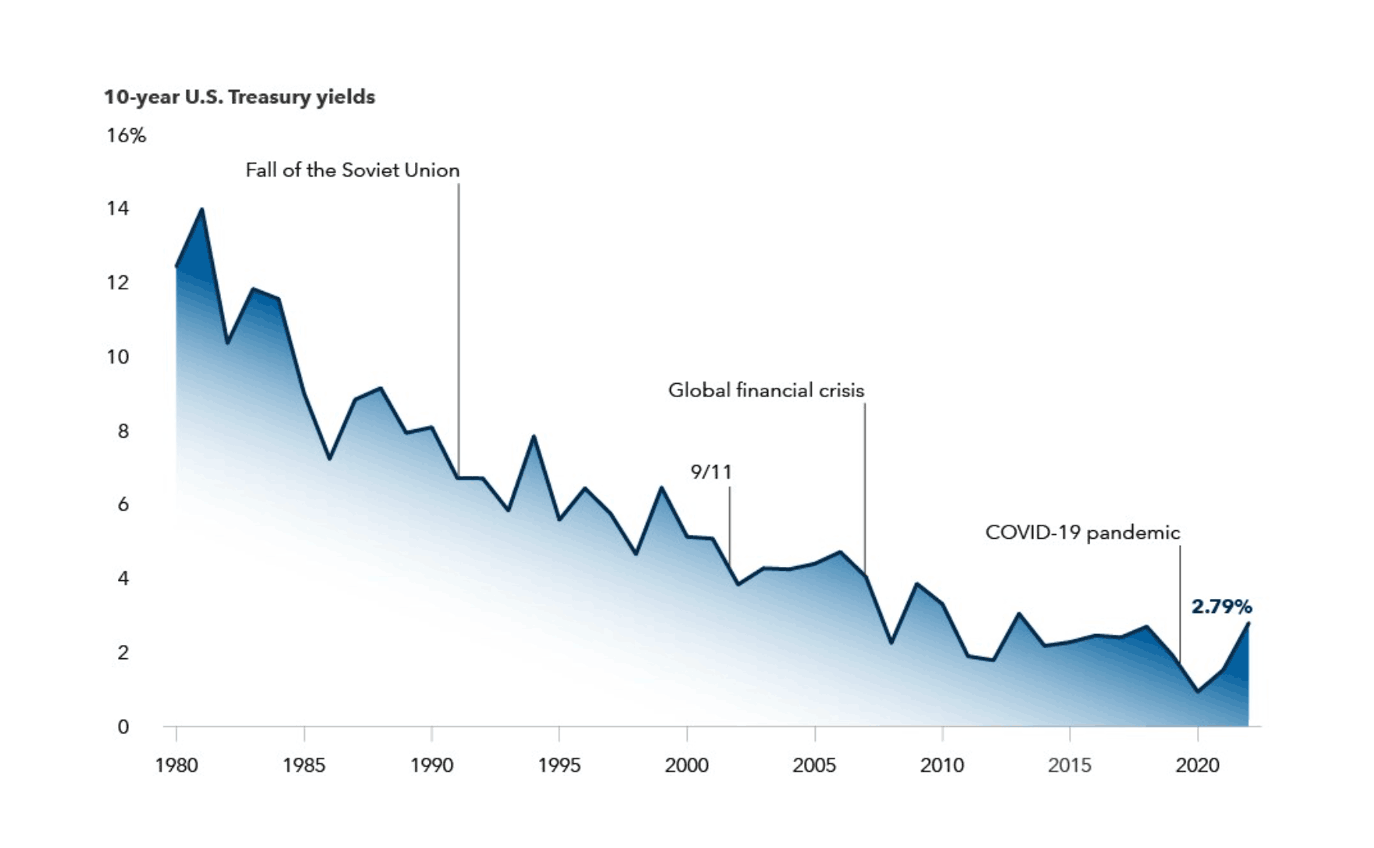

Free fall: Interest rates have plummeted in the era of easy money

As of 4/11/22 Federal Reserve. Refinitiv Datastream.