Speaking at the firm’s mid-year economic outlook on 21 June, Robert Lind, an economist at Capital Group, said he was not optimistic about Europe’s growth outlook during the second half of 2023. “It's very hard to be extremely bullish about European growth. The largest economy in Europe, Germany, is struggling,” he said.

The contracted by 0.3% in the first quarter of 2023 following a 0.5% decline in growth during the last quarter of 2022. Economists often describe countries that have experienced two consecutive quarters of negative growth as being in a technical recession.

However, Lind said evidence that energy prices have reached their peak and are starting to drop should remove one of the big drags on European growth. “As energy prices continue to fall, it should help to support German industry and turn around the German economy, particularly as we look into 2024.”

Outside of Germany, the European economy has been surprisingly resilient through the energy shock, particularly in France and Italy, Europe’s second and third largest economies, according to Lind. “We've seen a significant improvement in both of those economies, notably in terms of business investment. That means to me that we are starting to see greater optimism about the future.”

He warned that while rising interest rates could take some of the steam out of the recovery, the European economy is in better shape than expected. “Hopefully, over the course of the next few years, we’ll start to see a combination of stronger growth and a gradual fall in inflation back towards the 2 percent target.”

It would be extremely dangerous now to tip Europe back into a significant slowdown.

ECB faces a tricky task

However, Lind said the European Central Bank had a tough job on its hands and falling inflation in Europe is not guaranteed. “The inflation problem is not really about excess demand in Europe. It's largely about the supply shock from energy that is now starting to filter through into other aspects of the European economy.”

Lind said the ECB faced a difficult balancing act, on the one hand, keeping policy fairly tight, possibly for longer than the markets are currently expecting, while on the other hand not causing too much pain for the European economy. “It would be extremely dangerous now to tip Europe back into a significant slowdown. That leads me to conclude that the ECB will start to be a little bit more pragmatic.” Lind said he expected the ECB to raise rates one or two more times before holding rates level going into 2024.

Bullish on European equities

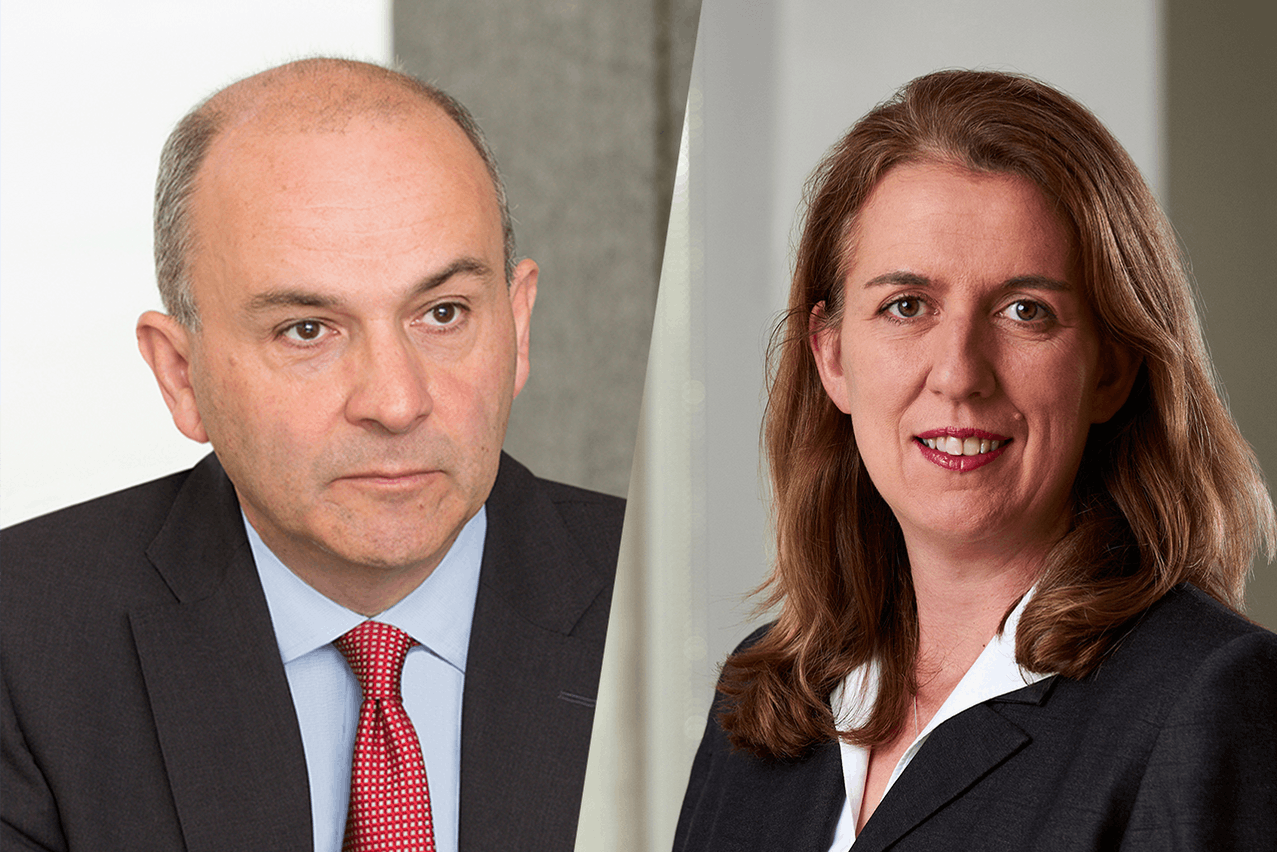

Despite the challenging economic outlook, Julie Dickson, equity investment director at Capital Group, said she was excited about European equities. “I think they’ve been overlooked for a really long time in favour of the big US tech names that have dominated markets for a number of years.”

Dickson said she saw potential for growth in European multinationals, even if they are exposed to non-European currencies. “These companies are adapting to changes in consumer behaviour and expanding into markets outside of Europe. While currency fluctuations can impact them, their growth in non-European markets can offset this.” She said a number of European multinationals, in sectors such as luxury brands and healthcare, were remarkably resilient and demand for their products and services are expected to remain incredibly strong.