From the top of the glass building in Leudelange, from his uncluttered office with a view of the fields, watches over the present and the future of Lalux Assurances. President of this central branch of the family group--the Compagnie financière La Luxembourgeoise, chaired by his cousin --he looks back on 100 years of history.

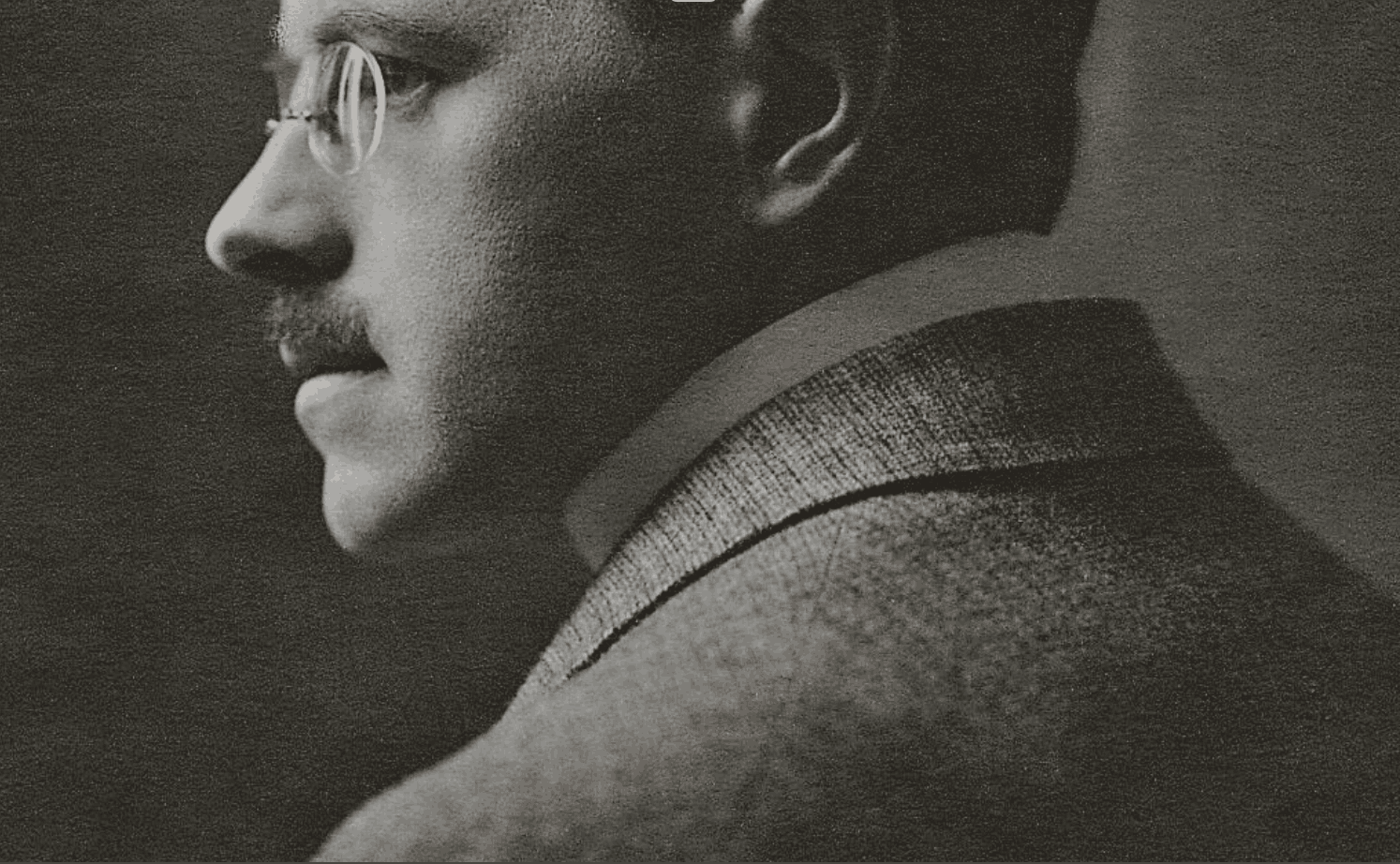

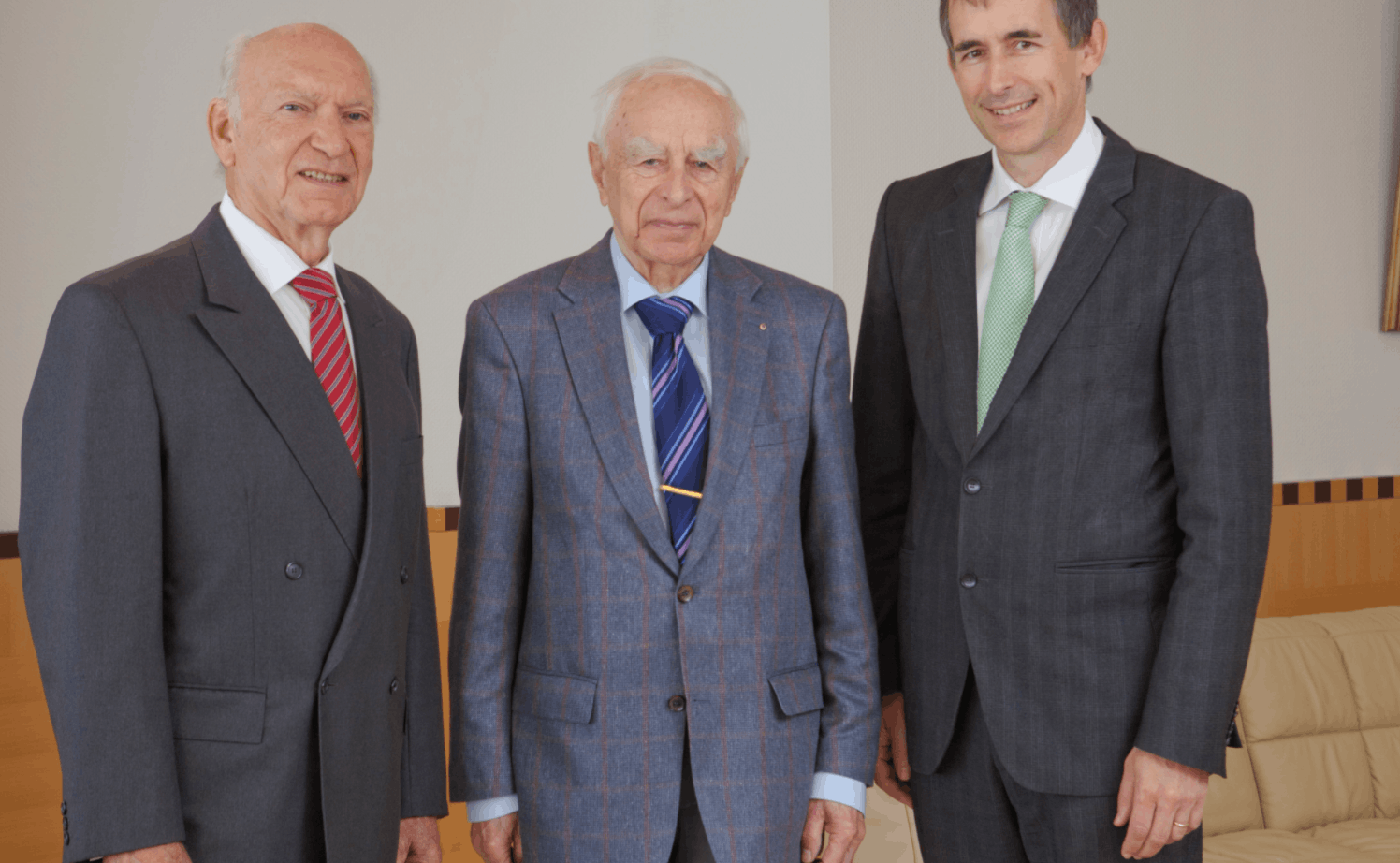

“We were set up in 1920, after the First World War, by 33 people and on a government initiative,” he says. Among them was Pit’s grandfather, Aloyse Hentgen, who became managing director of the insurance company two years later. His son Robert joined him and became president of the group’s parent company until 2012. Then came Pit. “I joined La Luxembourgeoise in 1995 and became managing director in 1998. I became president of the insurance company in 2002, combining these two functions from 2002 until the end of 2015.”

His operational position as managing director ended following a 2016 law on the status and supervision of insurance and reinsurance companies, which prohibits the statuses from being combined.

This dual position (an “opportunity”, Pit calls it) was an exception in the history of the family business, says Pit. “I spent ten years at Banque Générale du Luxembourg (BGL) in asset management, after studying applied economics. I had an offer to join another bank. But at the same time, the general manager of Lalux had announced that he would be retiring earlier than planned.” Back then, Pit hadn’t yet taken a clear position on whether he wanted to join the family business. So his father asked him. It took him two weeks to finally decide on Lalux.

A decisive conversation

“It wasn’t my father who asked me to come. It was my uncle, François Pauly’s father [then a director in the company, editor’s note]. I remember a long and decisive telephone conversation. I’d just returned home; it was still light. I sat down with the phone in the kitchen and when we finished, the sun had gone down. He was very convincing. There were arguments, but also more emotional elements, like ‘If not you, then who?’ and ‘You have to help the family’. I’m sensitive to that, so it certainly played a role.” Pit doesn’t regret picking up the phone that day: “I’ve had an interesting professional life, boosted by that decision.”

The dilemma of 2015, having to choose between director and president, was an easier decision. “For me, it was clear that I had to continue as chair rather than stay managing director under a chair who wasn’t family. And it feels good to change the head of the company. We’re fortunate that we found the right person in Christian Strasser. Since then, Lalux has decided to set a new rule that family members should no longer be part of the group management.”

I’ve had an interesting professional life, boosted by that decision.

The next generation of directors, but not managers, is being formed on this basis. Six young people have recently joined the boards of subsidiaries, three of them from the family. Among them is Pit’s 29-year-old son, who studied at HEC Lausanne and Imperial College London. He is particularly interested in global warming, “a dimension that we must increasingly take into account.”

The other two are François Pauly’s nephews--his brother’s son and his sister’s son. “We want to start training the younger generation,” says Pit. “Many young people between 20 and 40 years old have done excellent studies. We have plenty of choice, which is reassuring. In a few years’ time we can be sure of having very good replacements.”

A family affair

From 33 shareholders originally, the company now has over 400. Not all of them are equally involved. “My brother is a psychiatrist; my sister is a judge,” says Pit. “They’re attached to the company because it has always been part of our world. They are shareholders. But they’ve never been interested in joining its operations.” And in terms of who does join those operations, “there is no jealousy. With François, it was I who made the proposal for him to become president and succeed my father. We complement each other and we get along very well, like brothers.”

Pit also has a daughter who works as a physiotherapist. François Pauly’s children have gone into architecture and the hotel business.

“We’re not one family in charge, but several dozen,” Pit sums up. “The fact that we have known each other for three generations unites us. The meetings are harmonious.” Perhaps that is also because “developments have been favourable in recent years; there hasn’t been much to criticise.”

The family firm today employs 430 people and has a turnover of €572m.

This article in French on Paperjam. It has been translated and edited for Delano.