The importance of having a plan

“It’s surprising that succession planning is often not considered in family businesses,” says Véronique Simonin, Head of Sales and Strategic Key Partner Management at Swiss Life Global Solutions. Yet the succession of a business to the next generation of owners can result in significant costs, some of which require substantial liquidity.

When a founder or partner dies, his or her beneficiaries may inherit a majority stake in the business, which can throw the ownership structure out of balance. Véronique warns: “This situation can threaten the stability of the business and, in some cases, deprive the other partner-owner of their control. The key to avoiding this is to ensure that the company has sufficient liquidity.”

Here are two common examples where liquidity is essential:

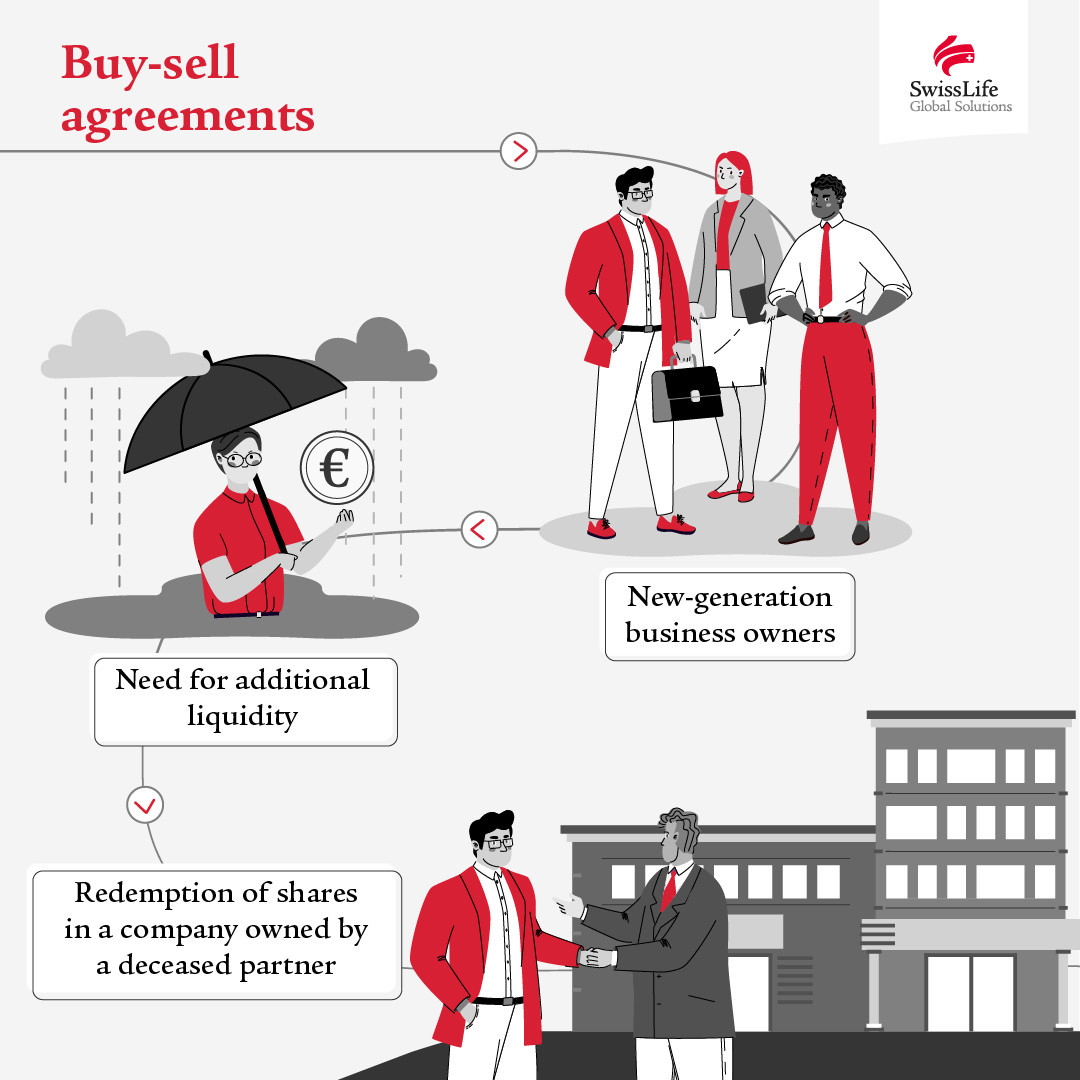

1. Buy-sell agreement:

“Imagine that a partner dies: the next generation of business owners may require additional liquidity and must be able to buy out the business shares quickly to prevent the situation getting out of hand,” explains Véronique.

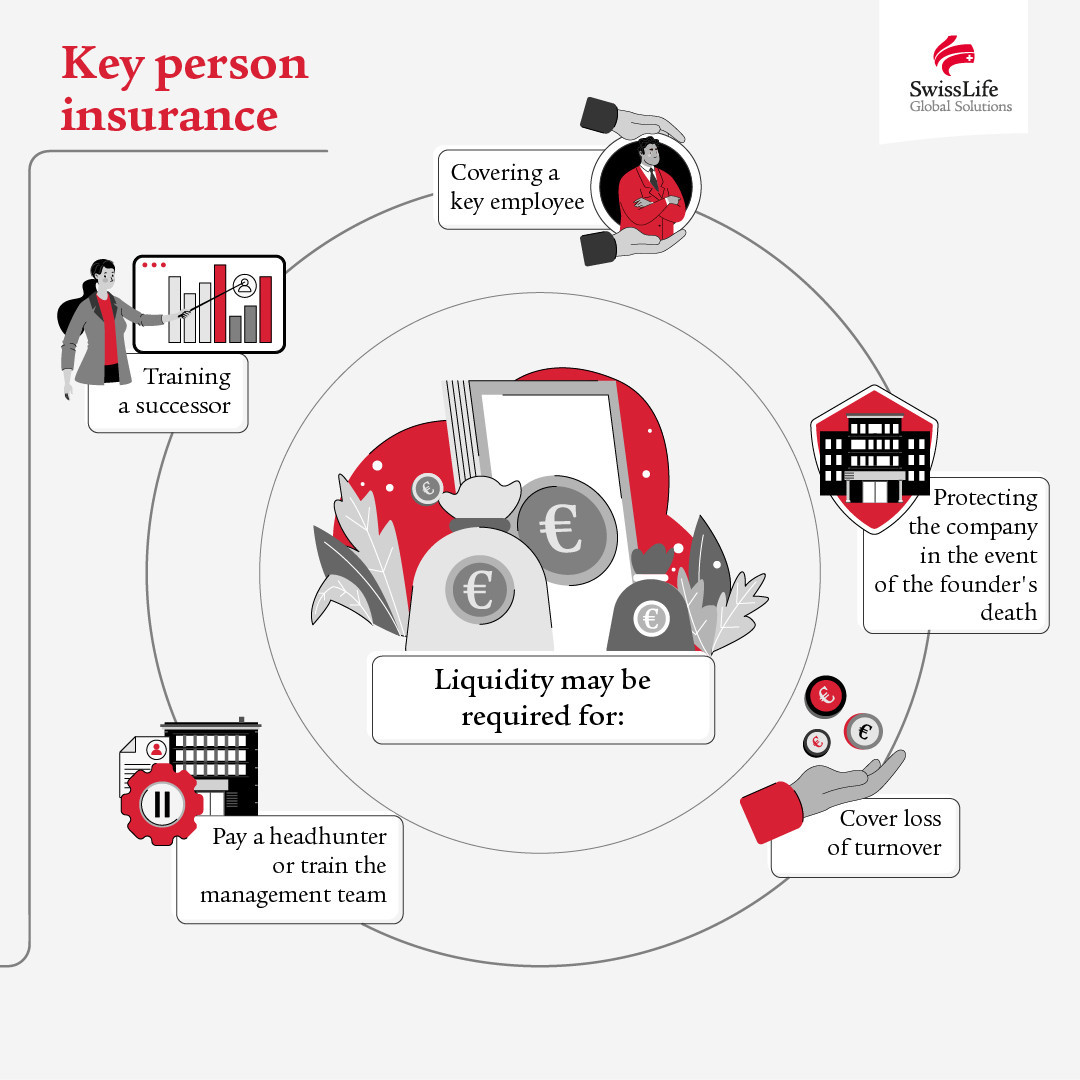

2. Key-man insurance:

“It’s not just about replacing a key person. Liquidity may also be required to cover the loss of a key employee, safeguard the business in the event of death, and address financial losses due to business interruption, as well as recruitment or training costs for a successor.”

These examples illustrate how disruptive the unplanned loss of a major shareholder can be if it has not been anticipated, the resulting damage can lead to litigation, strategic disharmony and preventable costs. Véronique adds: “A lack of liquidity can constrain a business owner’s ability to navigate unexpected challenges effectively, increasing the risk of conflict and hasty decisions”.

Generating liquidity empowers the next generation

Creating liquidity is an essential way to respond positively to unforeseen events, particularly the loss of key players. It allows businesses to negotiate buyout agreements and stabilise the business, ensuring the company continues to generate sustainable value for society, employees, and shareholders. “Too often, entrepreneurs feel torn between the financial security of their family and that of their business. But with the right planning and the generation of liquidity, both goals can be achieved.”

Liquidity generation must therefore be a priority for any company looking to hand over to the next generation in the best possible conditions.”

Failure to prepare for the unexpected can be a major risk factor.

Other significant risks for young businesses, which are often underestimated, include the departure of key people or the loss of a founding partner. “Take the example of a founding partner who holds a large equity stake in the company. In the event of the death of a founding partner, the remaining founder may face a shift in the ownership structure if they are unable to buy out the deceased’s family’s shares,” warns Véronique.

In this situation, liquidity can be used to buy out shares quickly and avoid a crisis. “Wealth planning,” she insists, “is not just about the financial future, it’s also about protecting the business and its employees.”

Creating flexibility through wealth planning

Wealth planning offers a variety of solutions to anticipate these challenges and help entrepreneurs plan with confidence.

We developed our tailor-made solution, Swiss Life Generations, precisely to meet the specific needs of entrepreneurs.”

This life insurance product provides essential financial support in the event of a founder’s death. “With Swiss Life Generations, co-founders can protect each other if one founder dies, while sole proprietors ensure that their family can retain the business running in a difficult time and use the liquidity to meet other obligations if the unexpected occurs,” she says.

Swiss Life Generations also offers further flexibility. “Entrepreneurs can designate and modify beneficiaries as their needs evolve, which is essential in an ever-changing world.”

With this unique combination of long-term financial security and short-term flexibility, Swiss Life Generations allows entrepreneurs to focus on developing their businesses.

Véronique concludes: “A well-planned business is not just a safety net. It’s also an important lever for planning the future with greater confidence and peace of mind.”