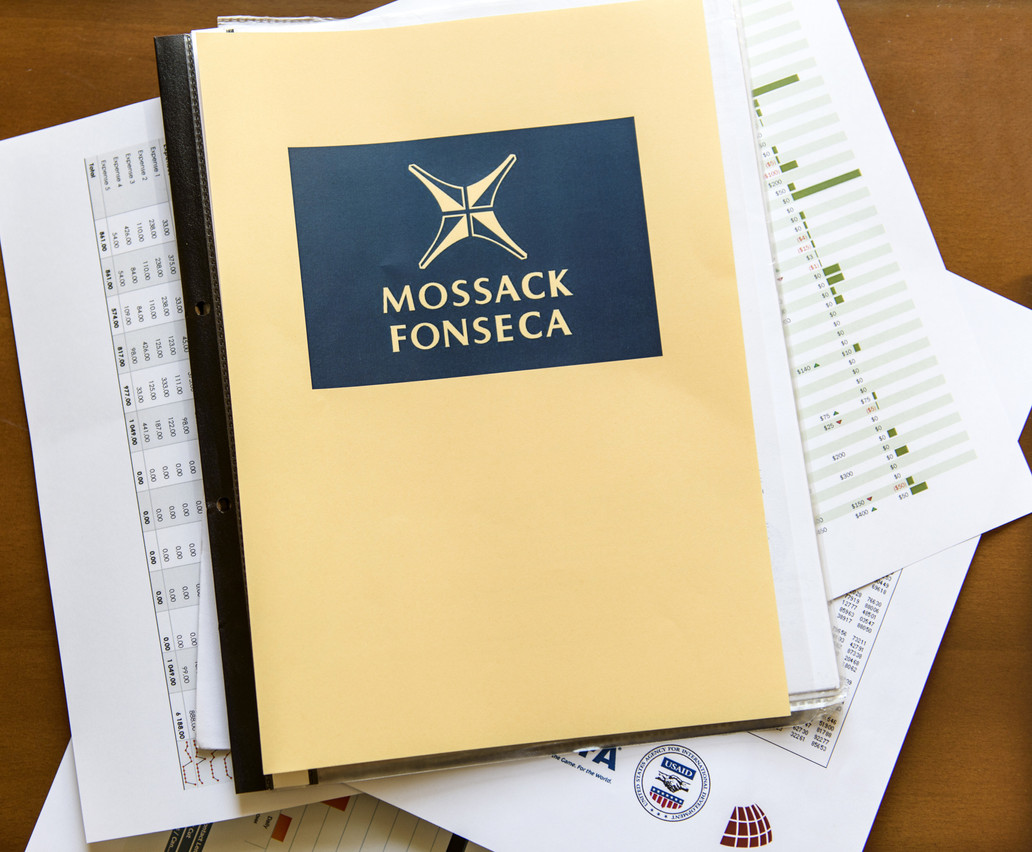

The full extent of offshore financial exploitation through Panama-based law firm Mossak Fonseca was laid bare following an investigation by an international consortium of journalists.

In all, 11.5 million encrypted confidential files were leaked, exposing a massive tax haven network involving global shell corporations set up by Mossack Fonseca and used for fraud, tax evasion and avoiding international sanctions. Among the documents were more than 10,000 companies connected to Luxembourg and the names of lawyers based in Luxembourg.

The Luxembourg tax administration tried to gain access to information on entities created through Mossack Fonseca. The lawyers resisted, citing professional secrecy. In September 2020, a tribunal sided with the lawyers, saying the authorities can only request information related to ongoing investigations or audits. It dismissed the request in relation to the Panama Papers, saying it did not meet either criterion.

On Tuesday 13 July, the the right of tax authorities to investigate third parties, in this instance the lawyers, in order to “initiate investigations on the basis of the general tax surveillance regime”.

It added, however, that in certain specific cases governed by the tax code, “the professional secrecy of lawyers who are approached as third parties in the context of a tax audit conducted by the tax authorities cannot be invoked.”

The court document reads: “the decision of the Director of the Direct Tax Administration of December 12, 2017 is not subject to annulment in its entirety, and states that the said decision is only subject to partial annulment insofar as it confirms the request to the respondent to provide the identities of all the foreign companies created in collaboration with the firm Mossack-Fonseca without limiting them to those whose economic beneficiaries are likely to be subject to taxation in Luxembourg.”

The court referred the case to the Director of the Administration des Contributions Directes for execution, and evenly split the costs of the two proceedings among the state, the respondent and the Ordre des avocats du barreau de Luxembourg.

The after German authorities provided a large number of documents linked to the scandal, including offshore company incorporation deeds, trust agreements, shareholder resolutions, emails and copies of passports.

In all of the cases, the Bar Association voluntarily intervened to support the lawyers who filed the appeals.

A finance ministry spokesperson told Delano on Monday that it was currently analysing the results.