From niche to necessity

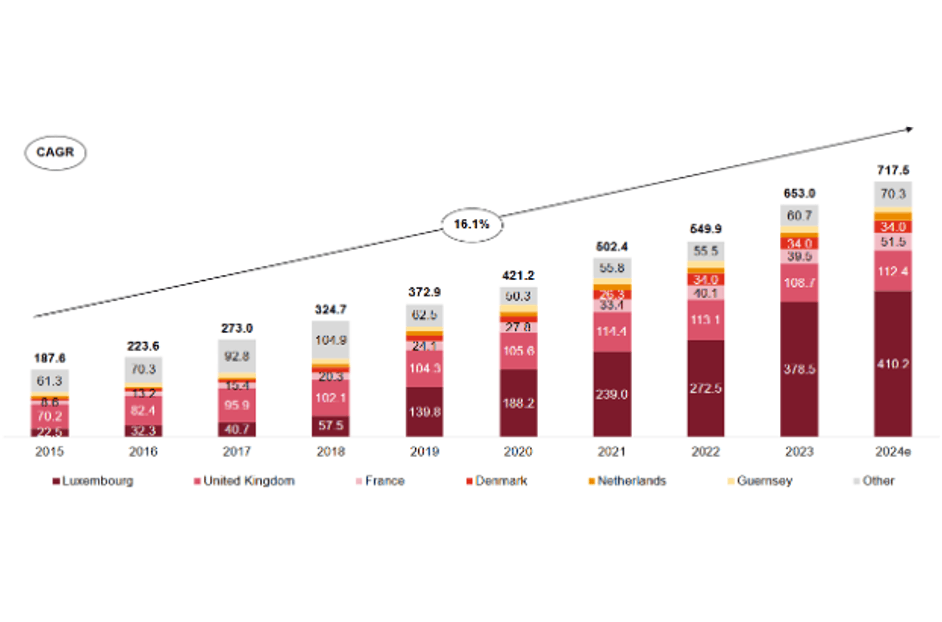

Two decades ago, infrastructure barely registered as an asset class, seen primarily as the domain of sovereign wealth funds and public-private partnerships. However, in the years since, infrastructure funds have exploded in size, with global assets under management (AuM) growing significantly. In Europe, the AuM of infrastructure funds surged from US$ 187.6bn in 2015 to an estimated US$ 717.5bn in 2024.

Figure 1. Global infrastructure funds AuM, by region (USD bn)

Data excludes Funds of Funds and Secondaries Source: PwC Global AWM & ESG Research Centre, Preqin, Monterey

Luxembourg has emerged as a key jurisdiction, capturing a sizable share of this growth. In fact, over half (57.1%) of European infrastructure AuM is held by funds domiciled in Luxembourg.

Figure 2. European infrastructure funds AuM, by domicile (USD bn)

Data excludes Funds of Funds and Secondaries. PwC Global AWM & ESG Research Centre, Preqin, Monterey

Financing twin catalysts

Today, infrastructure investing is mission critical. Its growth is driven by necessity, emerging from the seismic transformation of the global economy, with two catalysts fuelling its momentum—the energy transition and digitalisation.

Through the recently-launched Competitiveness Compass, the European Commission underscored energy security, decarbonisation, and grid modernisation as urgent priorities. In parallel, the Compass also identified the ‘innovation gap’ in the European economy as an area that must be addressed.

Be it the large renewable energy projects needed to decarbonise the economy, or the data centres needed for AI and cloud computing, infrastructure investments are at the core of this transformation. But governments alone cannot finance the large-scale investments needed. This is Luxembourg steps in.

Through the recently-launched Competitiveness Compass, the European Commission underscored energy security, decarbonisation, and grid modernisation as urgent priorities.

A regulatory and structural advantage

Luxembourg’s dominance in infrastructure investment is no accident—it is the result of deliberate policy choices, a strong regulatory foundation, and an investment-friendly ecosystem that has evolved in response to global market needs. The breadth of its fund structures effectively facilitates large-scale investments in infrastructure projects which require vehicles that can accommodate long investment horizons.

The Special Limited Partnership (SCSp) has transformed infrastructure investment by allowing tailor-made agreements with investors, ensuring a high degree of flexibility in structuring capital commitments. This flexibility is essential for sectors like renewable energy and digital infrastructure, where capital deployment must be spread across many years. Additionally, the SCSp provides a tax-efficient structure, making them particularly attractive to pension funds and sovereign wealth funds aiming to minimise tax leakage. Their unregulated nature further streamlines operations, eliminating administrative burdens and allowing fund managers to focus on investor-aligned agreements.

Similarly, the Reserved Alternative Investment Fund (RAIF) has transformed fund structuring for infrastructure investors by enabling rapid capital mobilisation without direct CSSF approval. Under the supervision of an authorised AIFM, RAIFs provide institutional oversight while allowing managers to seize time-sensitive opportunities—critical in energy transition and digital infrastructure. The absence of diversification constraints ensures capital can be channelled into high-impact projects, making RAIFs a strategic tool for scaling infrastructure investment with speed and efficiency.

As for investors seeking a regulated framework, the Specialised Investment Fund (SIF) and UCI Part II Funds provide a robust foundation for infrastructure financing, as does the ELTIF 2.0 which paves the way for the ‘democratisation’ of infrastructure investments. These structures allow fund managers to efficiently pool international capital and allocate it to large-scale projects across Europe.

For asset managers, the question is no longer whether infrastructure investment is the right play—it’s where to structure their funds to maximise impact and capitalise on emerging opportunities.

The future of infrastructure investing lies in Luxembourg

At a time when many hopes are pinned on the prospective Savings and Investments Union (SIU), Luxembourg presents a blueprint for what a successful SIU could look like in practice when it comes to infrastructure investments. As the Competitiveness Compass points to an economic transformation driven by innovation, decarbonisation, and security, infrastructure investment will be the foundation of this shift.

For asset managers, the question is no longer whether infrastructure investment is the right play—it’s where to structure their funds to maximise impact and capitalise on emerging opportunities. The answer is clear: Luxembourg is the place to be.