Third time’s a charm. After the and indexes, a third tranche takes effect in , announced Statec on Wednesday 30 August on the basis of provisional figures. (The consumer price index for August is due on 6 September, according to the statistics bureau’s publication schedule.)

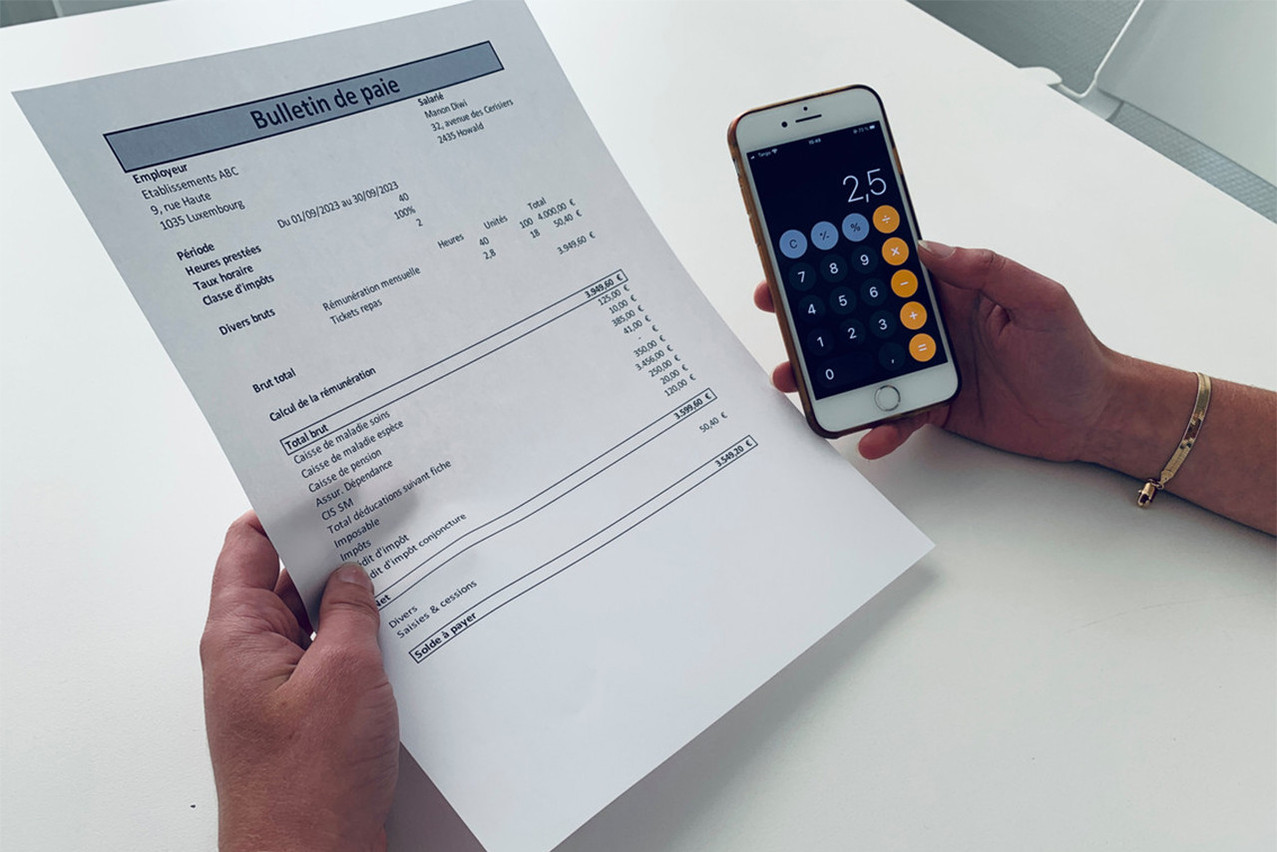

Under Luxembourg law, a round of indexation triggers automatic increases in salaries and pension payments to match rising inflation. September salaries will go up by 2.5% in Luxembourg, but the cost will be partially borne by the state--in 2024. --between employer and employee representatives and the government--signed last March provides for a reduction in the contribution rate paid by bosses to the Employers’ Mutual Insurance Scheme (Mutualité des employeurs).

No rate change for employers in September

In practice, this means that while employers will be paying more money to employees, they will be paying less to public social insurance schemes. However, the reduction will only take effect from January 2024, which means that companies will have to dig deep into their pockets from September onwards before seeing their contribution rate fall.

This time lag is explained by the fact that the contribution rate is set for a full year. However, the changeover to the new index bracket covers just four months of the year 2023. In practice, companies’ social security contributions will only be reduced from 1 January 2024.

Towards the end of the year.… employers will then know how much less they will have to pay in terms of contributions to the Employers’ Mutual Insurance Scheme throughout 2024.

“Towards the end of the year, the Mutualité will notify all employers individually of their class and rate of contributions. At that point, employers will then know how much less they will have to pay in terms of contributions to the Employers’ Mutual Insurance Scheme throughout 2024,” explained the chief advisor at the Ministry of Social Security, Abilio Fernandes Morais.

The measure provides for compensation by the state until January 2024 only. This means that from February 2024 onwards, the September 2023 indexation of salaries will be entirely at the expense of employers. Employers will simply have an adjusted contribution rate for the whole of 2024, in order to compensate for the months during which the state paid for the increase in salaries.

Read also

€340m bill

According to the bill, the monthly amount to be compensated by the state is €72.5m. For the period covered, that corresponds to €362.5m, but taking into account the amounts that the state recovers through various mechanisms such as the covid-19 isolation and quarantine reimbursement rate, for example, the figure rises to €340.6m.

The legislation stated: “The financial impact for each financial year, which will be borne entirely by the state and may be financed in different ways in order to smooth out the impact on the state’s cash flow, will be €310.5m in 2024, €23.6m in 2025 and €6.5m in 2026. However, as the state must recover an amount of approximately €40m through various mechanisms, the cost of this project will ultimately be €300.6m.”

Originally published in French by and adapted for Delano