Luxembourg prides itself on being a bridge between China and Europe: it’s a major centre for cross-border yuan business and investment flowing both ways. But in a tense macroeconomic and geopolitical context, . Where does that leave the grand duchy’s ambitions for development?

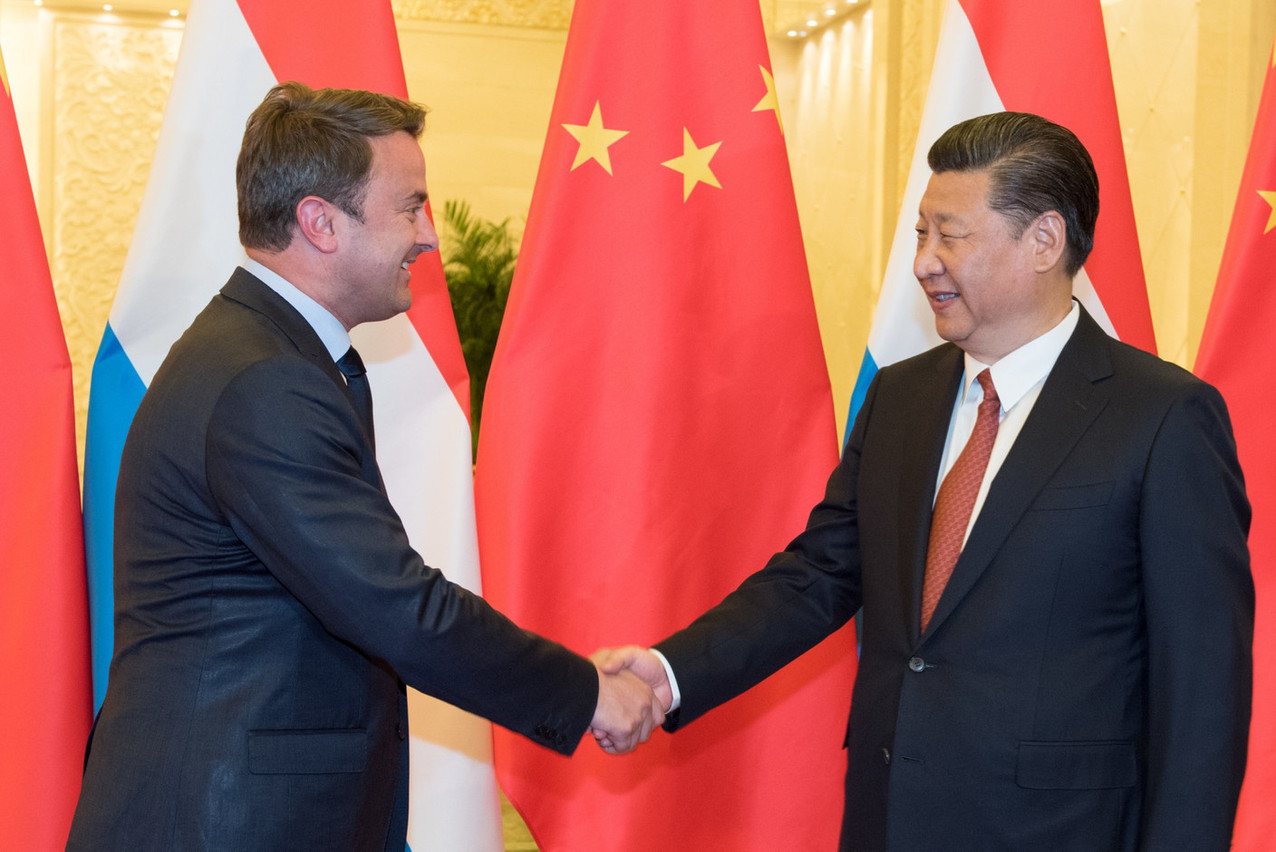

Politically, Luxembourg’s special relationship with China is not in question. The new government’s coalition agreement contains a paragraph on the subject that states: “Luxembourg will maintain good bilateral relations with China, consistent with our economic interests and our values, including human rights.”

The Association of the Luxembourg Fund Industry (Alfi) takes a similar view: “It is important to maintain dialogue and commercial relations with China, obviously taking into account the economic context, but also geopolitical tensions,” says outgoing director , adding: “Luxembourg was a pioneer in opening up access for international investors to Chinese financial products and allowing Ucits funds to be exposed to such products. But while the channels are open, we do not decide whether it is in the interest of investors--institutional or private--to be exposed to China or not.”

For Thommes, the Chinese market offers significant potential. Many international fund houses have set up in the country, notably to serve the local market: “There is a fairly strong demand for asset management products, given that Chinese households save around a third of their income. Fund houses are also looking to position themselves in the pension niche, where a recent reform has created opportunities."

We are still in the early stages of building our relationship with China.

At their peak in 2021, the assets of Luxembourg funds in China hit €126.9bn, a modest figure on the scale of the Luxembourg fund industry (over €5trn in assets under management) considering that China has the world’s second-largest economy. “It’s an emerging market,” comments , CEO of Luxembourg for Finance.

“We are still in the early stages of building our relationship with China,” he adds. “We have been very successful in attracting seven Chinese banks to Luxembourg. Now we need to expand their activities: investment funds, in particular, offer great potential for them.”

Four of these seven banks have set up in Luxembourg within the last decade, and are themselves also contributing to development: although they mainly offer corporate banking services (trade finance, cash management, syndicated loans) and yuan services, they have also developed capital market activities in Europe, as well as asset and wealth management. Bank of China has been present in Luxembourg since 1979, and is now one of the few banks to offer investment banking services.

The activities of Chinese banks in Luxembourg can continue to grow.

Fabio Regis, director of Bank of China Europe’s asset management centre, believes that “the activities of Chinese banks in Luxembourg can continue to grow by moving up the value chain.” In an interview with Delano’s sister publication Paperjam, Regis calls the presence of seven Chinese banks “a decisive factor” in attracting other companies and businesses from China--like giants Alipay and China Union Pay, based in Luxembourg and around which a veritable payments ecosystem could develop.

Another target: sustainable finance. “We need to develop more ESG architecture in Luxembourg, data centres and technical, legal and financial advice dedicated to China,” says Regis. The financial centre could capitalise on the Green Bond Channel, an information platform created by the Luxembourg, Shanghai and Shenzhen stock exchanges. On the gigantic Chinese bond market, green bond issues exceed $55bn. In 2022--against the global trend--they increased by 50%.

This article in Paperjam. It has been translated and edited for Delano.