The BCL replaced the Institut monétaire luxembourgeois

In 1992, the Maastricht Treaty required all member states adopting the euro to have their own central bank to define their monetary policies with the European Central Bank.

At the time, Luxembourg did not have its own central bank, but only an Institut monétaire luxembourgeois (IML). A law passed on 22 April 1998 stipulated that the IML would become Luxembourg’s central bank once the European System of Central Banks was in place.

The BCL owns part of the European Central Bank (ECB)

Together, the central banks of the European Union (EU) countries “own” the ECB, since they each hold a share of its capital. The BCL therefore holds and manages part of the ECB’s foreign exchange reserves in gold and foreign currencies.

Christine Lagarde, president of the ECB since 2019, and Gaston Reinesch, governor of the BCL. Photo: BCL

Every five years, each country makes a financial contribution to the ECB based on the size of its population. The amount of this contribution is determined by the capital key allocated to the country. For the BCL, the key is 0.2679%, representing paid-up capital of €29,000,193.94.

The BCL is threefold independent

The BCL’s independence is provided for by the Treaty on the Functioning of the European Union (TFEU) and by Luxembourg law, in order to protect it from potential political influence. It is institutional, operational, financial and personal.

Institutional, because the members of its governing bodies must neither seek nor accept instructions from third party institutions or bodies--European or national--or from national governments. Operational and financial, so that it can equip itself with sufficient technical and financial resources to enable it to carry out its missions. Personal, with regard to its governor (currently Gaston Reinesch), in his personal capacity as a member of the governing council of the ECB. This independence takes the form of a renewable six-year term of office.

In return for this independence, central banks have a duty of accountability and transparency towards the public and elected representatives.

The BCL’s capital amounts to €175m

The Luxembourg state is the sole owner of the BCL’s capital, which currently stands at €175m. Initially, on 31 December 1998, it stood at €25m, but was increased on 1 June 2009 to €150m by incorporation of reserves. “This is a very small amount for a central bank with a balance sheet of some €330bn,” says the BCL.

The members of the BCL’s governing bodies are chosen by the government

The two statutory bodies of the BCL are the board, its highest executive authority, and the council. The members of these two bodies are appointed for renewable six-year terms.

The BCL Board is made up of Nicolas Weber, director, Gaston Reinesch, general manager (or governor) and Roland Weyland, also a director. Photo: Olivier Minaire Photography

The three members of the management: the director general (or governor) and the two directors are appointed by the Grand Duke on the recommendation of the government in council. To date, they are (who is serving his second term), and respectively.

The council is made up of nine members: the three members of the management board mentioned above and six other members appointed by the government in council. These are currently , , , , Claude Wirion and .

The BCL implements the monetary policy of the eurozone in Luxembourg, but not only that

The BCL is obviously involved in implementing the tasks of the European System of Central Banks, which consist of defining and implementing European monetary policy, conducting foreign exchange operations, holding and managing the country's official foreign exchange reserves and promoting the smooth operation of payment systems.

But it also carries out other tasks. For example, it produces banknotes and coins, as well as numismatic products dedicated to Luxembourg's culture, history and heritage.

This 925 silver and Nordic gold coin is dedicated to the fight against the extinction of beech forests in Luxembourg, caused by global warming. In particular, they are home to the bois-joli, the shrub featured on the coin. The coin has a face value of €5 and a retail price of €50. There are 3,000 of them in circulation. Visual: BCL

It also contributes to research and micro and macro prudential supervision, as well as compiling monetary and financial statistics.

The BCL supplies banks with banknotes and coins

All commercial banks established in Luxembourg must open an account with the BCL. The BCL supplies them with the euro notes and coins that their customers need. It also withdraws notes and coins that are damaged or unfit for circulation.

The BCL is also the competent authority for combating counterfeiting of euro banknotes and coins in Luxembourg.

Since its creation, BCL staff numbers have increased by 118%

In 1998, the BCL had 211 employees. By 31 May 2023, it had 460. This development is without equivalent in the eurosystem--which groups together the European Central Bank and the national central banks of the member states of the EU that have adopted the euro--according to the BCL.

Of the 460 people who work at the BCL, 159 are women and 301 are men. They have an average age of 44 and represent 25 nationalities. “The BCL has taken on staff with a variety of statuses and nationalities, thereby enriching the diversity of its human capital,” says a press release.

The BCL has created a university chair at the Toulouse School of Economics

As part of its involvement in academic research and studies, the BCL has set up a chair entitled “Aggregate Stability and Central Banks” at the Toulouse School of Economics, with the aim of promoting high-level research into central banking issues.

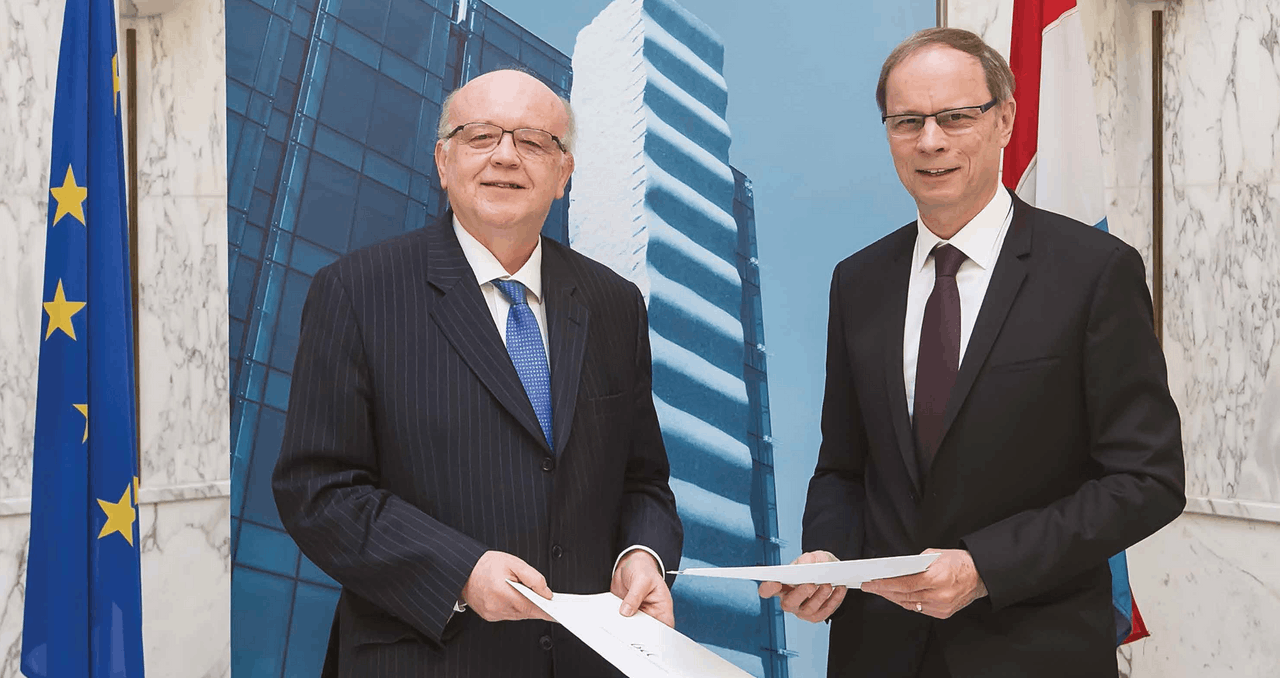

Gaston Reinesch, governor of the BCL, and Jean Tirole, president of the TSE and winner of the 2014 Nobel Prize in Economics, signed a cooperation agreement and began work on setting up the chair in 2015. Photo: BCL

Funded by the BCL, its activities began in September 2022. It will be led by professors Jean Tirole (winner of the 2014 Nobel Prize in Economics) and Patrick Fève, and set up for a period of five years.

The BCL is committed to education and debate

Since 2013, the BCL has been organising the Generation €uro Students Award competition in Luxembourg, which is aimed at secondary school students aged 16 to 19--more specifically, second year students in mainstream and general education studying economics. The prize for the three finalist teams is internships at the BCL and a two-day visit to the ECB in Frankfurt.

The BCL also regularly opens its doors to visitors wishing to find out more about the bank’s European and national missions, its buildings and the history of Luxembourg’s currency. This is also an opportunity for the bank to talk to the general public.

Finally, the BCL has indicated that it intends to consult civil society organisations more frequently, as it did during the series of listening events organised in 2020 and 2021.

This story was first published in French on . It has been translated and edited for Delano.