“We see the metaverse as the next leap forward in global communication and connectivity. It has the potential to revolutionise many sectors and processes, and reshape all facets of society, the way we work, consume, interact and produce.” In early December, Omar Moufti, product strategist for thematic and sector ETFs at BlackRock, formalised the arrival of this investment heavyweight on the metaverse ETF market. It is the sixth in Europe.

“The metaverse is an immersive virtual world built on established elements of gaming, virtual reality (VR) and augmented reality (AR). At this stage, it’s a lot like the internet of the early 1990s or the smartphone of the early 2000s: we expect it to be big and very likely to change people’s daily lives. But we don’t yet know exactly how, or how big the change will be,” acknowledged Reid Menge of the BlackRock Technology Equity Team back in February.

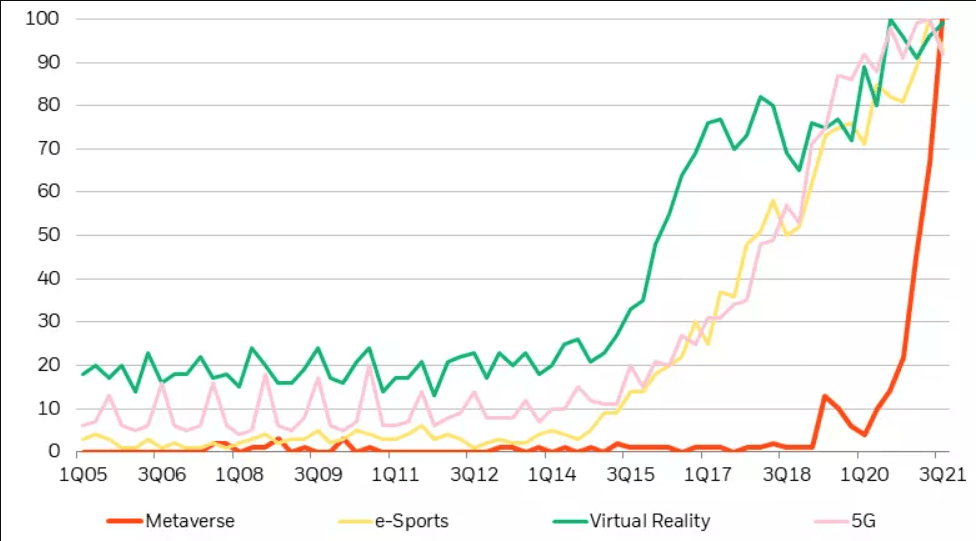

The chart shows the speed at which mentions of certain technology themes in the transcripts of global companies have reached a ‘peak of interest’. A value of 100 corresponds to the peak of popularity of a term. (Source: JP Morgan 2021)

The analyst was already predicting the arrival, at the beginning of 2023, of new generations of augmented reality glasses, likely to democratise these virtual worlds. Of the projects often announced by Apple, Google or Microsoft, only the first is still planned for 2023. The Iris Project seems to be set for 2024 and Microsoft, which has won a multi-billion dollar contract with the American army, is facing criticism from the military.

Why start by talking about augmented reality glasses (or headsets)? For two good reasons. First, in another BlackRock report from May, the analysts are clear: “The screen is the limit.” The screen is the current limit to the adoption of certain technologies. So is the price to get equipped and go have fun in one of the 200 metaverses that exist.

A “first division” with eight companies

But also because those who are at the forefront of this issue--Meta, Apple, Google and Microsoft--are also the favourite stocks of the investment companies that are getting into the metaverse.

Alongside BlackRock’s Euronext-listed iShares Metaverse (MTAV), we also looked at companies in the basket of Fidelity (Fidelity Metaverse ACC-USD), Franklin (Franklin Metaverse), HAN ETC (HANetf ETC Group Global Metaverse) and Roundhill (Roundhill Ball Metaverse).

From this benchmark, which is neither exhaustive nor objective, it emerges that the five investment firms have all bet on eight companies, Google, Apple, Meta... and a quintet formed by Electronic Arts (video games), Nvidia (processors and graphics cards), Take Two (video games), Unity Software (software) and Snap (social networking).

But Snap? The same Snap whose CEO, Evan Spiegel, didn’t hesitate to poke fun at Meta’s CEO , explaining, “The metaverse is ‘living inside a computer.’ The last thing I want to do when I get home from work on a long day is live inside a computer!” The same.

The same one that decided, in 2021, to go for instead of virtual reality products, the difference being that AR adds something to a universe that exists when VR takes to a digital universe. On this point, Snap joins Apple CEO Tim Cook in advising his teams not to use the word “metaverse”, which “nobody understands”.

Roblox, the smart metaverse

Behind this first division of technology players, nine others were selected by at least four investment firms: Activision, Adobe, Advanced Micro, Amazon, Coinbase, Microsoft, Nintendo, PTC and Roblox.

Amongst these fairly well-known players, Roblox, one of the first players to cut its teeth in the metaverse, should be mentioned. For its 50 million monthly players, the platform has deliberately left AR-VR issues aside to focus on the user experience with success. Whether it is games, shopping, events, partnerships (with Spotify, Gucci, Nike, BBC, Netflix or Lego), .

Another player has taken an even different gamble: PTC wants to develop the industry’s metaverse by combining the advantages of 3D with the internet of things. “The metaverse brings the physical and digital worlds together, allowing people and objects to collaborate more intuitively with complex systems, in person or remotely,” explains Steve Dertien, chief technology officer at PTC. “The metaverse, as a 3D interface for the IoT, will make the physical and digital indistinguishable, and therefore increase our human ability to make more informed decisions with minimal mental energy and training.”

Alibaba, Sea, Krafton: when Asia is already gone

Ten companies are integrated at least three times: Autodesk, Bentley Systems, Block, Intel, Matterport, Naver, NetEase, PayPal, Sony and Tencent.

And 19 companies are included at least twice: Accenture, Alibaba, Capcom, Cloudflare, Colopl, Dassault Systèmes, Galaxy Digital, Gree, Hexagon, Mastercard, Nemetschek, Nike, Overstock.com, Robinhood, Samsung Electronics, Sea, Taiwan Semiconductor Manufacturing, Visa and Vuzix.

That leaves 222 companies that allow each fund to differentiate itself from its neighbour. But not only that. Because within each fund, each company has a different weighting. It is then possible to look at the choices of the investment companies differently.

Let’s take the top ten companies in each of the five ETFs and remove the most popular technology players, our top three divisions (27 companies). Who are in the top five?

- Dassault Systèmes and Mastercard in BlackRock;

- Dassault Systèmes at Fidelity;

- Accenture and Qualcomm at Franklin;

- Qualcomm, Sea and Alibaba at Han;

- Samsung Electronics, Krafton and Alibaba at Roundhill.

Eight companies in total and as many heavyweights. Three of which are Asian and should be followed closely.

1. Alibaba took advantage of Singles’ Day on 11 November to unveil new metaverse features to its shopping platform, with extended reality (XR), virtual influencers and augmented reality. But the Chinese giant is also pushing into the luxury sector with its special platform, the Tmall Luxury Pavilion, where, this year, avatars were given special “tokens” giving them preview access to luxury products... and all the world’s luxury brands wanted to be part of the adventure.

2. Korean video game developer Krafton, which raised €18bn on the stock market this summer, is the company that launched--according to many media reports--the first virtual CEO, Ana. In reality, this is a supporting artificial intelligence, capable of providing informed advice to a real CEO by swallowing all the data. This is already a great technological feat, but it needs to go much further to become a sort of autonomous guide to the metaverse for all those who get lost in it.

3. The New York-listed Singaporean group Sea Limited is the boldest bet: in one year, the stock has lost nearly 80% of its value, inviting investors like Tiger and Tencent to reduce their exposure. Embroiled in the FTX fiasco, the group has invested via its investment subsidiary in a few projects to follow, including Refract’s AXIS (a 8.5 million investment). This video game motion capture technology could take the experience to the next level.

One lesson

So far, with the setbacks of Meta and a few heavyweight players, these ETFs will have only one merit: to reinforce the idea that the metaverse will eventually take hold in different sectors, whether in the office to improve the experience of meetings or project collaborations, in the industrial or medical sector, or in the training sector.

The size of the metaverse market will be over $100bn by 2022 and is expected to reach $1.5trn by 2029. Already twice the size of 2021 in 2022, funding rounds for projects in the metaverse should pick up again if the crypto tech winter doesn’t last too long, Fortune predicts.

2021 was the year of the metaverse buzz. 2022 was the year of the massive arrival of financiers. But what will 2023 be the year of?

This story was first published in French on . It has been translated and edited for Delano.