Digital progress has changed international competitiveness and the division of labour, according to Dr Thieß Petersen, senior advisor at Bertelsmann Stiftung. Digital technologies are being used more in production, meaning that developing and emerging countries lose their key competitive advantage--cheap labour. This also leads to companies bringing business back to their original country, a process called reshoring.

But is this also the case for Luxembourg? Not necessarily, said Petersen. The smaller the country is, the more problems it has with reshoring. It might not have all the necessary industries or raw materials at home. Nearshoring, however, could be a solution. Instead of re-locating business from Asia to Luxembourg, companies might shift business to eastern Europe or Germany, for example.

Camille Fohl, chairman of Spuerkeess’s board of directors, pointed out that about 20% of Luxembourg’s trade is with Germany. So if a bigger country like Germany is reshoring, then this will indirectly have an impact on Luxembourg.

What are some reasons for reshoring?

Before the covid pandemic and Russia’s war in Ukraine, reasons for reshoring included quality deficits of foreign locations, long transport times and rising transport costs, and rising labour costs in Asia. These reasons still hold, noted Petersen. In particular, transport costs are likely to keep growing, contributing to increased costs.

Read also

However, there are also “newer” reasons for reshoring, such as the desire to reduce the risk of supply chain disruptions and to reduce dependency on imports. In this manner, countries can also avoid “political blackmailing.” For example, Germany’s dependence on Russian gas is now a disaster for the economy, said Petersen. Due to the lack of imports, the prices for energy are rising sharply, leading to increased inflation rates.

This is also observed in Luxembourg. The International Energy Agency (IEA) that Luxembourg’s energy system depends on importing fossil fuels--in 2018, 95% of the grand duchy’s energy supply was imported.

How will the energy crisis affect the green transition?

Reshoring and nearshoring--bringing business closer to home--will also play a role in the green transition. The energy crisis provides new, additional incentive to use renewable energies and reduce our dependencies on fossil fuel imports, declared Petersen.

In the short run, however, it is necessary to look for alternative fossil energies as building up the infrastructure for renewable energy takes time, he added. But in the medium and long run, it will be an incentive for companies and consumers to increase their investment in green technologies.

Read also

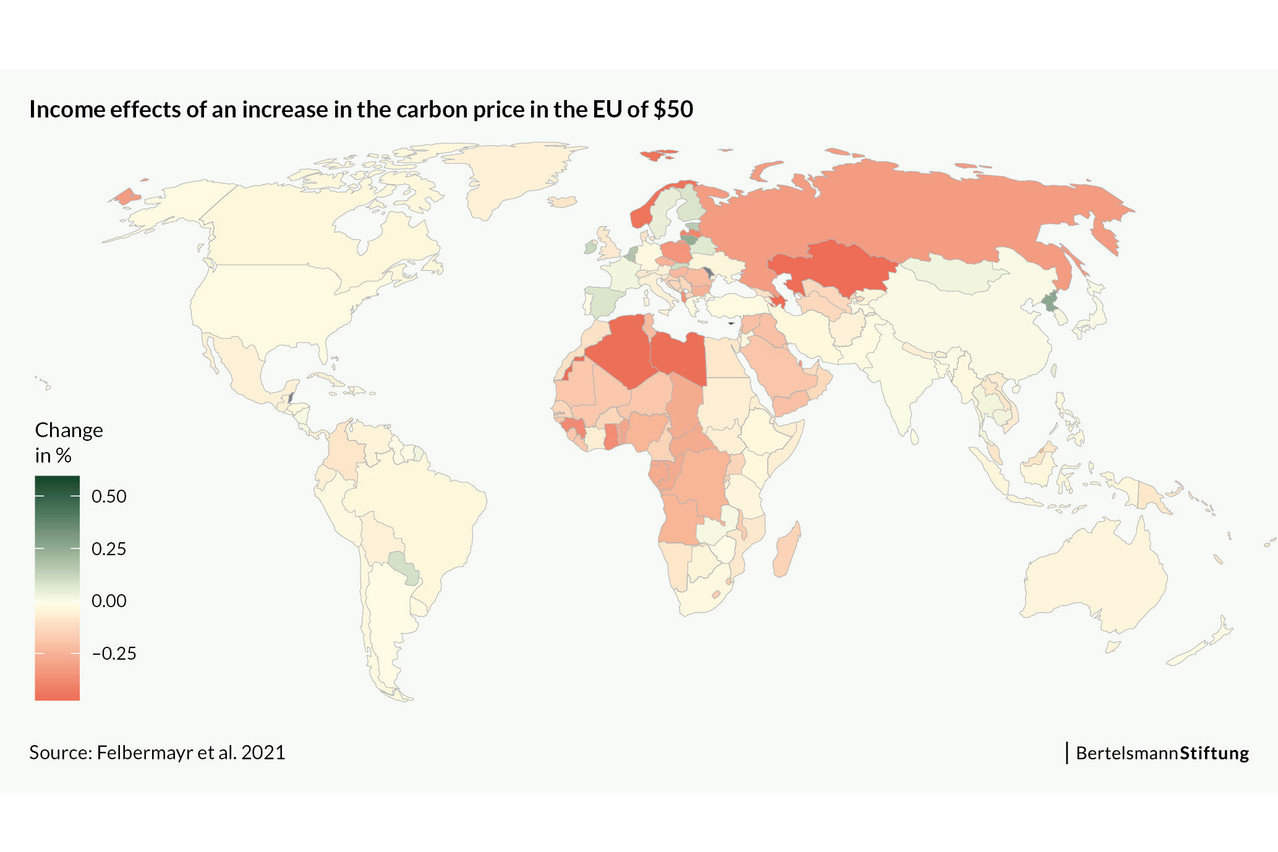

Petersen also used a model to simulate how an increase of the carbon price in the EU by $50 (compared to 2014 prices) would affect income. The simulation showed that there would be GDP losses for economies that rely on fossil fuels (particularly in eastern European countries like Poland and Hungary) and for countries exporting fossil fuels to the EU (like Norway and Qatar). But countries with a large service sector, such as Ireland, Belgium or Cyprus would see GDP gains.

According to the simulation, countries that export or rely on fossil fuels would see GDP losses, while those that have already have a high carbon price or have a large service sector would experience gains. Felbermayr et al. 2021

So one might expect Luxembourg, a small country with a large service sector, to also see GDP gains. But according to this model, Luxembourg would instead experience a slight reduction in its GDP. This is probably due to the fact that the country has some energy-intensive sectors, Petersen explained. Indeed, according to a published by the IEA on Luxembourg’s energy policy, the iron and steel industry accounted for 46% of industrial energy consumption (2017 figures). The manufacturing of iron and steel uses mainly electricity and natural gas.

Food for thought

Petersen’s presentation on the future of globalisation was part of a series organised by the Spuerkeess. Circuit Foil CEO and Cargolux CFO Maxim Strauss also participated in the 25 October event.

These breakfast panels with experts provide a platform to exchange ideas and generate food for thought. It benefits both the state bank and the companies who attend, said Superkeess chairman Fohl--it gives Luxembourgish companies the opportunity to discuss upcoming trends, but it also helps the Spuerkeess serve the economic and social development of the country. The panels are a dynamic way to create awareness around new topics, anticipate changes and contribute to the development of the economy.

Camille Fohl, chairman of Spuerkeess’s board of directors, highlighted the utility of the series of breakfast panels in creating awareness around new trends. Matic Zorman / Maison Moderne