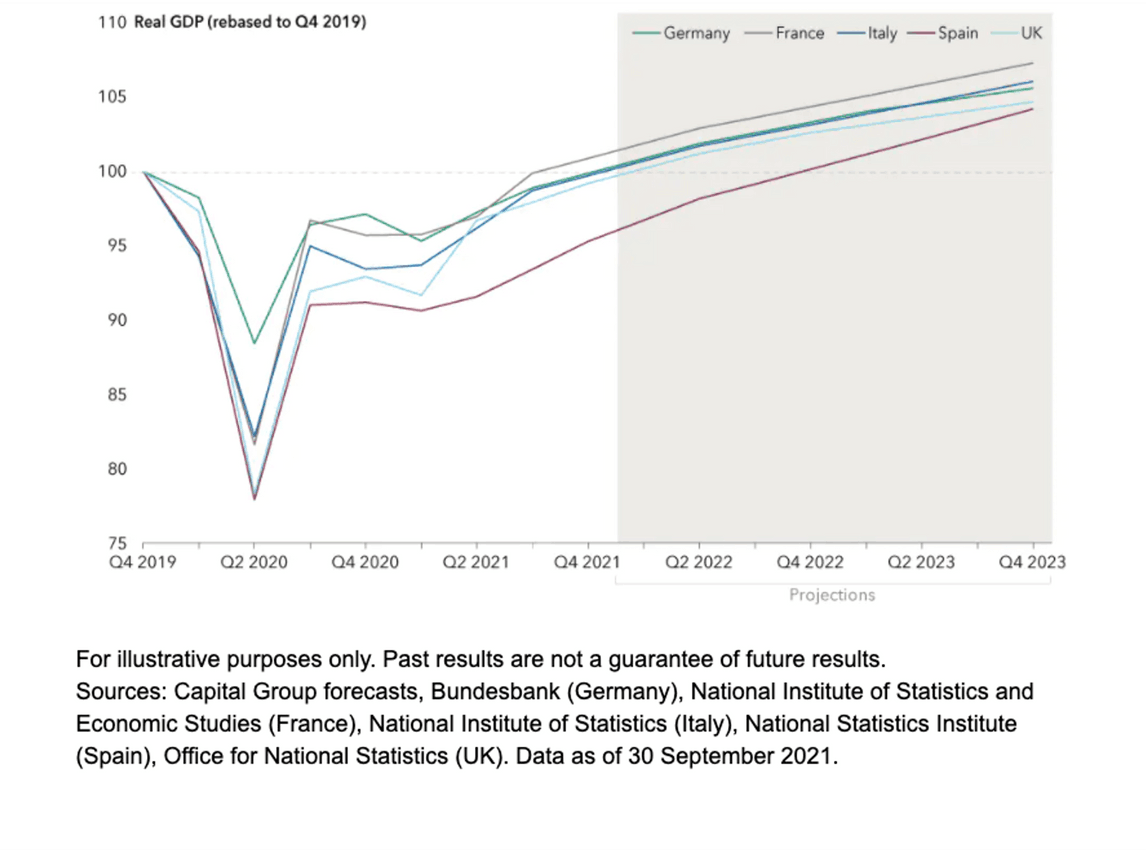

As its economies opened up again, Europe saw strong growth over the last two quarters of 2021. In 2022, this trend looks set to continue, with Europe expected to post GDP growth rate of 4% to 5% – particularly in Germany, France, Italy, Spain and the UK.

Higher investment, a positive sign

“Most of the major European economies are growing strongly,” Lind explains, “driven by surging demand, improving consumer sentiment and booming industrial activity.” Since the pandemic began, consumers have cut back on household spending and businesses have scaled back their investments. Today, the situation appears to be improving.

Real GDP forecasts for major European economies show an encouraging recovery Capital Group forecasts, Bundesbank (Germany), National Institute of Statistics and Economic Studies (France), National Institute of Statistics (Italy), National Statistics Institute (Spain), Office for National Statistics (UK). Data as of 30 September 2021.

Interested in learning more? Further data and analysis by Robert Lind, Economist at Capital Group, is available

Continued monetary and fiscal support is another positive sign. The EU Recovery Fund should boost and encourage public investment in areas such as the green transition, the modernization of public infrastructure and digital transformation. “This fund, which was set up in 2020, is going to be a very significant contributor to European growth over the next five years, and represents a sustained commitment by European leaders to support their economies.”

This fund is going to be a very significant contributor to European growth over the next five years

These stimulus measures are likely to spur domestic demand. Household saving rates are higher than their pre-pandemic levels, which may help shield consumers from possible income shocks. According to a European Commission survey, companies are planning to increase their investment spending to address supply bottlenecks and meet robust demand.

Potential threats to growth

But growth is not a foregone conclusion. Three areas of uncertainty could cause major volatility in European equities.

1. The course of the pandemic: The emergence of the Omicron variant and high infection rates have intensified concerns around another wave of the coronavirus pandemic. Many European countries are tightening measures to combat the virus, including extending lockdowns, imposing mask requirements and mandating vaccines. While such restrictions could weigh on activity in the near term, economies should rebound once the pandemic recedes again.

2. Higher inflation: In 2021, inflation rates soared in Europe. In the major economies, consumer price index inflation is now above 2% targets. Central bankers initially assumed this rise in inflation would be transitory, but are now starting to worry the inflation jump could be more persistent due to the longer-than-expected disruption in global supply chains (for materials, equipment and labor). Companies may raise their selling prices in response, which could add to inflationary pressure. Tighter restrictions could in turn aggravate the supply problems.

Markets are anxiously awaiting the response from central banks. If the risk of inflation continues to grow, the ECB may be required to raise interest rates.

3. Political uncertainty: Some countries are likely to see heightened political uncertainty this year. In France for example, the presidential and legislative elections could trigger some tension, and the president’s approval ratings may fall due to the impact of the pandemic on the economy and the health system.

The recently formed German government under Olaf Scholz will face some significant challenges this year. The country will have to consider when to reinstate its domestic debt brake and its approach to changes in the EU’s fiscal rules.

Lastly, the UK and its Prime Minister Boris Johnson will have to tackle a number of thorny issues, including whether to unilaterally suspend the post-Brexit Northern Ireland protocol and how to manage strained relations with the EU.

Smoother sailing ahead

Despite these uncertainties, Lind says, “There could be modest positive returns in European equity markets in 2022.” Over the last few years, equity risk premiums have indeed remained higher in the major European markets than in the US. Sizeable risk premiums in European equities should therefore provide some insulation from any threats that may arise in other regions or continents.

Earnings estimates are now increasing strongly in the EU and the UK across a range of industries (including financials, energy and materials). As earnings recover, these equity markets have the potential to outpace other markets.

Interested in finding out more? !