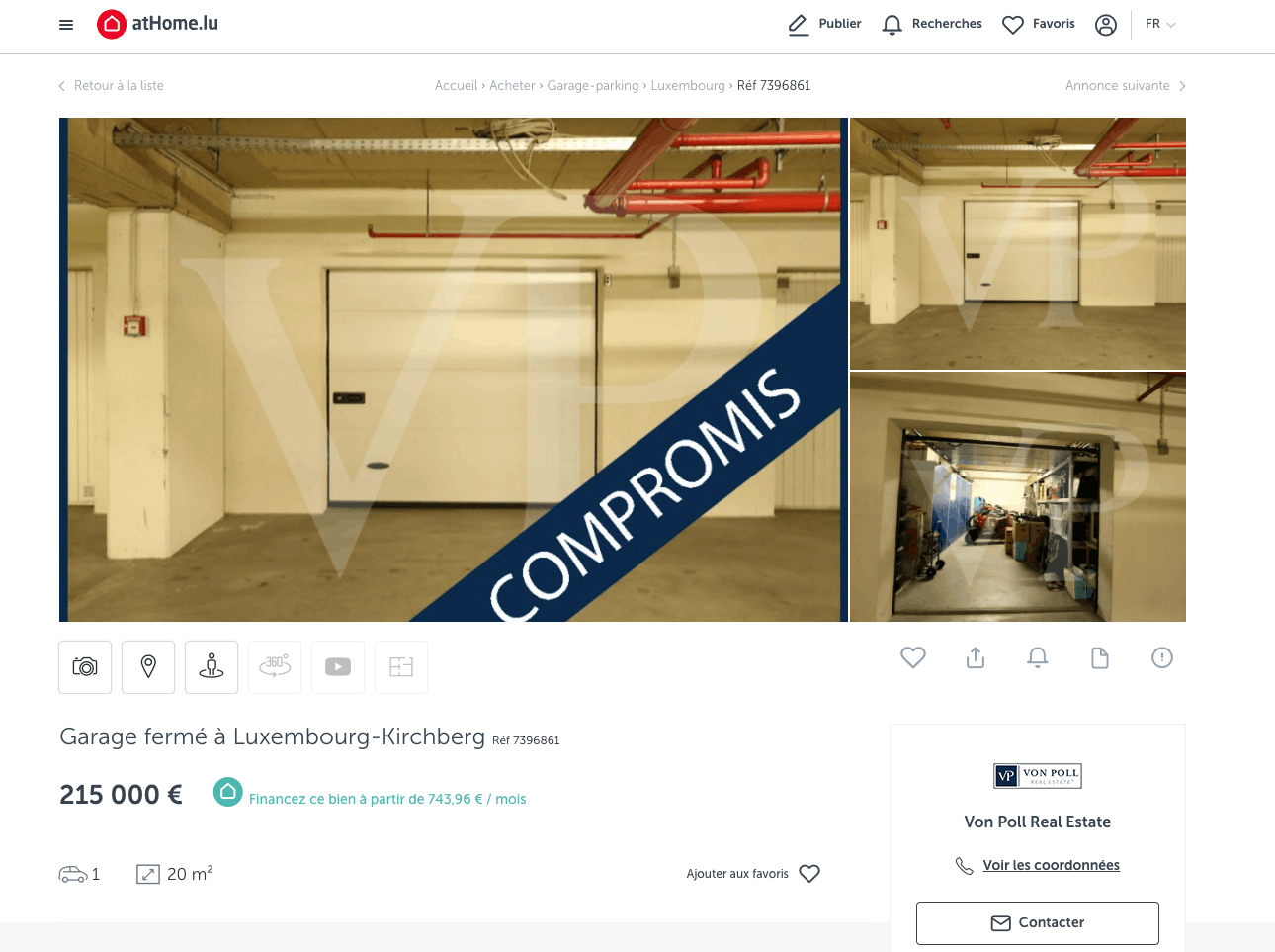

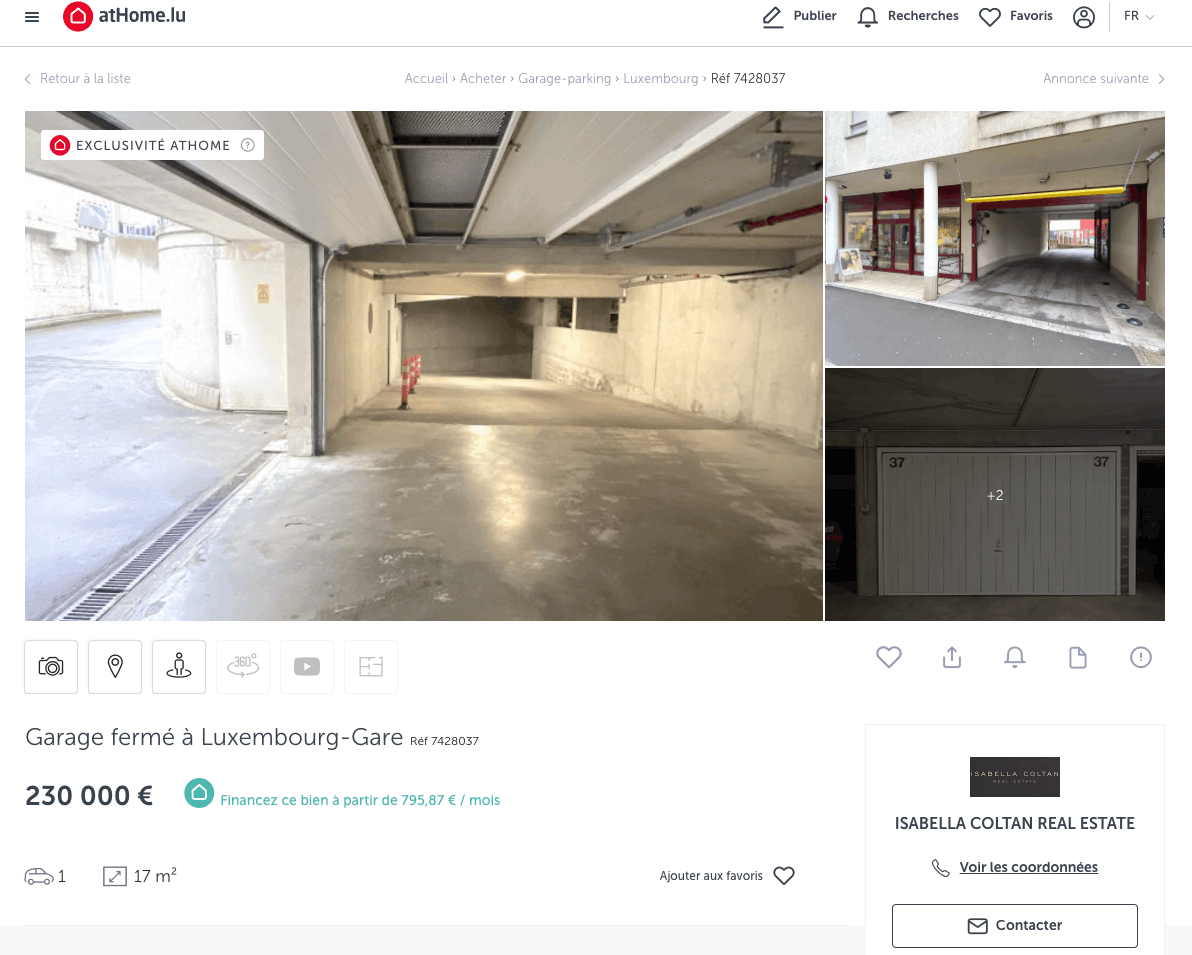

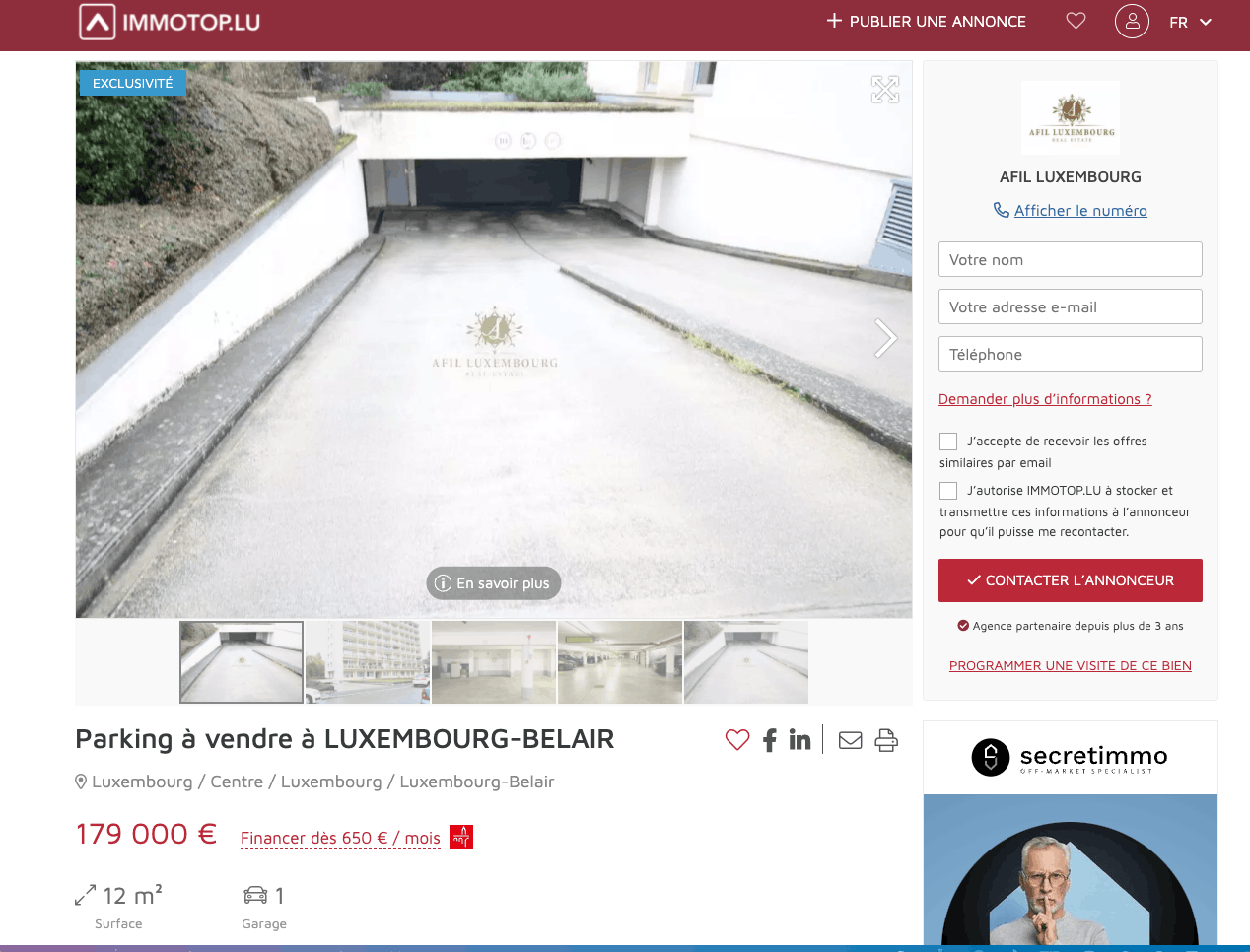

A 12m2 covered parking space for €179,000 in Luxembourg-Belair, a 17m2 closed garage for €230,000 in the Gare district or a 20m2 garage for €215,000 in Kirchberg... As with real estate, the prices of parking spaces can sometimes reach exorbitant amounts. However, other advertisements show slightly more moderate prices, between €50,000 and €150,000 per space.

A median price of €3,193 per m2 in 2021

As is the case for houses and land, these square metre prices increase in value every year. According to Immotop data, the median sale price of a garage/parking space in Luxembourg in 2019 was €40,707. The following year it was €44,197 and in 2021 it rose to €56,625. The median size of a parking space has also increased, from 16.99 to 20.7m2. The price increase is confirmed by looking at the median price per square metre: €2,174 in 2019, €2,380 in 2020 and €3,193 in 2021. This is of course far below the median square metre price of houses and flats, which was €9,558 in the fourth quarter of 2021 on Immotop.lu.

But like residential property, the cost of parking spaces also explodes the closer it is to the capital. The median price per m2 was €84,000 in 2021 on Immotop.lu in Luxembourg City. It rises to €84,500 in the Gare district and to €89,000 in Bonnevoie.

Prices are rising while supply is falling: the number of parking/garage ads fell by 13.25% between 2019 and 2020, then by 24.65% between 2020 and 2021. The majority of ads, 78.86% at the beginning of 2022, are for rental. "One of the most profitable activities,” according to the real estate website. The average rent is €150 a month for a basic location and €250 for an enclosed private garage.

A wide dispersion

"The evolution of prices has at least followed that of housing," admits Julien Licheron, researcher at the Luxembourg Institute of Socio-Economic Research (Liser). According to him, housing prices have risen "on average by 6% per year since 2010". This compares with +9% and +34% over the last two years if we look at the median price of parking spaces at Immotop, even if we are not comparing the same data.

The researcher says he is surprised by both the "very high prices: we are talking about an average of 15m2 for €100,000 in Luxembourg City”, and their "distribution, with [some] spaces at €50,000 and others at €200,000" in the same geographical area. This can be explained by the coexistence of two types of sellers: private individuals who do not need their space and are perhaps not aware of the market, and investors. He notes that there are sales of lots of several spaces in the same residence on the one hand, and individual spaces on the other.

"I wouldn't be surprised if a parking space was more profitable than a flat, given the low rate of return on a flat," he adds. It is calculated by taking the ratio between the rent and the purchase price and would be 1.5 to 2% per year for a flat, according to Licheron.

The gateway for first-time buyers

This is confirmed by the New Immo agency. "The return is better and the risk is lower,” according to its director, Anne Reuter. Apart from perhaps a few grease stains, there is less chance of deterioration than in a flat. You can count on "€100 to €200 per month guaranteed rent” not to mention the increase in value. It is also easier to evict a tenant who does not pay his rent: "you can put your car in its place".

She notes a significant increase in demand. "As soon as we have a space, we sell it.” This happens six or seven times a year. "We don't sell more parking spaces because we don't have more to sell. But we see that prices have gone up and people are flocking to them. A lot of people are calling us to see if we have any spaces." On the rental side, the agency offers "at least two a month". It is a rare commodity. "Few people have them and put them up for sale," says Reuter. It is often new residences with parking spaces that put the remaining ones up for sale.

"It started with people coming to work in a neighbourhood and needing a place to park," she says. Rather than pay hundreds of euros each month, they preferred to buy. And as "it's a bit of a tradition to invest in bricks and mortar", car parks quickly became "the gateway for first-time buyers, young workers or border workers". The demand has grown since January 2021, when a 20% deposit became necessary to take out a property loan.

For a €400,000 home, for example, it would be necessary to be able to put down 80,000 euros. "People have therefore started to fall back on parking spaces."

A majority of investors

At New Immo, 80% of parking space buyers are investors. "Those who are looking because they need it are less on the lookout," explains Reuter. Most owners have one or two spaces each. A few have "a good ten or so".

Public car parks also sell some spaces, but often ask for proof of address. This is not the case with transactions between private individuals. The real estate agent observes people who rent spaces at an attractive price and sublet them for more.

It remains to be seen whether incentives to choose public transport over the car will reverse this business in the long term.

This story was first published in French on . It has been translated and edited for Delano.