How many businesses will take advantage of the tripartite agreement in 2022? How much will this measure cost? Will it really help Luxembourg to catch up with the EU in terms of business investment as a proportion of GDP? Won’t it add another layer of red tape at the same time as the new government promises to simplify the process? What about the greenwashing specialists who will know how to apply it, unlike small businesses with less experience regarding these issues?

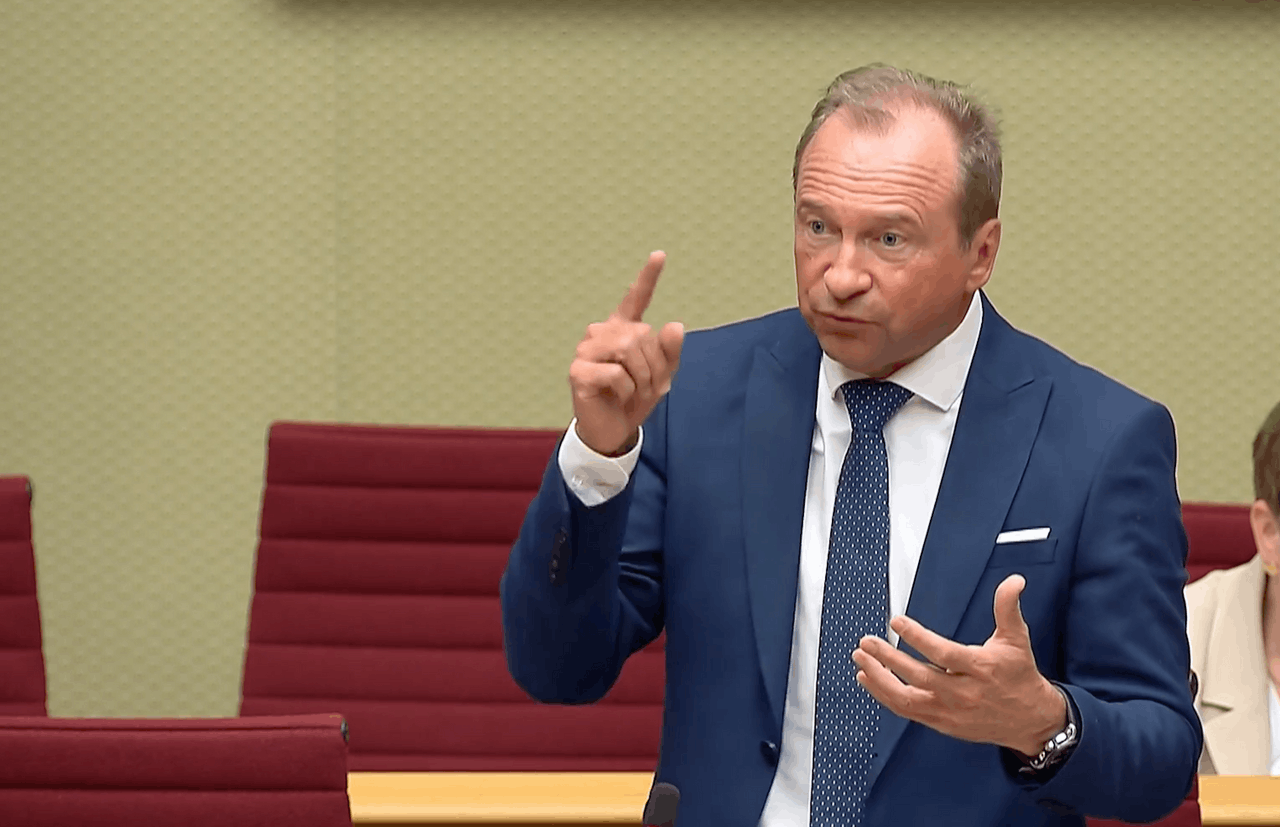

The government was unable to answer any of these questions when 58 of the 60 MPs passed bill 8276 in the Chamber of Deputies late on Tuesday afternoon. According to information that Luxembourg’s new finance minister (CSV) was able to obtain from the tax authorities, 7,800 companies were previously eligible for tax credits, and the cost of this measure was in the realm of €200m (compared to €276m in 2015 and €179m in 2018, to take the extremes).

No more floor at €20,000

“The cost could go much further,” the minister acknowledged to MPs. Under a certain number of conditions, businesses--even sole-entrepreneurs, Roth pointed out--could obtain a tax credit of up to 18% of the bill for the digital transition or the environmental transition, including on the operational side. The number of applicants is set to increase as a result of one of the formal objections lodged by the Conseil d’État (state council), which removed the minimum threshold of €20,000 set by the legislators.

Companies will need prior approval from the economy ministry, which will add another layer of red tape, and politicians have overlooked the fact that this bonus, while high, will have to be topped up by 82% from the finances of companies that have not only had the lowest operating profits in Europe for some time, but have also had to absorb multiple indexations of salaries and energy costs.

According to the Chamber of Commerce’s latest economic barometer--carried out on the eve of the general election--“only 14% of companies plan to increase their investments over the next six months, 65% say they want to stabilise them and 21% want to reduce them.” 45% of business leaders regularly call on bank financing, and more than half of companies (55%) say that they finance their projects and investments from their own funds (65% of companies in the financial sector, 6% in the non-financial sector and 60% in the hotel and catering sector). In more than seven cases out of ten, these are investment projects, which have never been refused to companies with more than 500 employees, says the barometer. Against this backdrop, banks will have a key role to play in providing the missing 82%.

An element of competitiveness and attractiveness

“We have had to work with the CTIE [Government IT Centre] on our own digitisation,” said Roth, “to be able to cope with the number of files that will come in.” All the more so as the government has not only promised a response within three months, but has also campaigned on the mantra of “silence is equivalent to agreement.” It’s hard to understand how this could apply, given that without a certificate from the ministry of the economy, the tax authorities will not apply the measure--which is only logical.

Roth, who had initially promised an impact assessment in two years’ time, opted for the one in the motion adopted in parliament, which gives him three years. The finance minster has also promised to come back regularly to review the scheme, which has been criticised by the Chamber of Employees, whose arguments have been echoed by (déi Lénk) and (déi Gréng).

For (DP), this text is a new element of competitiveness and attractiveness. The former economy minister, (LSAP), who recalled having with the former finance minister, (DP), added this subsidy to other national or European schemes, which will complement other sources of funding for businesses. And (ADR) pointed out that the measure was not due to the government, but to the tripartite.

“By supporting them, we will be preserving our industrial, craft and commercial fabric, while contributing to the development of a resilient and competitive economy for the future,” commented the economy minister, (DP), in a issued once the vote had been taken.

This article was first published in French on . It has been translated and edited for Delano.